According to a report by Boston Consulting Group (BCG), the Fintech sector currently captures only 2% of the vast $12.5 trillion global financial services revenue. However, it is poised for substantial growth, with projections indicating a potential expansion to 7% of the market. Notably, Fintechs are forecasted to represent almost a quarter of all banking valuations worldwide by 2030.

As Fintech continues to revolutionize traditional financial services through innovative digital solutions, the handling of vast volumes of sensitive data becomes increasingly complex and fraught with risks. In this context, the importance of rigorous technology due diligence cannot be overstated. This blog post explores the critical role of technology due diligence in ensuring robust data management practices and safeguarding data privacy within the Fintech domain.

The Scope and Significance of Technology Due Diligence in Fintech

Technology due diligence is a comprehensive evaluation of a startup’s technology infrastructure, systems, processes, and security protocols. This involves scrutinizing various aspects such as the technology stack, data handling mechanisms, cybersecurity measures, regulatory compliance frameworks, and risk management strategies. Technology due diligence provides investors, regulators, and stakeholders with invaluable insights into the efficacy and resilience of a Fintech firm’s data management and privacy practices.

By conducting this comprehensive evaluation, potential risks and vulnerabilities can be identified early, allowing for proactive measures to be implemented to mitigate them. In an industry where data security and privacy are paramount, technology due diligence serves as a crucial tool in ensuring the integrity and trustworthiness of Fintech companies, ultimately safeguarding both customer data and investor interests.

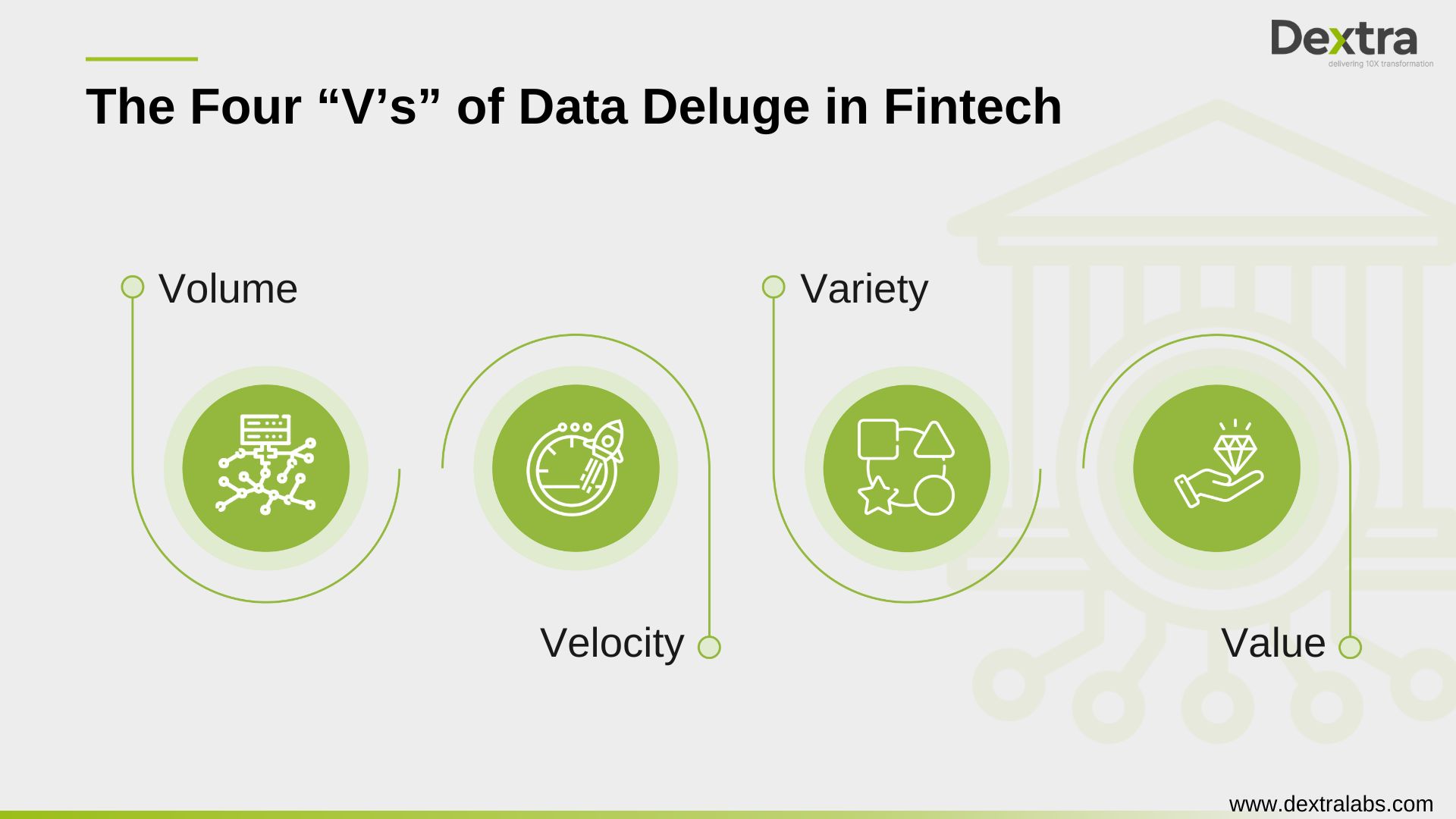

The Data Deluge in Fintech: The Four V’s

Fintech companies operate in an ecosystem characterized by an unprecedented influx of data. From customer financial transactions to personal identifiers, the breadth and depth of data collected are staggering. This data deluge not only fuels innovation but also underscores the imperative of responsible data stewardship. Without robust data management practices, Fintech firms risk exposing sensitive information to unauthorized access, data breaches, and regulatory non-compliance. Here’s some information about the four V’s for data deluge in fintech:

