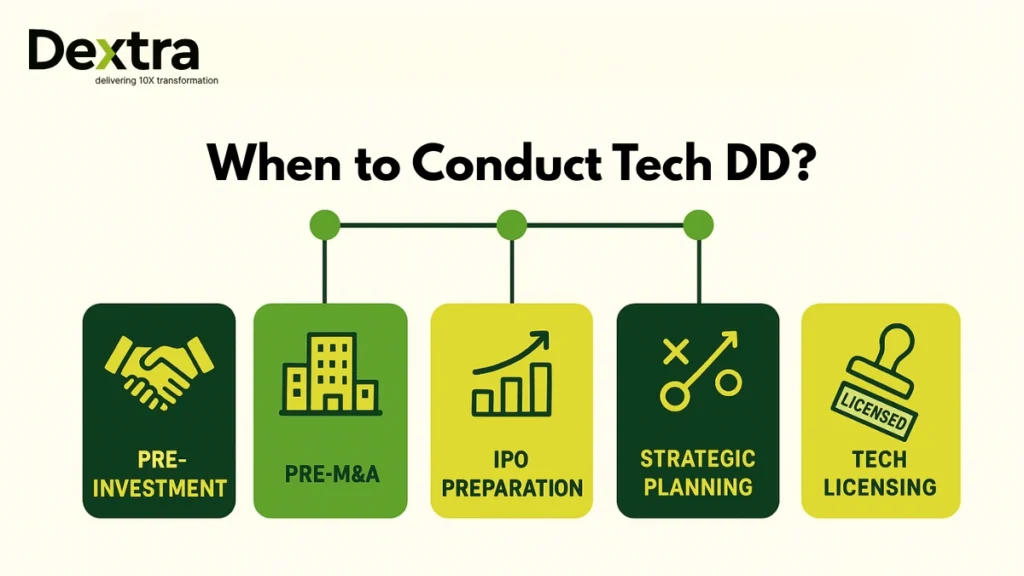

Technology due diligence (or tech DD) is an in-depth assessment of an organization’s technology infrastructure, systems, processes, intellectual property, cybersecurity measures, and overall technical capabilities. It is typically conducted during mergers and acquisitions (M&A), investments, partnerships & joint ventures, IPOs, technology licensing or transfer, or when doing strategic planning and risk assessment to understand an organization’s technology assets and risks. This makes it a critical priority for early-stage startups seeking funding, SMEs looking for partnerships or joint ventures, companies looking for mergers or aspiring to go public.

In 2025, the total value of global mergers and acquisitions (M&A) deals increased by 12% to $3.4 trillion (McKinsey). Yet even with all that activity, up to 90% of mergers ultimately fail (Harvard Business Review). One major reason is that many companies overlook critical technology-related issues like having hidden technical debt, security flaws, or systems that can’t grow well.

Technical due diligence plays a key role in M&A. It allows investors and buyers to closely evaluate a company’s technology to properly assess the true strength of the investment and its technology-related risks. Skipping this step can lead to major problems later.

Let’s discuss and understand it in more detail!

What Is Technology Due Diligence?

When you’re thinking about investing in a tech company or a business that relies heavily on technology, technology due diligence (or tech DD) is a must. It’s not just about reviewing finances or legal paperwork anymore. Today, investors, VCs, and private equity firms (PE firms) need to understand how strong a company’s tech really is.

In a typical Tech DD, experienced experts, usually former CTOs or tech executives, carefully analyze the company’s entire technology setup. This includes how products are built, how scalable the systems are, and whether the tech team is ready to support growth. They analyze risks, hidden issues and opportunities to create more value after the deal.

You can also think of it like, suppose while you’re already doing your financial, legal, and commercial due diligence, adding technology due diligence helps you make a smarter, more complete decision. It gives you real insights into whether the company’s tech is truly an asset or a hidden liability.

At Dextralabs, we specialize in helping Investors, PE Firms, deal aggreagators make confident, informed choices. Our team offers clear, in-depth technology due diligence consulting that fits your investment goals.

Who Needs Tech Due Diligence and When?

There are a few key moments when it really makes sense to do a tech due diligence (or tech DD). The most common one? Right before an investment or acquisition.

