The AI market today feels electric; historic even. The capital is flooding in. Infrastructure is stacking up. Boards are rewriting strategy decks in real time. But behind the optimism, a quieter conversation is taking shape among the world’s most influential tech leaders.

A conversation about irrationality.

About overcapacity.

About the possibility, not the certainty, of an AI bubble.

Jeff Bezos recently warned of “irrational enthusiasm” in AI markets.

Sam Altman admitted that “AI is overhyped in the short term.”

The Bank of England flagged “systemic leverage risks” driven by AI’s capital intensity.

And Google CEO Sundar Pichai said the part no one expected: “No company will be immune if an AI bubble bursts — including us.”

When tech leaders of this magnitude speak in red flags, you don’t ignore it. You analyze. You assess. You reposition.

Because the real question for founders and investors isn’t: “Is AI a bubble?” The real question is: “How do we position ourselves if parts of the market are inflated, but the technology itself is transformative?”

That’s the difference between companies that emerge stronger in 2030… and those that won’t be around.

Dextralabs’ position is simple: The winners in the AI era will be the enterprises that combine innovation with governance, not those who confuse spending with strategy.

Also Read: The Agentic AI Maturity Model 2025: From Level 1 to Level 4 Enterprise Readiness

The AI Bubble Debate: Why It’s Not Just Market Gossip

The last 18 months saw one of the fastest capital accelerations in tech history.

GPU supply chains broke.

Data center capacity surged.

AI startups raised rounds at 50× revenue — or with no revenue at all.

Investors, founders, and policymakers are right to ask: Are we building the future — or are we building too fast for fundamentals to catch up?

To find clarity, we need to understand what people mean when they say “AI bubble.”

Also Read: From Copilots to AI Co-Workers: How Enterprises Are Orchestrating Multi-Agent Workflows

What the “AI Bubble” Really Means, and Why It’s Not Simple?

A bubble isn’t about fake technology. It’s about capital outpacing value creation.

The term “AI bubble” usually points to three forces:

1. Valuations detached from fundamentals

When a pre-revenue AI startup raises $500M because it “might” build a model someday, that’s bubble territory.

2. Overinvestment in infrastructure

Billions are flowing into data centers and compute clusters — often ahead of validated business demand.

3. AI-washing

Companies slapping “AI-powered” labels on old workflows or simple automation — creating the illusion of innovation.

But unlike the dot-com era, this bubble talk comes with nuance.

The AI boom isn’t built on empty promises — it’s built on real infrastructure, energy, logistics, and compute.

Which makes both the opportunity and the risk materially different.

Also Read: Stop “Fixing the Chatbot.” Build an AI System That Actually Raises Revenue

Is the Bubble Real? What the Evidence Actually Shows?

The data paints a mixed, but revealing, picture.

A. Overcapacity Is Emerging

Guinness Global Investors put it bluntly:

- The world is building compute faster than real adoption requires.

- The pace of DC construction is exceeding near-term value realization.

- Overbuild could lead to underutilization — and write-downs.

When Peter Thiel sells $100M of Nvidia…

When SoftBank unloads $5.8B…

When hedge funds reduce exposure to the Magnificent Seven…

These aren’t emotional decisions.

They’re risk-adjusted responses.

B. ROI Reality Is Biting

Multiple studies (MIT, TechTarget) show:

- A large percentage of enterprises see no measurable ROI from generative AI.

- Most pilots never scale.

- Production deployments are far fewer than headlines suggest.

- P&L impact is minimal for the majority.

AI is magical in demos.

AI is punishing in real workflows.

C. Education Sector Mirrors the Problem

The Swiss Institute of AI criticized the sector: “Talk is replacing transformation.”

Schools made declarations, not deployments. A perfect microcosm of enterprise AI right now.

D. Governance Gaps Are Becoming Investment Risks

Guinness and arXiv both point to the same issue:

- AI risk is financial, not just technical.

- Governance failures lead to slowdowns, rework, and misallocated capital.

- Lack of oversight amplifies the bubble effect.

So yes, some parts of the AI market do show bubble characteristics. But the narrative is incomplete.

