Software M&A tech DD in 2026 needs to go beyond “is the code okay?” and answer whether the product can scale, integrate cleanly, and support a credible post‑merger roadmap without exploding cloud spend.

Buyers are paying for growth stories—ARR momentum, retention metrics, expanding TAM. But the real limiter isn’t the product roadmap deck. It’s whether the platform can scale under real load, integrate cleanly into your tech stack, and run profitably without exploding cloud spend.

The technology sector recorded $640 billion in M&A activity in 2024, marking a 16% increase over 2023. Yet technology integration issues account for approximately 30% of failed mergers (Deloitte). The gap between headline growth and actual value creation often hides in the tech stack—fragile architecture, unsustainable cloud costs, or integration nightmares that surface only post-close.

This guide shows the 2026 tech due diligence workstreams that protect valuation, surface hidden risks early, and accelerate post-close value creation. At Dextra Labs, we help private equity firms, strategic acquirers, and enterprises across the UAE, USA, and Singapore conduct software M&A technical due diligence that delivers decision-grade outputs: risk registers, valuation impact narratives, integration readiness plans, and post-merger roadmaps.

Don’t Let Technology Kill Your Synergies

Dextralabs helps PE firms and strategic buyers turn tech DD into a post-merger value creation plan, not a surprise list.

Talk to Our Tech DD ExpertsWhat “Future-Proof” Means in 2026 Software Deals?

Future-proofing isn’t about having the newest tech stack or the most developers. It’s about four concrete capabilities:

1. Scalability Under Real Load: Can the platform handle 3-5x growth without architectural rewrites?

2. Predictable Cloud Costs: Do you understand unit economics and margin behavior at scale?

3. Integration Readiness: Can you absorb this into your existing tech estate without breaking things?

4. Realistic Modernization Roadmap: What will it cost and how long will it take to address technical debt?

These must be validated pre-close, not discovered post-merger. According to research, between 40-60% of expected synergies in M&A deals are directly linked to IT integration success . You can’t capture synergies from systems that won’t integrate or scale.

Also Read: How Much Does Technical Due Diligence Cost? A Complete Guide for Investors and Startups

Pre-Deal Tech DD That Protects Valuation (and Avoids Late Surprises)

Why Early Tech DD Matters?

Strong headline growth can sit on fragile architecture that “buckles under load.” A 2024 Armanino survey found that 69% of SaaS companies capitalized development costs (EY). This signals both evolution and potential complexity—structural challenges that tech DD must unpack.

Early tech DD surfaces technical risk hidden behind optimistic ARR/growth narratives:

- Architecture brittleness that limits scalability

- Cloud cost structures that erode margins at scale

- Legacy constraints that block integration

- Technical debt that requires massive remediation investment

What Changes in 2026?

Traditional tech DD asked: “Is the code okay? Are there security issues?”

2026 tech DD asks: “What are the cloud unit economics? What’s the modernization cost? Can this integrate without breaking?”

Research shows 75% of investors now evaluate digital maturity as one of the top three drivers of enterprise value, with mature digital operations correlating with up to 25% higher profitability (Medium). Buyers need to understand not just what’s there, but what it will take to make it work post-close.

The Four Outputs Deal Teams Need

At Dextra Labs, we structure tech DD around four critical outputs:

1. Risk: What can break? What’s the probability and impact?

2. Cost: What will remediation, integration, and modernization actually cost?

3. Timeline: How long will it take to stabilize, integrate, and scale?

4. Constraints: What can’t be changed easily? Where is the platform locked in?

Also Read: Data Center Investments: Tech DD Considerations for the Next Wave of Infrastructure Deals

Scalability Under Load: The #1 Future-Proofing Test

Buyers acquire software for growth. But can the platform actually handle that growth?

What to Validate?

- Architectural Bottlenecks: Where do requests queue up? What breaks first under load?

- State Management: How is session state, cache, and database state handled? Does it scale horizontally?

- Database Constraints: Can the database handle 10x write volume? What about query performance?

- Multi-Tenant Limits (for SaaS): How is tenant isolation implemented? Does one tenant’s spike affect others?