If you’re on the buy-side like a VC, investor, or private equity firm, you’ll want a deep understanding of the company’s technology and product setup before committing your money. At Dextralabs, we help you spot risks early, uncover hidden strengths, and find ways to create long-term value. You’ll walk away with clear insights, red flags (if there are any), and a plan for what to prioritize after the deal closes like automating processes or using data more effectively.

But it’s not just buyers who benefit.

Sometimes the sell-side, that is, the company itself, wants a technology due diligence done. In this case, the goal isn’t just to understand the tech, but to improve it. We often call this a technology health check. It helps founders, CTOs, or internal teams figure out how to speed up product development, improve workflows, or reduce growing pains.

This kind of technical diligence is also really helpful if you’re looking to raise funds or sell your business. You can clearly see what your current status is, including whether your team structure is scalable, or missing necessary skills at the leadership level (for example, CTO or CPO). From there, you can determine whether you need to hire and train or adjust your tech organization to accommodate your next stage of growth.

Whether you’re buying, selling, or scaling, Dextralabs offers reliable technology due diligence consulting tailored to your needs.

What Should a Technology Due Diligence Cover?

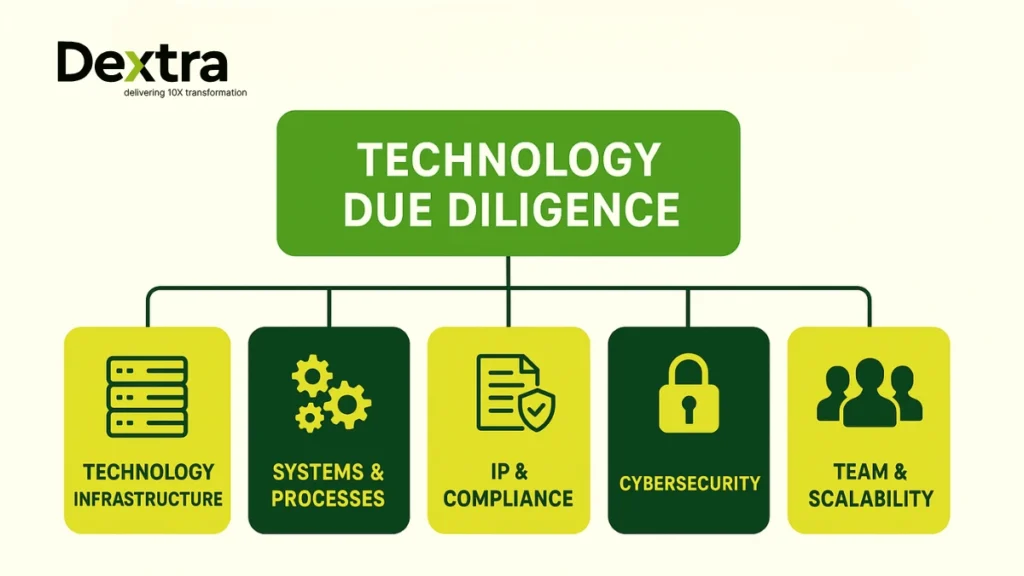

The scope of a technology due diligence (or tech DD) can vary depending on the goals of the assessment. While there are many different approaches and even detailed tech due diligence checklists out there, most evaluations cover some key areas. At Dextralabs, we customize our tech due diligence consulting to fit your specific needs. But here’s a closer look at the topics we typically cover, along with the kinds of questions we aim to answer:

1. Scalability

- Infrastructure scaling: Can the tech infrastructure accommodate 10 times or even 100 times more users? How much is still manual work?

- Team scaling: Will adding more team members improve productivity or slow things down?

- Scaling cost: What happens to infrastructure costs as the business grows?

- Business continuity & disaster recovery: If we have a major problem (e.g. a data centre outage), how much data could be lost? Do we have good redundancy?

- Monitoring & alerting: How quickly and accurately can the team detect infrastructure problems?

2. Tech Team

- Team structure: Does it encourage productivity?

- Team autonomy: Do the teams have the right combination of skills to work independently and without delays?

