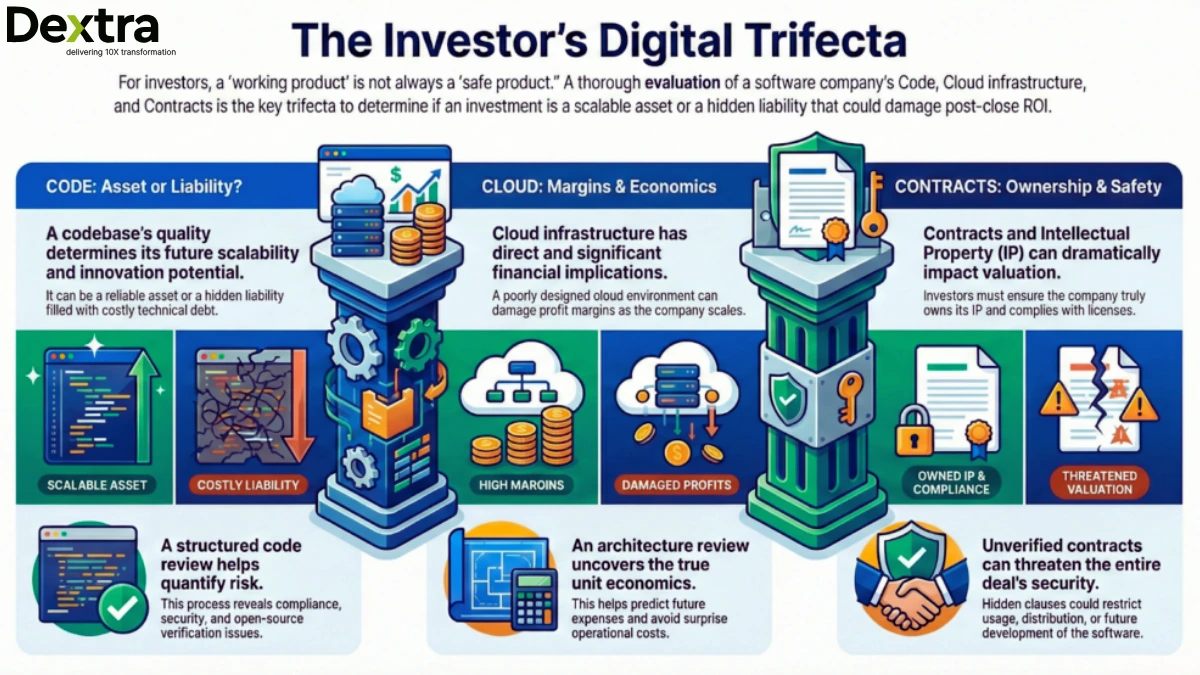

Technology is the foundation of contemporary enterprises, fueling innovation, streamlining operations, and fostering expansion in today’s digital era. For investors aiming to seize the potential within the tech industry, thorough DD (DD) holds paramount importance. In this article, we’ll delve into the critical role of tech DD for investors, examining its ability to mitigate risks and unearth value in an ever-evolving technological environment.

Understanding Tech DD:

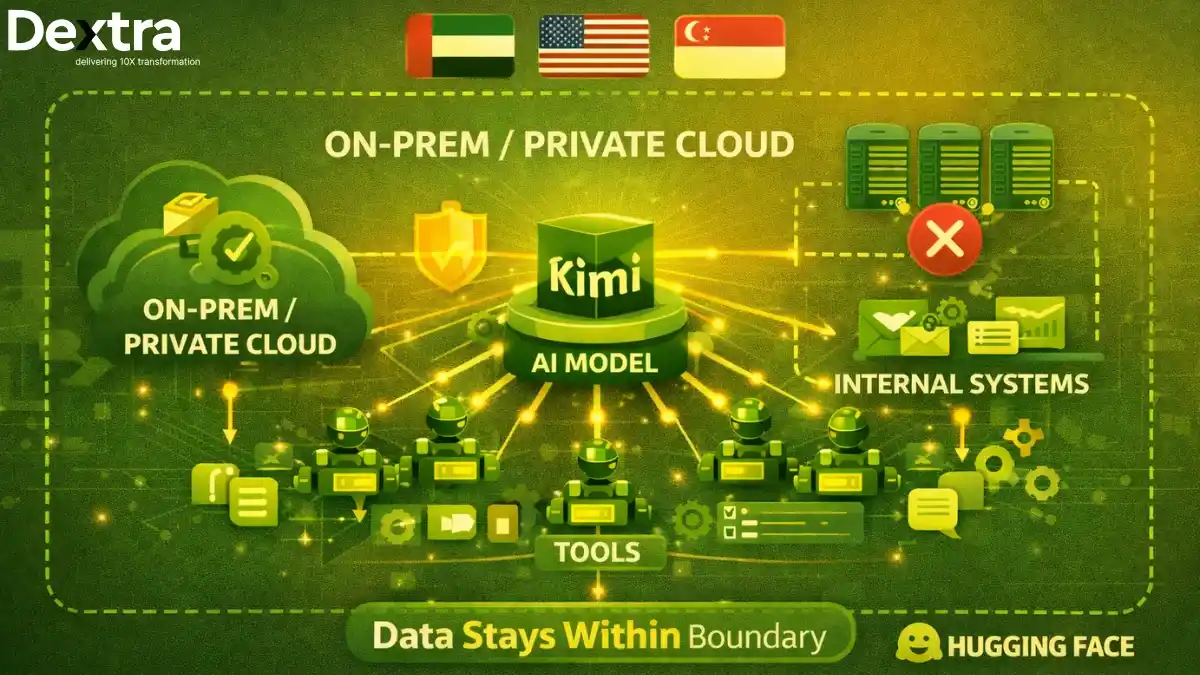

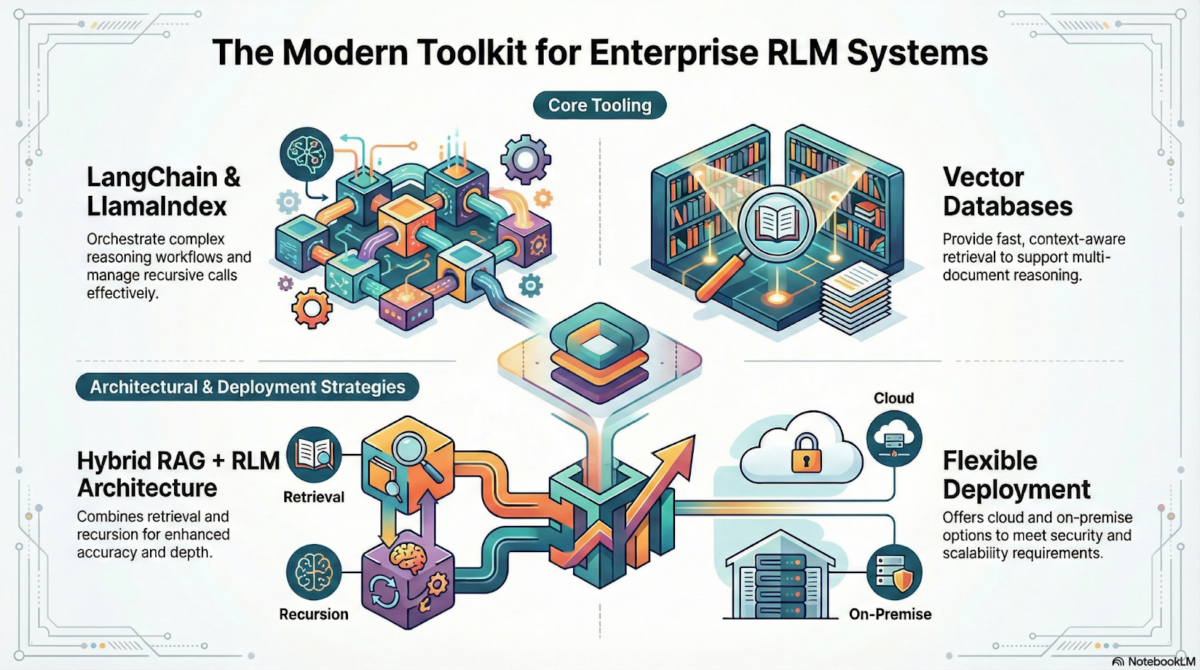

Tech DD is the comprehensive assessment of a company’s technology assets, infrastructure, processes, and intellectual property. It involves scrutinizing everything from software code and cybersecurity measures to IT systems and digital strategies. While traditional financial due diligence remains essential, tech DD provides investors with deeper insights into the technological capabilities and risks of a potential investment.

Mitigating Risks:

Given today’s fast-paced digital world, innovations can quickly become obsolete, and cybersecurity threats can pose significant risks to businesses. Conducting thorough tech DD helps investors identify potential risks early on, such as outdated technology stacks, inadequate cybersecurity measures, or reliance on legacy systems. By uncovering these risks, investors can make more informed decisions and implement strategies to mitigate them, safeguarding their investments in the long run.