Also Read: AI Takes Over Farms and Clinics: A New Dawn in Agriculture and Healthcare

Why Is the AI Bubble Story Misleading Without the Other Half?

Here’s where things get more interesting.

A. AI’s Transformative Potential Is Still Massive

Goldman Sachs estimates that AI could generate trillions in productivity gains. Technology is not a fad. It’s foundational.

B. This Is Not Dot-Com 2.0

Axios points out:

The dot-com era was built mostly on software speculation. The AI era is built on physical infrastructure with real utility:

- Chips

- Networking

- Energy

- Datacenters

- Robotics

- Edge compute

This isn’t a hallucination — it’s construction.

C. Big Tech’s Spending Isn’t Bubble Behavior — It’s Strategy

When companies like Google, Microsoft, Amazon, and Nvidia invest billions:

- They can absorb CapEx

- They have distribution

- They monetize compute directly

- They build ecosystems, not demos

Pichai himself reinforced confidence: “Google will weather any turbulence because we run a full-stack AI infrastructure.”

For smaller players, this means one thing: Don’t copy Big Tech’s spend; copy Big Tech’s discipline.

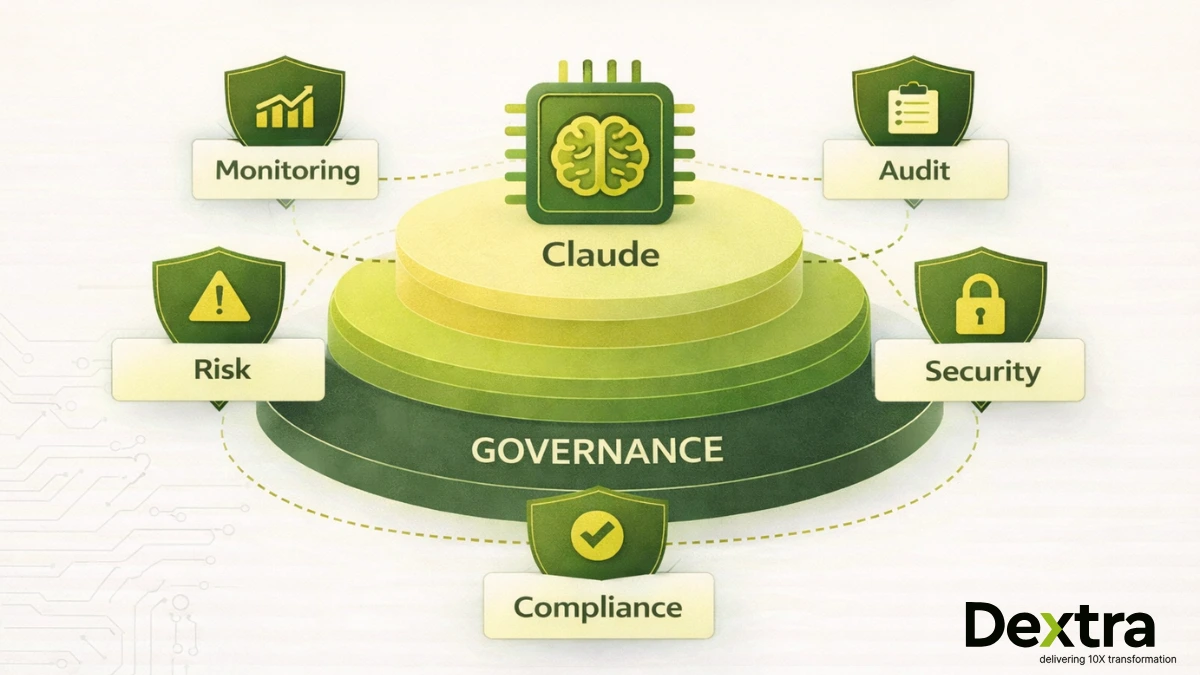

D. Governance Is Becoming a Value Driver

arXiv research shows:

- Auditability

- Disclosure

- Market-governance mechanisms

- Capital transparency

…reduce bubble exposure and improve long-term returns.

Simply put: enterprise AI governance is now a competitive edge.

Also Read: The CIO’s Playbook for AI-Driven Legacy Modernization in 2025

How Companies Build Durable Value Instead of Bubble Exposure?

