The private equity investment landscape is going through a real transformation, largely because technology is playing an increasingly strategic role in deal-making and portfolio management. In 2024, technology-related transactions made up 23% of private equity deployment by value in the U.S., up from 21% the year before. This rise clearly shows how digital capabilities have become key drivers of value in today’s investment process.

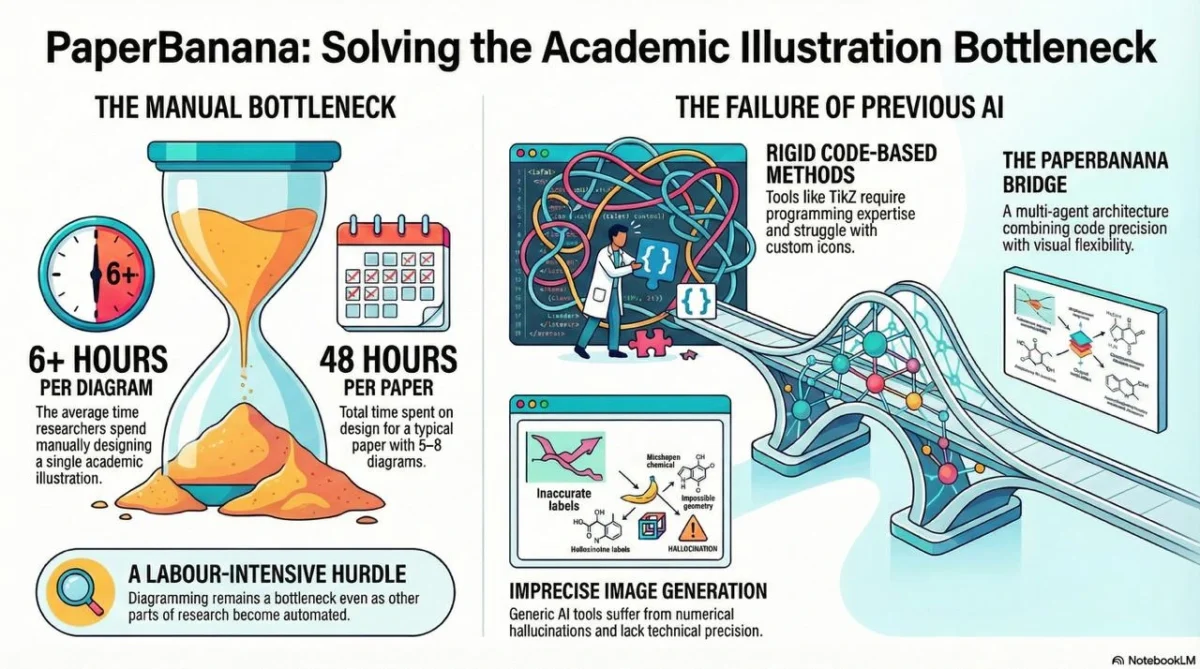

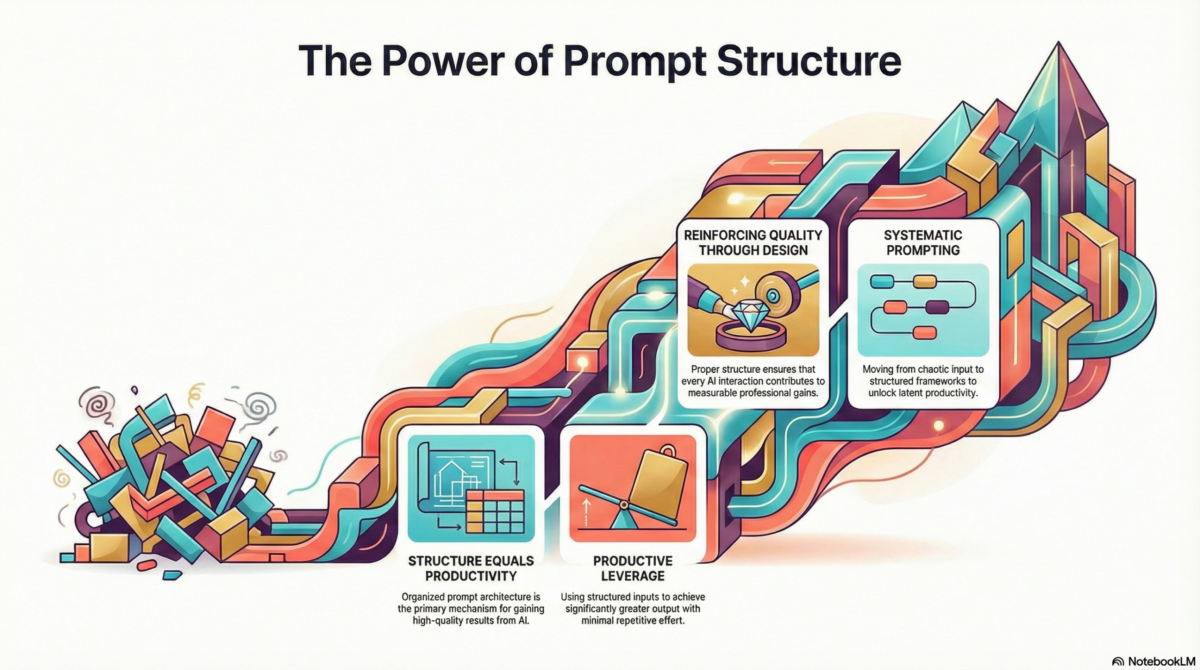

In this evolving environment, specialized tech due diligence has become essential. It’s no longer just about spotting risks or red flags. Instead, tech due diligence for private equity firms now uncovers opportunities for operational improvements, scalability, and innovation that can truly create value. The trend is unmistakable—73% of PE firms have shifted their focus from simply managing risk to actively identifying ways to boost value.