Assessing Innovation and Competitive Advantage:

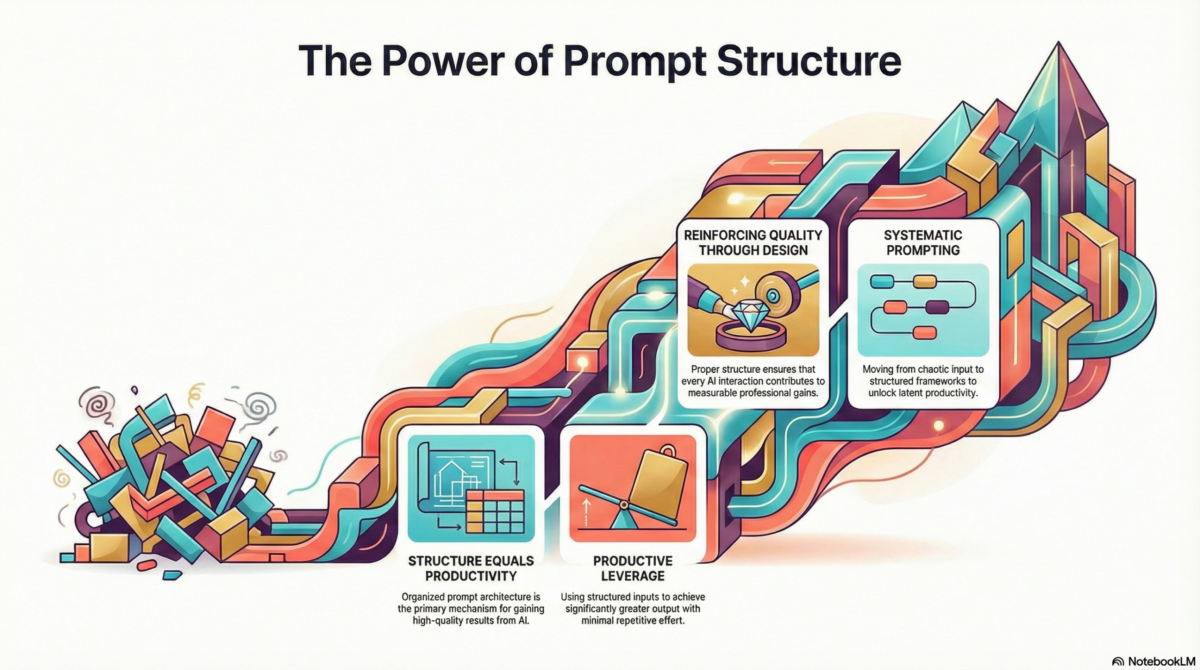

Innovation is the lifeblood of tech companies, driving competitiveness and differentiation in the market. Through tech DD, investors can assess a company’s technology roadmap, R&D investments, and intellectual property portfolio to gauge its ability to innovate and maintain a competitive edge. Understanding a company’s technological strengths and weaknesses allows investors to evaluate its potential for sustainable growth and market leadership.

Identifying Scalability and Operational Efficiency:

Scalability is critical for tech companies aiming to expand their operations and capture new markets efficiently. Tech DD helps investors evaluate a company’s scalability by assessing its technology infrastructure, scalability of software platforms, and ability to handle increasing user loads. Additionally, it provides insights into operational efficiency, identifying opportunities for streamlining processes, optimizing resources, and driving cost savings.

Unlocking Value and Maximizing Returns:

By conducting thorough tech DD, investors can unlock hidden value and maximize returns on their investments. Identifying synergies between technology assets, assessing growth opportunities, and mitigating risks enables investors to make more strategic investment decisions. Whether investing in early-stage startups or established tech giants, tech DD provides the insights needed to capitalize on opportunities and navigate the complexities of the tech sector effectively.

In an era defined by rapid technological advancement and digital disruption, tech DD has become indispensable for investors seeking to navigate the complex landscape of the tech sector. By assessing technological capabilities, mitigating risks, and unlocking value, tech DD empowers investors to make informed decisions and capitalize on opportunities for growth and innovation. As technology continues to reshape industries and redefine business models, the importance of tech DD will only continue to grow, serving as a cornerstone for successful investments in the digital age.

Dextralabs provides startups and potential investors/acquirers with tech DD enabling them to assess the startup’s technology infrastructure, systems, processes, and assets. It allows stakeholders to thoroughly assess the technical aspects of a startup, understanding its strengths, weaknesses, risks, and opportunities. Reach out to our experts to know more.