- Performance Testing Evidence: Are there load tests? What do they show? Are results documented?

Red Flags That Signal Scalability Risk

- Brittle Architecture: Monolithic codebase with no clear service boundaries

- Missing SLOs/SLAs: No performance targets or monitoring

- No Capacity Planning: “We just add servers when things slow down”

- “Hero Engineer” Dependencies: Only one person understands how scaling works

- Reactive Scaling: No auto-scaling, manual intervention required

Deliverable: Scalability Risk Rating

Dextra Labs produces a scalability risk rating plus a plan that includes:

- Specific bottlenecks and remediation approach

- Infrastructure investment required

- Timeline for scalability improvements

- Performance targets and monitoring strategy

Also Read: Specialization and Value Creation: How Tech DD Drives Differentiation for Modern PE Firms

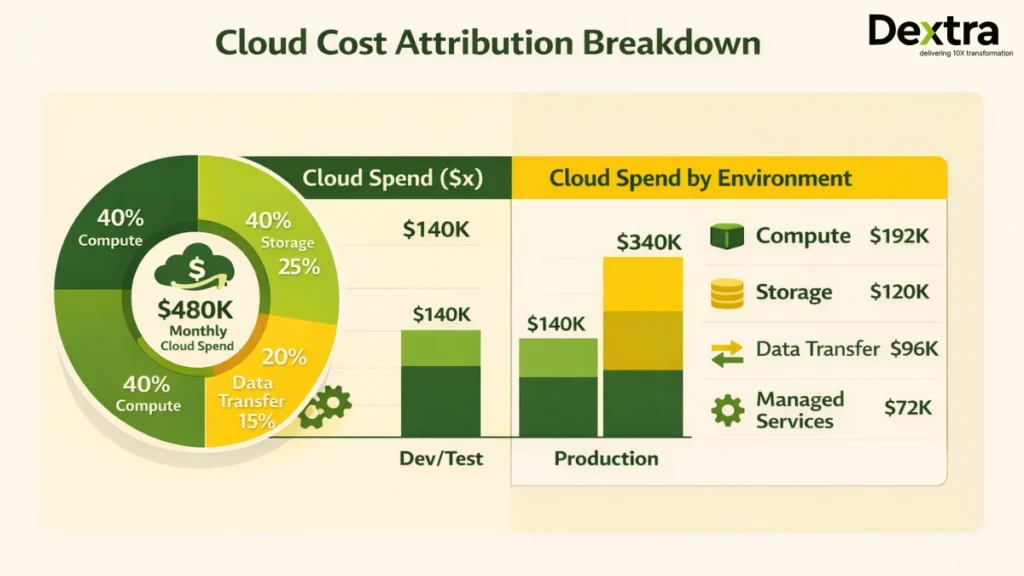

Cloud Cost and Unit Economics: FinOps Lens in Tech DD

Strong growth doesn’t matter if cloud costs grow faster than revenue. Global cloud spending is projected to exceed $1.5 trillion by 2026 (Windsor Drake), making cloud cost structure a critical value driver.

What to Analyze?

- Cloud Architecture Patterns: Are they using managed services efficiently? Over-provisioned?

- Cost Drivers: What’s driving the biggest expenses? Compute, storage, data transfer, managed services?

- Observability Maturity: Can they attribute costs per customer, tenant, or workload?

- Cost Attribution: Do they know their cloud COGS per user/tenant?

DD Questions Buyers Should Ask

“What drives your cloud COGS?” – If they can’t answer, margins are unpredictable.

“What happens to margins at 2x usage?” – Does cost scale linearly, sub-linearly, or super-linearly?

“Where are your top 10 cost hotspots?” – If they don’t know, there’s waste.

“What’s your reserved instance vs. on-demand split?” – Poor planning means 30-50% overspend.

Tie-In to Financial Reporting Signals

The Armanino finding that 69% of SaaS companies capitalize development costs is a double signal:

- Ongoing investment in the platform (positive)

- Complexity that needs technical unpacking (requires DD)

Capitalized costs should trigger questions about what’s being built, why, and whether it’s creating value or just managing technical debt.