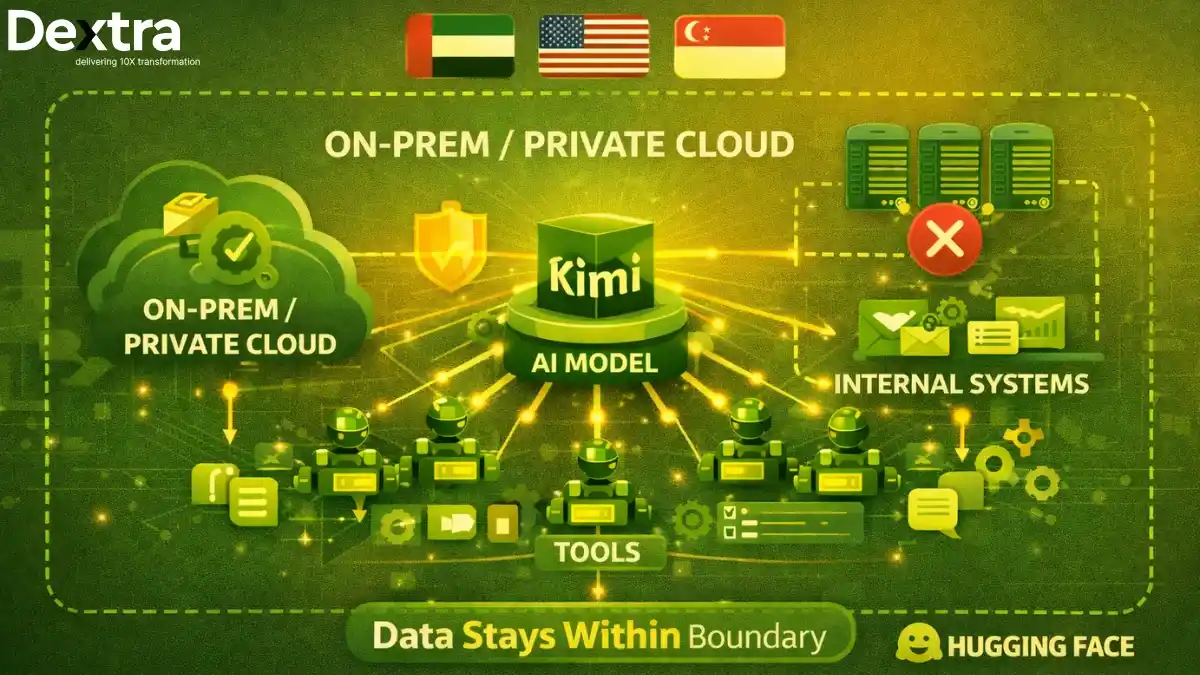

From private equity tech audits to broader private equity technology assessments and thorough technology risk assessments, these deep dives into tech are crucial throughout the investment journey, from deal origination right through to post-close integration. Especially in key markets like the United States and Singapore, PE firms are turning to experts with regional knowledge. In this space, Dextralabs tech due diligence Singapore stands out as a trusted partner, delivering customized, detailed assessments that align technology capabilities with overall investment goals.

The Shift Towards Specialized Value-Add Strategies in Private Equity

Private equity has long relied on financial engineering and cost-cutting to boost portfolio performance. While these strategies still play a role, the approach today is far more dynamic. PE Firms are increasingly looking beyond the balance sheet to find value, especially through technology. This transformation shifts focus away from solely managing risk toward identifying undiscovered growth opportunities, which require a level of insight into operations that can only be uncovered through technology. EY’s latest report underlines how the role of due diligence is evolving from a checkbox process to a strategic driver of long-term value.

Trusted by Leading PE Firms in Singapore and the USA

From identifying technical debt to aligning tech with growth strategy, Dextralabs delivers actionable insights that create real value. Let’s elevate your due diligence process.

Get a Free Tech DD AssessmentTechnology now sits at the heart of driving efficiency, scalability, and innovation. With specialized tech due diligence, investors get a clearer picture of how well a company’s technology aligns with its business model and future growth plans. These assessments highlight where digital tools, cloud infrastructure, or AI can provide a real competitive advantage—insights that are shaping deal-making like never before. Accenture suggests that modern due diligence must focus on a target’s digital readiness and technology stack to forecast post-acquisition success.

This evolution has also led to a rise in sector-specific expertise within private equity and venture capital. Firms have increasingly developed their own internal teams or engaged with specialists that have deep insights into the challenges faced by tech-enabled businesses. That specific knowledge translates to better assessments and stronger post-investment plans— and better results across portfolios. McKinsey notes that sector-specific and technology-focused PE firms are increasingly outperforming generalists.

