When private equity or venture capital investors review a company, financial due diligence only tells part of the story. Even a “working product” can quietly break if it is unscalable, financially inefficient in the cloud, or legally risky due to IP or OSS licensing. This is where software due diligence comes in.

One reason this risk is so significant is that open source components can make up between 50% and as much as 85–90% of a modern software codebase, amplifying licensing and security concerns if left unchecked, according to a joint Open Source Due Diligence report by KPMG and Flexera.

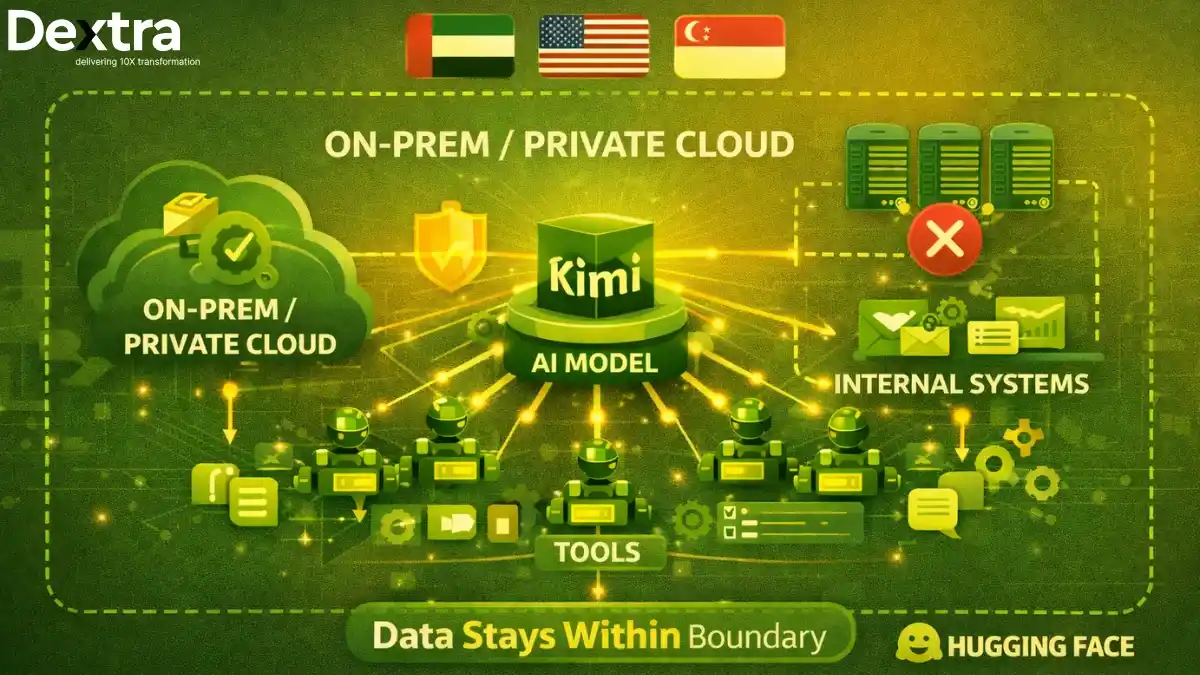

Dextralabs positions SW DD as an investment-grade, end-to-end lens for revenue-generating software, not just internal tools, on key areas like legal/IP, vendor dependencies, infrastructure cost efficiency, security/compliance, and open-source verification.

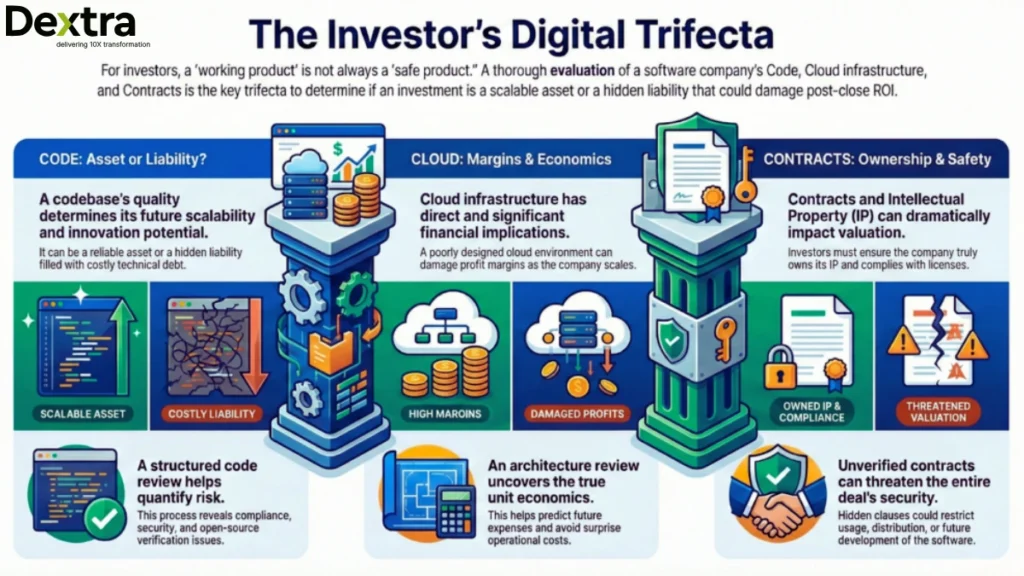

It enables investors to transform technical findings into valuation insights, negotiation leverage, and a post-close roadmap by assessing the product across code, cloud, and contracts.