Deliverable: Cloud Cost Analysis

Dextra Labs delivers:

- Current cost breakdown by service, environment, team

- Unit economics analysis: cost per user/tenant/transaction

- Optimization roadmap: quick wins (weeks) vs. structural improvements (months)

- Margin projection: how cloud COGS behaves at 2x, 5x, 10x scale

Also Read: Technical Due Diligence: Meaning, Process, Checklist

Integration Readiness: Where Good Deals Go to Die?

According to Bain research, megadeals fail when fundamental questions don’t get answered:

- What is our shared vision?

- What is our operating model?

- Can our enterprise technology infrastructure support the combined company?

- Are we truly prepared for the daunting change management?

No experience curve will protect a company from bad outcomes if these basic questions aren’t answered thoroughly (Bain).

Evaluate Compatibility Across Critical Dimensions

Identity and Access: Can users authenticate? Are there SSO conflicts?

Data Model Alignment: Do schemas map cleanly? Where are the impedance mismatches?

API Maturity: Are APIs documented, versioned, stable? Or are they brittle internal hacks?

Eventing: How does the system emit events? Can you integrate event streams?

Audit Logging: Can you meet combined compliance requirements?

Deployment Model Compatibility: Cloud vs. on-prem, containerized vs. VMs, multi-region vs. single-region

Integration Planning Starts During DD

Don’t wait until post-close to figure out integration. Tech DD should produce three integration options:

Option 1: Absorb – Fully integrate into buyer’s platform

Option 2: Bridge – Maintain separate but connected systems

Option 3: Replace – Migrate users/data and sunset acquired platform

Each option needs cost, risk, and timeline estimates.

Deliverable: Integration Readiness Assessment

Dextra Labs produces:

- Integration option analysis with pros/cons for each approach

- Timeline estimate (realistic, not optimistic)

- Integration cost model (engineering effort, infrastructure, migration)

- Risk register for each integration path

- Go-live criteria and rollback plans

Also Read: Top Tech Due Diligence Agencies for Startups in 2026

Post-Merger Tech Roadmap: The “Value Creation Plan” Buyers Expect

Tech DD findings aren’t just risk mitigation—they’re the foundation for your value creation plan.

Convert DD Findings Into a 90/180/365-Day Roadmap

Days 1-90: Stabilize

- Fix critical security vulnerabilities

- Establish monitoring and alerting

- Document architecture and dependencies

- Implement basic disaster recovery

Days 91-180: Integrate

- Connect authentication systems

- Integrate data pipelines

- Establish API connectivity

- Migrate priority workloads

Days 181-365: Modernize and Scale

- Address technical debt backlog

- Optimize cloud costs

- Improve performance bottlenecks

- Implement auto-scaling

Include Governance

Define integration management structure:

- Who owns integration decisions?

- How are conflicts resolved?

- What’s the escalation path?

- Who owns modernization initiatives post-Day 100?

Output: Prioritized Backlog with Business Impact

Every initiative should tie to business outcomes:

