Something unusual is happening in India’s startup corridors. Deeptech — once the quiet, long-gestation cousin of consumer tech — is suddenly drawing the kind of attention usually reserved for big-ticket SaaS and e-commerce deals.

Generalist VC giants like Peak XV Partners, Accel, and Elevation Capital are stepping into a territory that was once the domain of niche, specialist funds. At the same time, specialist investors are shifting their focus towards later-stage deeptech bets, signalling a maturing ecosystem.

The spotlight? Areas like aerospace, defence, quantum computing, material sciences, AI-driven manufacturing, genomics, and surveillance.

The Noise Became Data: Two Signals That Changed the Mood

Over the past week, two funding announcements shifted the conversation from “deeptech potential” to “deeptech momentum”:

1. Speciale Invest’s ₹600 crore Fund III

20% oversubscribed, targeted at 18–20 startups building sovereign technology and globally scalable IP in AI infra, space tech, climatetech, and quantum systems. Over 50% of the fund came from repeat LPs, with new institutional and corporate VCs joining in.

2. $524 million raised by Indian GenAI startups in 2025

The highest in the past five years, signalling not just excitement but also the infrastructure readiness for deep AI work coming out of India.

Neither of these is a vanity milestone. Both are investor-led endorsements that India’s deeptech foundation is solid enough to bet on — not for quick flips, but for building category-defining companies over the next decade.

Why Deeptech Capital Isn’t Like Other Venture Capital?

Investing in deeptech is not just a matter of identifying market demand. The equation involves:

- Long product cycles — Breakthrough hardware, scientific innovation, or regulated applications don’t go from lab to market in months.

- Capital intensity — IP-led models require not just R&D spend but also specialised talent, testing infrastructure, and compliance pathways.

- High technical risk — It’s not enough to prove product-market fit; the core science or engineering must be viable at scale.

- Geopolitical layers — Sectors like defence tech or quantum computing come with regulatory and national security implications.

This is why deeptech due diligence is nothing like standard startup diligence. The wrong call can sink millions before a product even leaves prototyping.

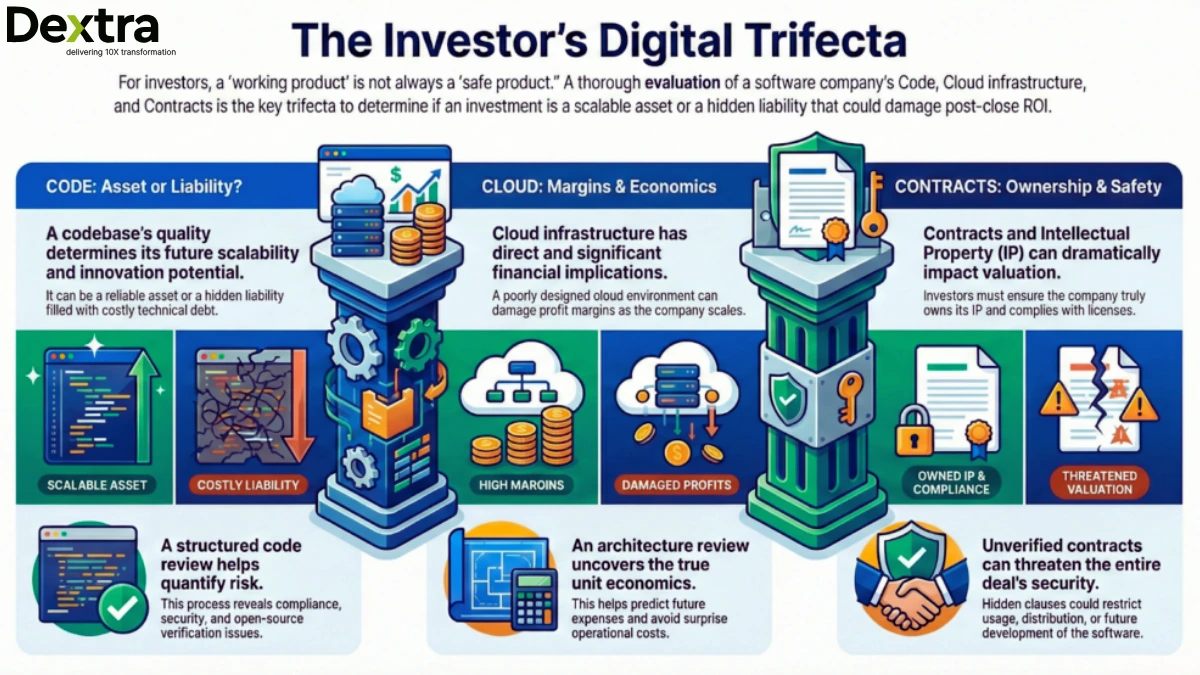

The Blind Spot: Technical Due Diligence for Deeptech

Here’s the problem, most generalist funds moving into deeptech are experts at assessing teams, markets, and scaling potential, but deeptech requires a different lens.

Without rigorous technology due diligence (Tech DD), even well-capitalised bets can end up backing science projects that don’t survive outside the lab.

This is where Dextralabs has built its niche. We partner with VCs and institutional investors to:

- Validate core IP claims — ensuring the technology works as stated and has defensible barriers against replication.

- Assess scalability readiness — from manufacturing pathways to regulatory clearances.

- Stress-test R&D timelines — mapping realistic go-to-market projections.

- Evaluate technical leadership — checking if the founding team has the right depth to take research into production.

For deeptech, this isn’t just due diligence, it’s risk containment at the most fundamental level.

Dextralabs’ Deeptech Technology Due Diligence Checklist:

When we work with VCs or institutional investors evaluating deeptech, here’s the framework we apply before a term sheet is signed:

| Checkpoint | Why It Matters in Deeptech | How Dextralabs Validates |

| IP Strength | Determines defensibility against replication or infringement | Patent review, novelty checks, and technical feasibility testing |

| Scalability Path | Ensures lab results can translate into mass production | Manufacturing readiness assessment, supply chain audits |

| Technical Leadership Depth | Reduces dependency risk on a single founder | Skills audit, advisory network evaluation |

| R&D Roadmap Accuracy | Aligns investor expectations with realistic delivery | Milestone stress-testing, prototype review |

| Regulatory & Compliance Risks | Avoids market delays and legal blocks | Compliance mapping for target markets |

| Integration Potential | Identifies partnership and acquisition opportunities | Ecosystem compatibility study |

Why This Moment Matters for Investors?

If the 2010s were about consumer internet scale-ups, the late 2020s could be defined by Indian-origin deeptech giants. The combination of sovereign tech ambitions, global market scalability, and rising LP confidence makes this a rare entry point for long-horizon capital.

But the reward curve comes with a cost curve and only those investors who combine conviction with rigorous technical validation will see meaningful outcomes.

Speciale Invest’s oversubscribed fund is a vote of confidence. The $524 million in GenAI funding is a demand signal. But the next defining deeptech unicorn won’t just win because of capital, it will win because the technology was sound from day one.

Dextralabs stands at that decision point, giving investors the clarity they need before signing the term sheet.

Final Thought:

The stage for Indian deeptech is set. But unlike consumer apps, this is a theatre where every prop, every actor, and every script change costs millions. Before stepping on stage, make sure the script works, that’s what we do at Dextralabs.

Investing in Deeptech? Don’t Guess — Validate.

Partner with Dextralabs, Singapore’s top Technology Due Diligence agency, trusted by VCs and investors to de-risk deeptech funding through rigorous IP, scalability, and tech assessment.

Book Your Tech DD Consultation