- Volume: The volume of data generated within Fintech is enormous and continues to grow exponentially. This includes structured data such as transaction records and unstructured data (such as social media feeds or customer service interactions).

- Velocity: Financial transactions occur in real time, leading to high-velocity data streams. This requires Fintech companies to process and analyze data rapidly to derive actionable insights and make timely decisions.

- Variety: Fintech data comes in various formats, including text, images, videos, and numerical data. This diversity presents both challenges and opportunities for Fintech companies in terms of data storage, processing, and analysis.

- Value: Effectively harnessing Fintech data can provide significant value to companies and customers alike. By leveraging data analytics and machine learning algorithms, Fintech companies can enhance customer experiences, personalize services, detect fraudulent activities, and optimize business operations.

Navigating Regulatory Compliance

The Fintech landscape is governed by a labyrinth of regulations aimed at safeguarding consumer interests and preserving data privacy. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, imposes stringent requirements on Fintech companies. Compliance with these regulations is non-negotiable, as violations can lead to hefty fines and reputational damage.

Technology due diligence emerges as a pivotal process in this context, serving as a comprehensive assessment mechanism to ensure that Fintech companies adhere to regulatory standards. This diligence involves scrutinizing the alignment of data management practices with regulatory requirements, evaluating data storage, processing, and transfer mechanisms, as well as assessing cybersecurity measures and protocols.

By conducting thorough technology due diligence, Fintech companies can mitigate regulatory risks, build trust with consumers, and foster a regulatory-compliant environment conducive to sustainable growth and innovation within the industry.

Mitigating Cybersecurity Risks

Cybersecurity threats loom large over the Fintech sector, with malicious actors constantly seeking to exploit vulnerabilities in digital systems. Mitigating cybersecurity risks in the Fintech sector requires a multifaceted approach that encompasses various strategies and measures to protect digital systems, sensitive data, and customer assets. Here are some key strategies for mitigating cybersecurity risks in fintech:

- Risk Assessment and Management: Conducting Regular risk assessments are essential for Fintech companies to identify threats, vulnerabilities, and impacts, enabling effective resource allocation and mitigation strategies.

- Strong Authentication and Access Controls: Utilize robust authentication such as MFA and strict access controls to deter unauthorized entry to sensitive systems and data. Employ RBAC to limit privileges based on job roles.

- Encryption: Using encryption for data in transit and at rest adds security. End-to-end encryption keeps sensitive data unreadable to unauthorized parties, even if intercepted.

- Regular Software Patching and Updates: Keeping software systems and applications up-to-date with the latest security patches and updates is crucial for addressing known vulnerabilities and reducing the risk of exploitation by cyber attackers.

- Security Awareness Training: Regular, role-specific cybersecurity training fosters a security-conscious culture, covering best practices, phishing awareness, and social engineering tactics.

- Continuous Monitoring and Threat Detection: Deploying robust monitoring systems and threat detection tech lets fintechs swiftly spot and tackle cybersecurity threats. It covers network monitoring, IDS, and SIEM solutions.

- Incident Response Plan: Regularly testing an incident response plan ensures an organized and effective cybersecurity response, covering containment, eradication, recovery, and post-incident analysis to prevent future issues.

- Third-Party Risk Management: Assessing and managing cybersecurity risks from third-party vendors in Fintech is critical. Contractual obligations, security assessments, and monitoring can mitigate these risks.

Safeguarding Data Privacy

Data privacy is paramount in Fintech, where trust and confidence are foundational to customer relationships. Technology due diligence scrutinizes how Fintech companies collect, store, process, and share personal data, ensuring adherence to privacy best practices and regulatory requirements. By assessing data encryption, access controls, data minimization strategies, and transparency practices, due diligence helps mitigate privacy risks and foster a culture of data protection.

Conclusion: The Imperative of Technology Due Diligence

In fintech, where innovation intersects with regulatory scrutiny and cybersecurity threats, technology due diligence emerges as a linchpin for ensuring robust data management and privacy practices. By conducting thorough assessments of technology infrastructure, cybersecurity measures, and regulatory compliance frameworks, stakeholders can mitigate risks, safeguard data privacy, and uphold the integrity of the Fintech ecosystem. As Fintech reshapes finance, technology due diligence remains crucial. Partner with experts like Dextra for thorough technology assessments. We specialize in guiding startups and investors through complexities like data management and privacy. Benefit from tailored insights and comprehensive guidance, ensuring a thorough evaluation of your investments or tech ventures.