- Margin improvement through cloud optimization

- Churn reduction through reliability improvements

- Velocity increase through technical debt cleanup

- Reliability gains through architecture modernization

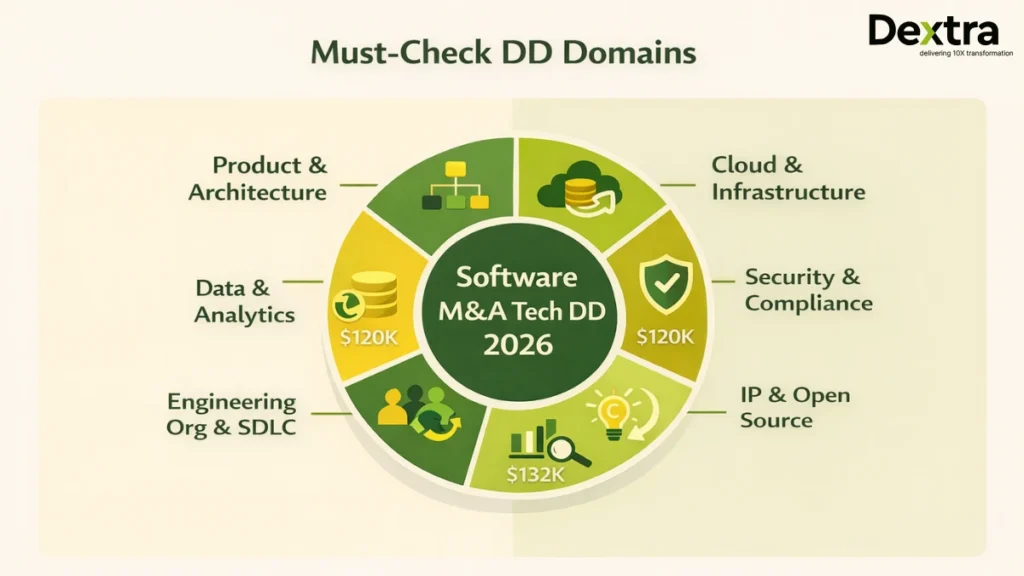

The “Must-Check” DD Domains: Dextralabs Checklist 2026

At Dextra Labs, we evaluate six critical domains in every software M&A tech DD engagement:

1. Product & Architecture

Focus: Scalability, maintainability, technical debt

Key Questions:

- Can this scale 3-5x without rewrites?

- Is the architecture documented and understood?

- What’s the technical debt backlog and remediation cost?

2. Cloud & Infrastructure

Focus: Reliability, disaster recovery, cost hotspots

Key Questions:

- What’s the DR/BC strategy? Has it been tested?

- Where are the top cost hotspots?

- What’s the infrastructure-as-code maturity?

3. Security & Compliance Posture

Focus: Risk reduction, deal protection

Key Questions:

- Any undisclosed breaches or incidents?

- What certifications exist (SOC 2, ISO 27001, HIPAA)?

- What’s the vulnerability management process?

The global market for Cybersecurity Due Diligence for M&A was estimated at $5.16 billion in 2024 and is forecast to reach $7.82 billion by 2031 with a CAGR of 6.2% (QY Research), reflecting increased buyer focus on security risk.

4. IP and Open-Source Risk

Focus: License obligations, ownership clarity

Key Questions:

- What open-source licenses are in use?

- Are there any GPL or copyleft contamination risks?

- Is IP ownership clear and documented?

5. Engineering Org & SDLC

Focus: Delivery risk, bus factor

Key Questions:

- How mature is the development process (CI/CD, testing)?

- What’s the team structure and key person risk?

- What’s the deployment frequency and rollback capability?

6. Data & Analytics

Focus: Data quality, governance, portability

Key Questions:

- How clean and complete is the data?

- What’s the data governance framework?

- Can data be migrated if needed?

What to Ask For in the Data Room: Practical List

At Dextra Labs, we request specific artifacts that map to decisions:

1. Architecture & Design

- System diagrams (network, application, data flow)

- Infrastructure-as-code (Terraform, CloudFormation)

- API documentation (OpenAPI specs, integration guides)

Decision Impact: Scalability risk, integration complexity

2. Operations & Reliability

- Incident history (last 12 months, root causes)

- SLOs/SLAs (uptime targets, performance metrics)

- Disaster recovery plans (RPO/RTO, test results)

Decision Impact: Reliability risk, operational maturity

3. Cloud & Cost

- Cloud bills/cost reports (3-6 months, by service)

- Reserved instance vs. on-demand breakdown

- Cost attribution (by customer, tenant, workload if available)

Decision Impact: Unit economics, optimization opportunities

4. Security & Compliance

- Penetration test summaries (recent findings, remediation)

- Vulnerability scan results

- Compliance certifications (SOC 2, ISO, HIPAA)

Decision Impact: Security risk, compliance cost

5. Development & Debt

- Dependency inventory (third-party services, libraries)

- Open-source license scan (FOSSA, Black Duck, Snyk)