- Processes & workflows: Are there clear ways of working together, and do they match the company’s current stage?

- Meeting culture: Are meetings focused, effective, and goal-driven?

- Recruiting & onboarding: How does the company attract, hire and train new talent? How quickly can they get new hires up to speed?

3. Tech Stack & Architecture

- Tech stack choices: Is the tech stack (e.g. languages, frameworks) a good fit for the company’s goals?

- Architecture: How flexible is the system when changes are needed?

- Security: Are there strong practices in place to protect data and systems?

- Technical debt: Is the team aware of past shortcuts? Are they actively paying down technical debt?

4. Legal, Compliance & IP

- GDPR compliance: Are systems and roles in place to respect user privacy and data rights?

- IP ownership: Does the company truly own its intellectual property even when employees or freelancers leave?

- Patent strategy: Is there a structured approach to protecting valuable tech assets through patents?

- Open source use: When using open-source tools, do developers understand the risks? Are license checks in place?

5. Core Tech Assets

- Documentation: Is there a well-maintained knowledge base that helps reduce dependence on key individuals?

- Software Development Life Cycle (SDLC): What’s the full process from idea to deployment?

- Code quality & Testing: Are there clear standards for writing code? Is automated testing part of the workflow?

6. Product & Strategy

- Product strategy: Is the roadmap aligned with the company’s mission? Who influences it?

- Product discovery: How does the team decide what to build (and what not to)?

- UX capabilities: Are user experience experts involved in shaping the product?

- Product intelligence: What kind of data is used to guide product decisions?

Depending on the industry, stage, and goals of the company, a tech due diligence may need to go deeper in some areas. For example:

- If a company handles sensitive personal data, we’ll do a more in-depth review of security and compliance.

- In fintech, we focus more on things like transaction security, API scalability, and business continuity.

- For early-stage startups, we look at how well the team is testing and validating ideas quickly.

- For growth-stage companies, we focus on whether their teams, processes, and infrastructure can handle fast scaling.

At Dextralabs, our technology due diligence (TDD) services adapt to your deal’s needs. We help you assess maturity, identify gaps, and spot opportunities to build value right from the start.

How Dextralabs Tailors Every Technology Due Diligence to Your Needs?

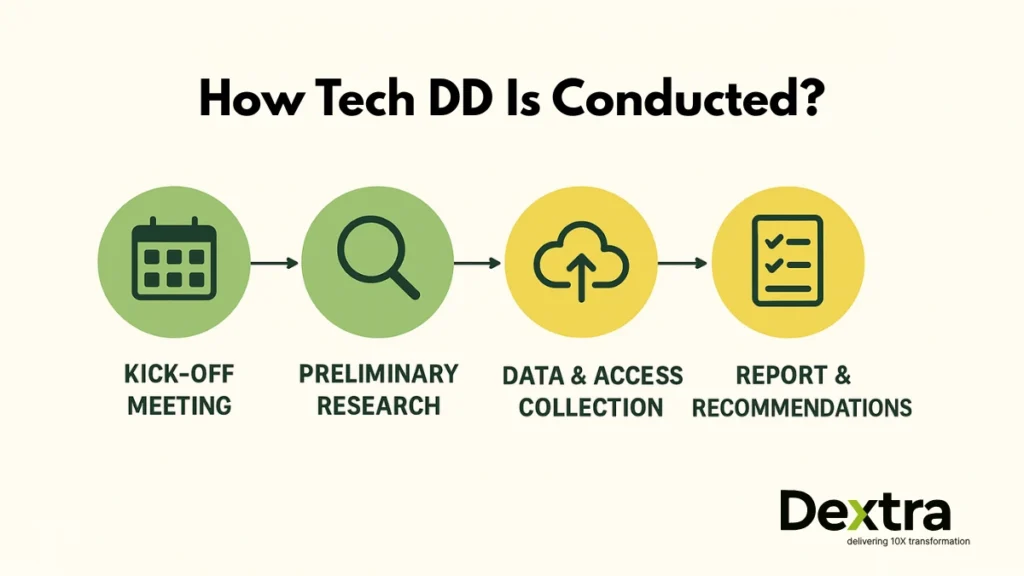

At Dextralabs, we believe that every tech due diligence (or tech DD) project should be built around the unique needs of the business being assessed. That’s why we take the time to set the right direction from the very beginning.