This is where most enterprises either get it right — or collapse under the weight of their own ambition.

Here’s what a sustainable AI strategy looks like:

Put Governance at the Center

The companies that survive the AI correction will have:

- AI investment committees

- Responsible deployment frameworks

- Model risk audits

- Capital intensity reporting

- Clear cost-per-outcome metrics

- Vendor governance and supply-chain checks

This is not bureaucracy.It’s resilience.

Measure Real Outcomes — Not Activity

Benchmarks that matter:

- P&L contribution

- Cost avoidance

- Cycle-time reduction

- Productivity ROI

- Customer experience lift

- Compute cost efficiency

If you can’t measure it, you can’t scale it. And if you can’t scale it, you’re not building value — you’re burning capital.

Invest With Precision

Founders and investors should focus on:

- Data quality

- Use-case alignment

- Workflow integration

- Scalable infrastructure

- Talent with domain + AI expertise

Avoid “AI for the sake of AI.”

Build Strategic Partnerships

Enterprises should partner with:

- Academic labs

- Evaluators

- Consultants tied to performance

- Infrastructure providers

- Governance and risk specialists

The enemy is not innovation — it’s unvalidated innovation.

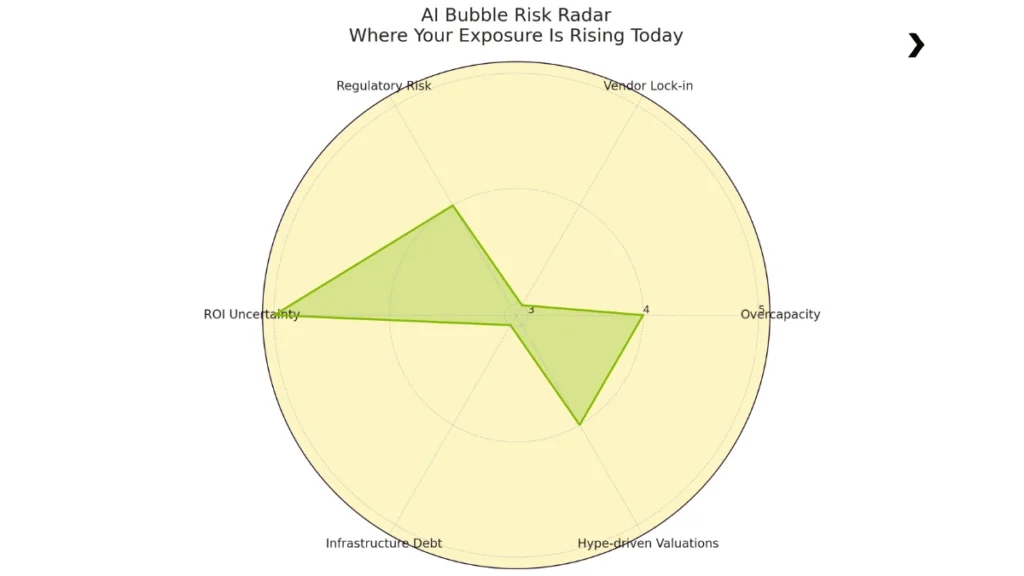

Monitor Exposure Continuously

The key risks to track:

- Overcapacity

- Vendor lock-in

- Regulatory shifts

- Talent shortages

- GPU supply imbalances

- Overvaluation

- Overhyped bets

This is the new “risk radar” for AI-era leadership.

Dextralabs’ perspective: Monitoring AI exposure should be a board-level function — not an engineering afterthought.

Also Read: Top 15 AI Consulting Companies in 2025: Innovating the Future of Enterprise AI

Two Companies, Two Outcomes (A Composite Case)

Company A: The Hype Chaser

- Spent millions on GPUs

- Rolled out 40 pilots

- No centralized governance

- No KPI alignment

- No clear ROI tracking

- Big press releases, zero business impact

Result?

- Board pressure.

- Investor skepticism.

- Hidden write-downs.

Company B: The Governance-Driven Builder

- Started with 3 use cases tied to strategy

- Built an AI governance function early

- Measured ROI from Day 1

- Embedded AI into workflows, not presentations

- Scaled only what performed

Result?