Code Works. Cloud Runs. But Is the Deal Safe?

Dextralabs delivers investment-grade software due diligence across code quality, cloud unit economics, and IP/contracts, built for PE & VC decision-making.

Talk to Our Tech Due Diligence ExpertsWhy Code, Cloud, and Contracts are the PE/VC Trifecta?

“Behind every investment is software that drives growth and revenue.” But a “working product” is not always a “safe product.” Code, cloud, and contracts represent the “trifecta” that is key to determining whether the “software” is scalable and cost-effective, while remaining legally secure after the close.

1. Code: Maintainable Capability vs. Technical Debt

A codebase is more than code; its existence is one of the most critical aspects in terms of scalability and innovation.

Dextralabs’ approach follows a structured workflow:

| Scope → Code and infrastructure review → Compliance/security → Open-source verification → Risk scoring/reporting. |

Evaluating code in this context helps investors determine whether they are buying a reliable, maintainable asset or a hidden liability filled with technical debt that could derail timelines, inflate costs, or reduce post-close ROI.

2. Cloud: Margins and Unit Economics

A cloud infrastructure appears operational. Yet it has direct financial implications. A poorly designed cloud infrastructure environment, inefficient resource utilization, and the use of costly services can damage margins as the company scales. A deep cloud cost and architecture review ensures that investors understand unit economics, predict future expenses, and avoid surprise operational costs.

3. Contracts/IP: True Ownership and Legal Safety

Contracts, intellectual property, and open-source software can have a dramatic impact on valuation and deal security. It is essential that investors ascertain whether a company owns its IP, is compliant with third-party IP contracts, and whether there are any secret contracts that could militate against usage, distribution, or further development.

Code Due Diligence: What Investors Should Verify?

The code looks “clean” is more of an outward observation, while code due diligence involves code architecture, code quality, code testing, and code technical debt.

1. Architecture & Scalability

Investors must verify that the software’s architectural design is scalable enough not only to facilitate growth but also to accommodate additional functionality in the future. A scalable architectural design ensures a company’s ROI by rapidly deploying additional functionality in the market.

2. Code Quality & Maintainability

“Clean code” is easier to update, maintain, and extend. In due diligence, these are the criteria that are assessed:

- Readability: How easily can new programmers learn this code?

- Duplication: Is there a repeated or redundant section?

- Patterns and Standards: Is the code sufficiently modular, regular, and of high quality?

The use of well-written code ensures low risks, operational costs, and complexity of integration.

3. Testing & Release Reliability

An optimized CI/CD delivery process and automated tests minimize bugs and increase the confidence of release operations. Key points are:

- Coverage of unit and integration tests

- Frequency and success rates of automated builds

- Defect rates after deployment

This is attested by the fact that reliable testing ensures business continuity and a smooth post.

4. Technical Debt

Technical debt represents the cost of shortcuts, workarounds, or legacy issues. Investors need to quantify what it would take to fix these issues within 6–12 months post-close. This includes:

- Time and effort for remediation

- Associated costs

- Impact on future development speed

Dextralabs provides a prioritized “fix-now vs fix-later” list, linking risks to timelines and investment impact. Using the same approach outlined in their Tech DD guide for investors, this list helps prevent nasty tech surprises, identify risks early, and protect ROI. PE/VC teams gain clarity for valuation adjustments, negotiation leverage, and post-close action planning.

Cloud Due Diligence: Validating Profitability, Not Just Uptime

Cloud infrastructure drives both performance and costs. Proper cloud due diligence ensures that scaling does not unintentionally reduce profitability.

1. Architecture Review

A thorough review examines:

- Deployment setup

- Redundancy and failover mechanisms

- Operational sustainability

The goal is to confirm resilience and reliability, reducing operational risk for investors.

2. Cloud Cost Efficiency

Cloud spend is often a hidden drain on margins. DD identifies:

- Major cost drivers

- Resource wastage

- Opportunities to optimize spend

3. Cloud Unit Economics

Investors benefit from understanding per-customer, per-tenant, or per-workload costs. This helps forecast margins at scale and informs negotiation points.