The Role of Technical Due Diligence in Value Creation

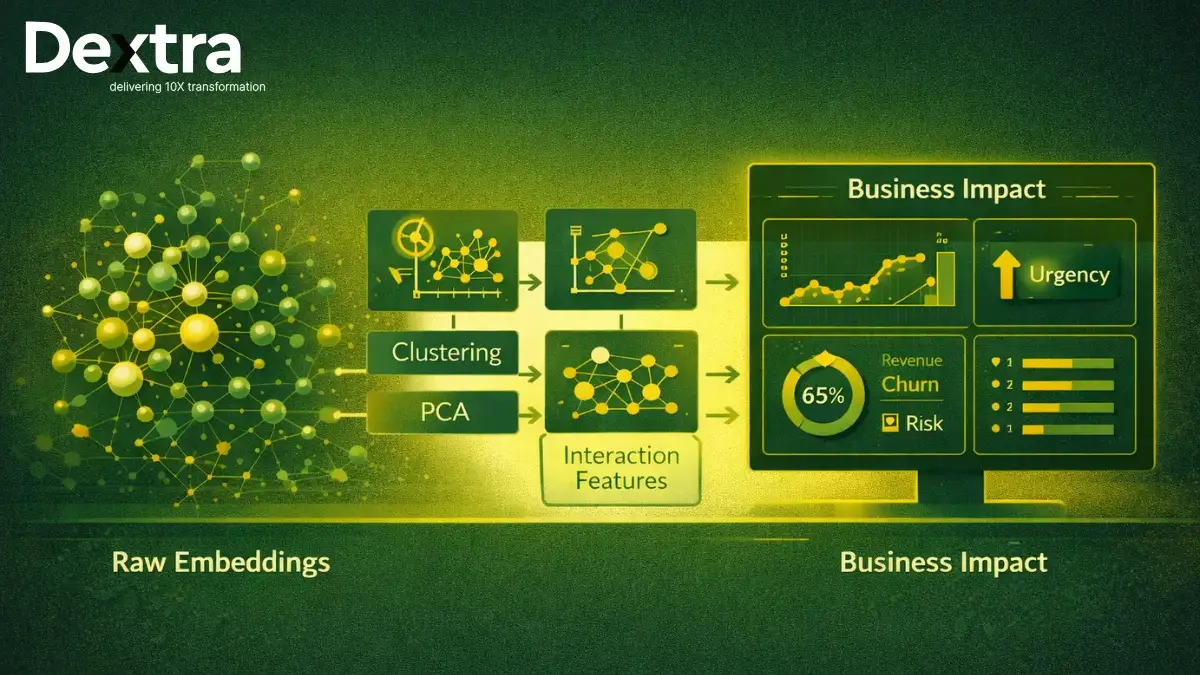

Technical due diligence (Tech dd for PE firms) isn’t just about spotting risks anymore—it’s a powerful way to uncover growth opportunities and create smarter investment strategies. Here’s how it brings value in three key areas:

1. Identifying Technological Strengths and Weaknesses

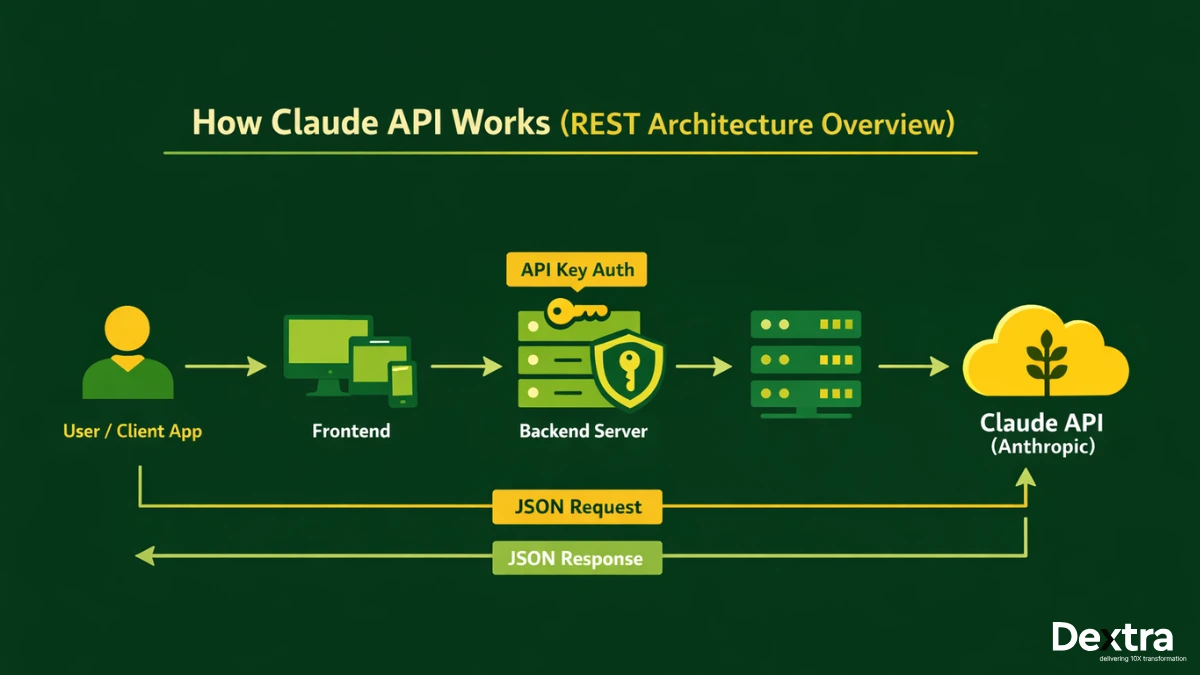

Determining how robust and scalable any technology really is, is one of the most important parts of any private equity technology diligence. That includes examining the software architecture, infrastructure, and interoperability with other platforms. It also involves knowing about any technical debt, like old systems or anything implemented that might jeopardize growth or result in a costly upgrade after the deal closes.

Accenture emphasizes that understanding the core technical capabilities—like software scalability and integration flexibility—is essential for anticipating operational uplift.

2. Risk Mitigation and Compliance