- Clear P&L uplift.

- Team adoption.

- Investor confidence.

- Real enterprise value.

Hence, same technology and same market. But different discipline and different destiny.

Risks and Trade-Offs: What Leaders Must Watch Now

Have a look:

- Overregulation vs underregulation

- Governance overhead (audits, reporting, compliance)

- Short-term financial pain from correcting speculative AI bets

- Vendor concentration risk

- Infrastructure debt

- Hype-driven M&A mispricing

- Energy and sustainability constraints

The companies that navigate these trade-offs will separate from the pack.

Conclusion: The Real Risk in 2025 Isn’t an AI Bubble, It’s Undisciplined AI

Yes, parts of the market are overpriced.

Yes, leaders like Bezos, Pichai, and Altman are signaling caution.

Yes, speculative capital is flowing faster than value.

But this doesn’t diminish AI’s potential. It clarifies the path forward:

The next era of AI will reward discipline, governance, and outcome-driven strategy — not noise, not vanity, not unchecked acceleration.

As Dextralabs sees it: In 2025, the biggest risk isn’t too little AI — it’s too much hype without accountability.

If you’re a founder, investor, or PE partner deciding how to deploy capital, reduce exposure, or build durable advantage:

Dextralabs helps enterprises design AI investment frameworks that balance innovation with governance. Let’s build long-term value — not just ride the wave.

FAQs on AI Bubble:

Q. What is meant by an AI bubble?

An AI bubble refers to a situation where investment and excitement about AI grow faster than real business value. The technology is very real — but when capital outpaces adoption, valuations become inflated, and expectations stretch beyond what the market can deliver in the short term.

Q. What happens if the AI bubble bursts?

If a correction happens, it won’t be a “collapse of AI” — but a decluttering of hype:

– Overfunded startups may shut down or get acquired at discounts

– Data center and compute investments could face write-downs

– Boards will demand real ROI before approving new projects

– Teams will shift from flashy pilots to workflow-integrated AI

The companies focused on governance, efficiency, and measurable outcomes will survive — and thrive.

Q. Is the AI bubble already breaking?

Some signals are showing early cracks:

– GPU overcapacity warnings

– Slow production rollouts in enterprise AI

– Institutional investors trimming exposure

– More scrutiny on AI startup valuations

But this is not the dot-com crash. The core infrastructure being built has long-term utility — AI isn’t going anywhere.

Q. Did Michael Burry bet against AI?

Burry (famous from The Big Short) has voiced skepticism about AI valuations and made moves suggesting caution in tech stocks. But he is not “betting against AI” itself — just against overpriced optimism.

Q. What is Bubble AI?

“Bubble AI” usually refers to:

– Solutions labeled as “AI-powered” that are just rules or automation

– Products built without data readiness

– Tools that look innovative but don’t change business outcomes

Bubble AI = innovation theater.

Real AI = transformation with measurable impact.

Q. Why are people excited about an AI bubble possibility?

Because bubbles — when they burst — reset markets:

– Weak products clear out

– Talent becomes more affordable

– Strong companies gain market share

– Innovation becomes more grounded and durable

A correction can accelerate maturity — not hinder progress.

Q. What is the 30% rule for AI?

Industry analysts often reference the idea that only about 30% of AI pilots reach production — and even fewer create direct business value. This rule is a reminder: adoption is harder than experimentation.

Q. How could an AI bubble burst impact Indian developers?

India is a global AI delivery hub — which means developers, contractors, and startups could see:

– Fewer experimental PoC projects

– More pressure for ROI-centric engineering

– Stronger opportunities in governance, automation, and domain-driven AI

In other words: less hype work, more real engineering.

Q. Do any industries benefit when tech bubbles burst?

Yes — historically:

– Buyers gain bargaining power

– Companies with real cash flow expand rapidly

– Productivity solutions (like automation & analytics) win big

– Consulting firms that guide transformation remain in demand

A bubble burst reward discipline.

Q. Is Michael Burry right about an AI bubble?

He’s right about the risk of inflated valuations.

But he also knows something important:

Transformative technology doesn’t disappear — hype does.

AI after the correction will be leaner, smarter, and more valuable.