4. Vendor & Dependency Risk

Third-party cloud services may lead to ‘lock-in,’ ‘outages,’ or ‘surprise costs’: Dextralabs examines vendor dependencies, contracts, and operational effects to ensure that the investment risks are well understood before closing the transaction.

Dextralabs delivers a “cloud margin risk” report and a 90-day FinOps optimization roadmap, ensuring operational and financial transparency.

Contracts & IP Due Diligence: Where Valuation Can Collapse Fast?

Contracts and IP ownership directly impact the legal defensibility and economic value of a deal.

A. IP Ownership

Investors must confirm that all rights are properly assigned from employees and contractors. Unassigned or unclear IP can cause post-close disputes or litigation, eroding value.

B. OSS License Exposure

Open-source software licences can be either copyleft or restrictive. AGPL, GPL, and other licences fall into this category. Non-compliance with this licence could mean disclosure of proprietary information,

C. Licencing Integrity

Third-party licenses are also checked to ensure that the company has distribution, modification, and usage rights for the software.

D. Contractual Obligations

There may be hidden obligations, such as Service-Level Agreements (SLAs), contracts, or vendor or customer-imposed restrictions, that may limit product flexibility and strategic choices. Identifying these helps investors negotiate effectively.

Dextra Labs provides an IP & licensing risk register with actionable remediation options: replace, re-license, isolate, or secure commercial licenses.

How Dextra Labs Runs “Code + Cloud + Contracts” DD?

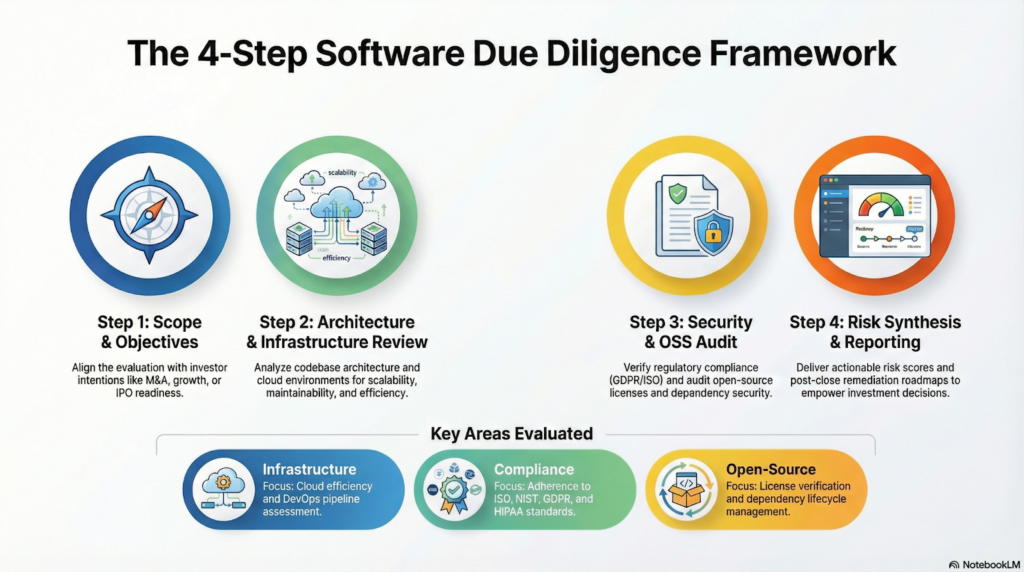

Dextralabs follows a structured, investment-grade SW DD workflow:

Step 1: Define Scope & Objectives

Each due diligence engagement starts with alignment to investors’ intentions, which could be M&A, a growth round, or IPO readiness. Scope definition ensures focused, efficient evaluation.

Step 2: Codebase & Infrastructure Review

Comprehensive analysis includes:

- Architecture mapping

- Cloud evaluation

- DevOps pipeline assessment

It’s a step in which scalability, maintainability, and efficiency are assessed.

Step 3: Compliance & Security Assessment

By comparing against standards such as ISO, NIST, GDPR, or HIPAA, one can ensure compliance with regulations and security standards. Early detection reduces potential liabilities.

Step 4: Open-Source Usage Verification

Dextralabs verifies OSS licenses, dependency security, and lifecycle management, ensuring legal compliance and operational integrity.

Step 5: Risk Synthesis & Reporting

All findings are synthesized into:

- Risk scoring

- Negotiation leverage

- Post-close remediation roadmap

This empowers PE/VC teams to make confident, data-driven decisions.

Deliverables PE/VC Actually Use

A Dextralabs software due diligence report for PE/VC investors offers investment-grade insights that can be used directly for valuation, negotiation, and post-close analysis. Each deliverable has been designed to be highly actionable, concise, and aligned with deal-making objectives.

- Executive Summary + Risk Matrix: It provides a comprehensive summary of key risks based on their severity level and impact. This helps investors make informed decisions based on the priority level of risks.