- Tech debt register (prioritized backlog)

- Product roadmap (6-12 months)

Decision Impact: Integration effort, modernization cost

Also Read: Software Due Diligence: A Strategic Guide for Investors, VCs & M&A Leaders in 2026

The Dextra Labs Approach 2026: Decision-Grade Tech DD

At Dextra Labs, we don’t produce generic reports, we deliver decision-grade outputs that directly inform:

1. Valuation Adjustment Narrative

When we find technical risk, we quantify it:

- Risk description and business impact

- Remediation cost (time, budget, resources)

- Suggested valuation adjustment with justification

2. Integration Readiness Plan

We map three integration paths with:

- Cost estimates for each option

- Timeline projections (realistic, not best-case)

- Risk assessment and mitigation strategies

3. Post-Merger Roadmap

We convert findings into a 90/180/365-day plan:

- Prioritized initiatives tied to business outcomes

- Resource requirements (engineering, infrastructure, budget)

- Success metrics for each phase

4. Risk Register

We maintain a live risk register that tracks:

- Technical risks with probability and impact

- Mitigation strategies and ownership

- Open questions that need resolution pre-close

Conclusion: Where Software Deals Are Won or Lost

In 2026, software M&A success is decided long before Day One of integration. It’s decided in the quality of technical due diligence.

Growth metrics may open the door, but architecture, cloud economics, and integration reality determine whether value survives the close. The hardest lessons in M&A don’t come from what buyers didn’t know, they come from what they didn’t validate early enough.

Future-proof software deals don’t rely on optimism. They rely on evidence. Evidence that the platform can scale under real load. Evidence that margins won’t collapse as usage grows. Evidence that integration won’t stall momentum or consume leadership bandwidth for years.

This is why modern tech due diligence is no longer a checkbox exercise. It’s a value creation discipline. When done right, it doesn’t just protect downside—it accelerates upside by giving buyers a clear, executable plan for stabilization, integration, and modernization.

At Dextralabs, we’ve seen the pattern repeat across regions and deal sizes: the buyers who win are the ones who treat tech DD as strategy, not inspection. They close faster, integrate cleaner, and start creating value sooner, because they know exactly what they’re buying and what it will take to make it work.

In software M&A, confidence isn’t about taking fewer risks. It’s about understanding them deeply enough to act decisively.

Future-Proof Your Next Software Deal

Partner with Dextralabs for decision-grade tech due diligence

Get a Free ConsultationFAQs on Software M&A technical Due Diligence:

Q. Why is software tech due diligence more critical in 2026 than before?

Because growth alone no longer guarantees value. Buyers must validate scalability, cloud unit economics, integration readiness, and technical debt upfront to avoid post-close surprises that erode margins and delay synergies.

Q. How does technical debt impact software M&A valuation?

Unaddressed technical debt increases future engineering costs, slows integration, and limits scalability. In 2026, buyers increasingly factor remediation cost and timelines directly into valuation adjustments and earn-out structures.

Q. What are the biggest hidden risks in software acquisitions?

The most common hidden risks include fragile architecture under load, unpredictable cloud costs, undocumented dependencies, weak disaster recovery, and integration blockers that only surface after close.

Q. How early should technical due diligence be conducted in a deal?

As early as possible, ideally pre-LOI or alongside commercial due diligence. Early tech DD reduces deal friction, prevents late renegotiations, and enables realistic pricing and integration planning.

Q. What should buyers expect as outcomes from a modern tech DD?

Buyers should receive decision-grade outputs: a quantified risk register, remediation and integration cost models, realistic timelines, and a post-merger technology roadmap tied to business value.

Q. How does tech due diligence support post-merger value creation?

By converting findings into a 90/180/365-day roadmap that prioritizes stability, integration, and modernization initiatives—each mapped to margin improvement, reliability, or growth acceleration.

Q. Can good tech DD accelerate post-close integration?

Yes. Clear integration options, cost estimates, and risk trade-offs allow leadership teams to move decisively post-close instead of spending months reassessing the same technical questions.