Tech due diligence is also a major component of risk management. It assesses the cybersecurity measures, data privacy protocols, and the overall security framework of the platform, preventing nasty issues like breaches or system outages. In addition, the verification of the company’s compliance with regulations such as GDPR or SOC 2 also helps to avoid expensive legal issues down the line.

EY’s insight points out that early detection of tech vulnerabilities and compliance gaps significantly reduces post-deal risks.

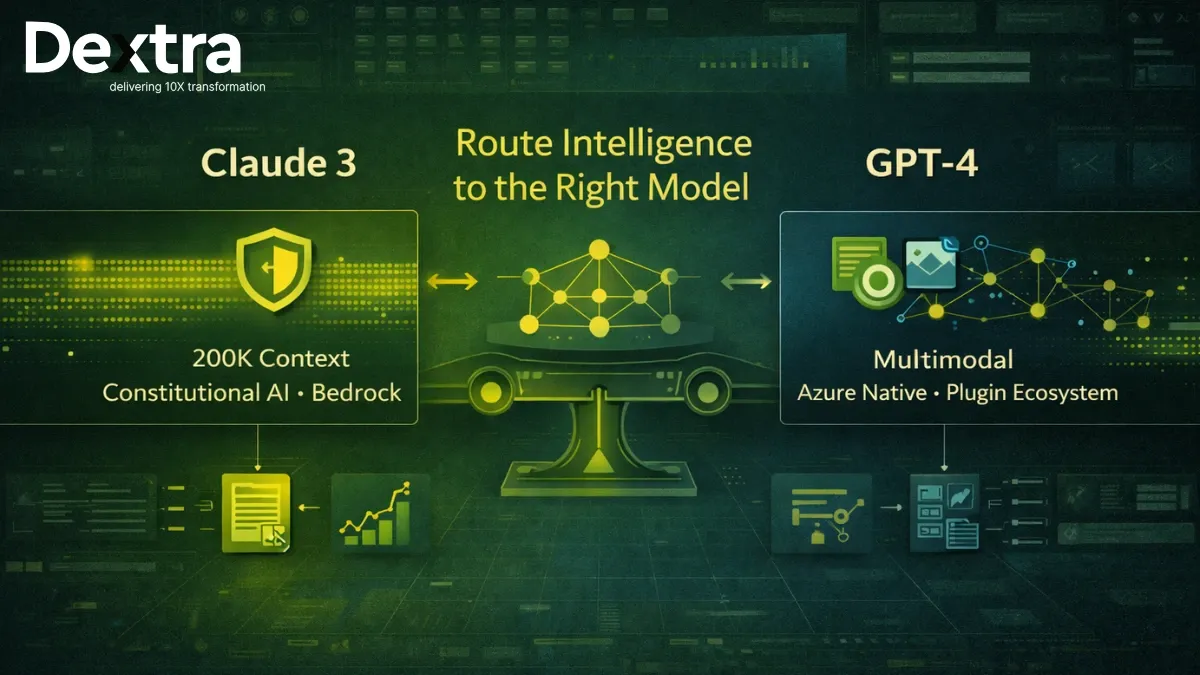

3. Strategic Alignment and Growth Potential

Finally, solid tech DD for PE firms helps figure out if the technology truly supports the company’s bigger business goals. It looks for ways to scale up operations, embrace digital tools, or weave in AI for better efficiency. These insights shape post-deal strategies and pinpoint tech investments that can fuel lasting growth.