- Architecture Review + Scalability Risk: Evaluates software design, modularity, and infrastructure resilience, highlighting potential bottlenecks that could affect growth or operational costs.

- Security & Compliance Summary: Reviews adherence to standards such as ISO, NIST, GDPR, and HIPAA to mitigate risks of legal and regulatory actions.

- IP & Licensing Status + OSS Exposure: It verifies IP ownership, reviews OSS usage, and points out any licensing risks that might pose an issue.

- Technical Debt + 90/180-Day Remediation Plan: It helps in quantifying technical debt and is used in creating a remediation plan that ensures a smooth post-close integration.

Together, these outputs provide integrated analysis to PE/VC teams on risk in software, allowing adjustments in valuation, negotiation, and planning in the post-acquisition phase.

When to Run Software Due Diligence?

Timing is key in software due diligence to ensure investors have full visibility into technical, operational, and legal risks at each stage of a deal.

- Pre-Term Sheet / Pre-LOI – Fast Red-Flag Scan:

A high-level, quick scan enables the identification of key risks, such as IP ownership, cloud dependencies, and technical debt. This helps investors avoid potential targets that prove difficult or uninvestable.

- Post-LOI – Deep-Dive Assessment:

Once the deal is under serious consideration, a holistic analysis of code quality, cloud architecture, unit economics, security, compliance, and OSS licensing informs adjustments, escrows, or remediation commitments. This gives the investors the requisite negotiation power and confidence.

- Post-Close – Recurring Portfolio Monitoring:

Ongoing due diligence is helpful for return on investment protection, tracking tech debt, cloud optimization, and compliance.

By performing SW DD at the correct interval, investors can minimize surprises, make informed decisions, and optimize value creation after market close.

Why Choose Dextra Labs? Trusted Tech Due Diligence, Globally

Dextra Labs is a Singapore-headquartered tech due diligence partner with global coverage in USA, UAE, and India. With a proven track record in enterprise AI consulting, technical audits, and SW DD, Dextralabs helps PE/VC firms and deal teams cut through uncertainty, de-risk investments, and accelerate value creation.

Core Advantages:

- Structured Code + Cloud + Contracts DD methodology

- Investment-grade reporting with actionable remediation plans

- Expertise in OSS license compliance, cloud FinOps, and technical debt assessment

- Support for M&A, growth rounds, and IPO readiness

Conclusion

In the world of business driven by technology, it is possible to lose value on deals by failing to consider software risks. A successful product might have hidden problems in cloud computing and legal liabilities that are identified in a comprehensive due diligence of the software.

By embracing a holistic, investment-driven strategy from code through the cloud and contracts, investors can uncover blind spots, make informed decisions, safeguard ROI, and set the stage for successful post-close execution.

Dextra Labs offers the expertise, reach, and systematic process to provide valuable, investment-quality software due diligence with direct impact on software valuation, negotiation position, and the resulting software portfolio.

Book a 30-minute deal-readiness call to understand your risk exposure today!

FAQs:

What is software due diligence and why is it critical for PE and VC investors?

Software due diligence evaluates the codebase, cloud infrastructure, security posture, IP ownership, and open-source risks of a technology company. For PE and VC investors, it protects valuation by uncovering hidden technical, legal, and operational risks before capital is committed.

How is software due diligence different from financial due diligence?

Financial due diligence focuses on historical performance and forecasts, while software due diligence assesses whether the technology can scale, remain cost-efficient, and stay legally defensible post-investment. A company can have strong financials but still be a high-risk software asset.

What are the biggest software risks that affect deal valuation?

The most common value-impacting risks include technical debt, unscalable architecture, unpredictable cloud costs, OSS license exposure, unclear IP ownership, and weak security or compliance practices—all of which can trigger valuation adjustments or escrows.

When should PE or VC firms conduct software due diligence during a deal?

Ideally, software due diligence should begin pre-LOI for red-flag screening and continue post-LOI for a full deep-dive assessment. Early visibility prevents late-stage surprises and strengthens negotiation leverage.

How does cloud infrastructure impact investment returns?

Cloud architecture directly affects unit economics, gross margins, and scalability. Inefficient cloud setups can cause margins to erode rapidly as the business grows, making cloud cost transparency and FinOps analysis critical for investors.

Why is open-source software (OSS) a major concern in software investments?

Modern software often relies heavily on OSS. Non-compliance with restrictive licenses (such as GPL or AGPL) can force code disclosure or legal remediation, creating serious IP and valuation risk if not identified pre-close.

What deliverables should PE and VC buyers expect from software due diligence?

Buyers should expect investment-grade outputs, including a risk matrix, scalability and cloud cost analysis, IP and OSS exposure assessment, security summary, and a 90–180 day remediation roadmap tied to valuation and post-close execution.