FTI Consulting found that over 70% of PE firms believe AI-driven companies represent superior long-term investment potential.

Dextralabs: Your Partner in Specialized Tech Due Diligence

When it comes to specialized tech due diligence, Dextralabs has earned its stripes as a go-to tech dd partner for private equity firms. With expertise in private equity technology assessment, Dextralabs serves clients in both Singapore and the United States, delivering deep dives into tech risks and growth potential for target companies.

Dextralabs has teamed up with PE firms on plenty of successful deals. For example, in Singapore, they uncovered hidden integration issues during a tech company acquisition. Meanwhile, in the U.S., their thorough private equity tech audit helped an investor spot key areas ripe for digital transformation—driving real value creation in private equity.

What really sets Dextralabs apart is their unique mix of advanced tools and hands-on experience. Whether it’s reviewing software architecture or sizing up AI readiness, their tailored approach covers every angle.

Dextralabs’ approach reflects global best practices outlined by firms like EY, Accenture, and McKinsey—combining technical scrutiny with strategic foresight. For those seeking expert, results-focused support, Dextralabs tech due diligence Singapore remains a trusted choice.

Conclusion: Leveraging Specialized Tech DD for Competitive Advantage

This goes far beyond the usual financial checks, helping firms spot hidden risks and uncover real opportunities for growth. In a tech-driven market, this kind of in-depth analysis isn’t just helpful, it’s essential to stay ahead.

Teaming up with experts like Dextralabs means private equity firms get tech assessments that are both thorough and tailored to their needs. Their deep experience in private equity technology assessment helps unlock value creation chances that might otherwise slip under the radar—giving investors a real competitive edge.

For PE firms aiming to boost deal success and fuel long-term growth, bringing specialized tech DD for PE firms into the investment process isn’t just a nice-to-have anymore, but it’s a must. Making this move can seriously change the game in today’s fast-moving landscape.

Make Smarter Deals with Specialized Tech DD

Partner with Dextralabs to gain deep, technology-driven insights that traditional due diligence misses. Our tailored Tech DD services help PE firms uncover growth opportunities and mitigate risks.

Get a Free Tech DD AssessmentFAQs:

Q. Why is specialized technical due diligence (Tech DD) crucial in modern private equity investments?

Specialized Tech DD enables private equity firms to assess a target company’s technology infrastructure, scalability, and potential risks. It goes beyond financials to uncover hidden strengths, technical debt, and opportunities for digital transformation—ultimately helping firms make informed decisions and create long-term value.

Q. How does Tech DD differ from traditional due diligence practices?

Traditional due diligence mainly focuses on financial, legal, and operational aspects. In contrast, Tech DD provides a deep dive into software architecture, cybersecurity, compliance, and technology alignment with business goals. It’s a forward-looking approach that evaluates how tech can drive growth post-investment.

Q. What are some key areas assessed during technical due diligence?

Tech DD typically evaluates:

– Software architecture and scalability

– Integration capabilities with other systems

– Cybersecurity and data protection measures

– Technical debt and development practices

– Compliance with industry regulations

– Alignment of technology with long-term business strategy

Q. How does technology create a competitive edge for PE firms?

Technology enhances operational efficiency, accelerates digital transformation, and opens new revenue streams. PE firms that integrate technology early in the investment lifecycle are better positioned to scale portfolio companies, reduce costs, and achieve higher exit multiples.

Q. What makes Dextralabs a reliable partner for Tech DD services?

Dextralabs offers sector-specific expertise and uses proprietary tools to deliver detailed technical assessments tailored to PE investments. With proven experience in markets like Singapore and the USA, Dextralabs has helped PE firms uncover hidden value and mitigate risks effectively.