We start by holding detailed kick-off meetings, followed by preliminary research and early input from our experienced industry experts. This helps us fully understand the company’s tech environment, its current challenges, and the opportunities it has for scaling or improving operations.

Our approach to tech DD is both flexible and thorough. We use a modular due diligence framework which means we can adjust the scope based on what’s needed. Whether you’re looking for a light-touch review that focuses only on the most critical areas or a full-scope confirmatory technology due diligence with deep dives and multiple stakeholder interviews, we’ve got you covered.

We don’t believe in one-size-fits-all checklists. Instead, we combine our expertise in technology due diligence consulting with structured tools and data-driven analysis to create a setup that works for your specific investment case. That includes detailed evaluations of the product, infrastructure, team, security, codebase, and scalability all aligned with the goals of your deal.

For early-stage startups, we might focus on speed, agility, and technical leadership. For growth-stage or enterprise-level targets, our technology due diligence checklist will likely go deeper into things like infrastructure automation, information technology due diligence, and technical diligence across teams and platforms.

We also make sure that the IT due diligence report we deliver is easy to understand, actionable, and aligned with your business goals. Whether you’re a venture capitalist, an investor, a private equity firm, or a growing small business, you’ll get a clear view of both the risks and the upside.

From identifying red flags to spotting post-deal value creation opportunities, our technical due diligence services help you move forward with confidence. And throughout the process, you’ll always have access to seasoned professionals whether it’s former CTOs, architects, or specialists in due diligence technology.

At Dextralabs, we don’t just assess technology but we help you use its full potential.

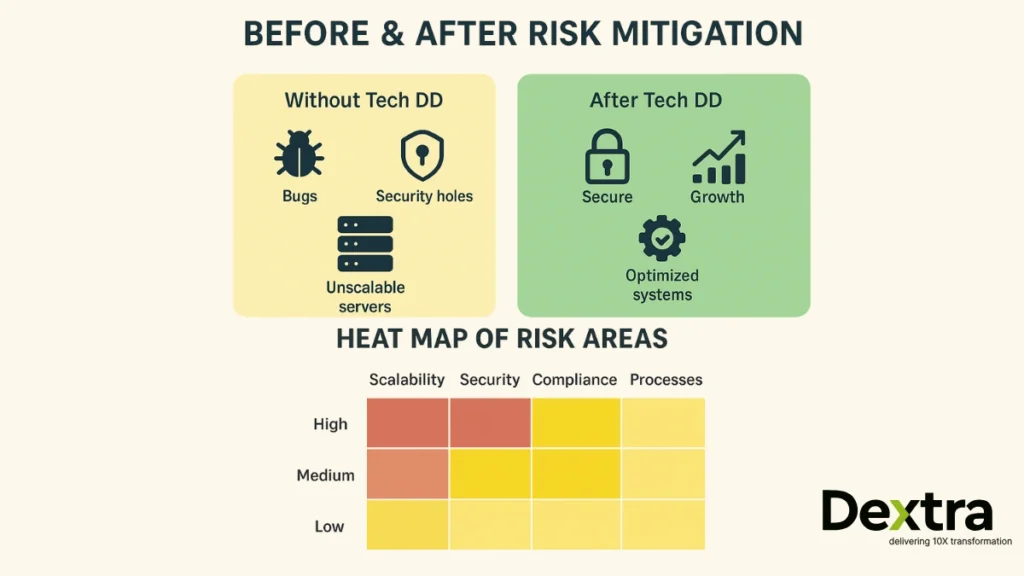

Common Risks a Tech DD Should Cover:

It’s important to understand what all can go wrong when you’re investing in a tech company whether through a startup round, private equity deal, or M&A transaction. A well-run technology due diligence (or tech DD) doesn’t just confirm what’s working; it identifies hidden risks that could impact your investment.

At Dextralabs, we make sure every technology due diligence project gives you a clear view of potential threats, inefficiencies, and blockers to growth. Here are some of the most common risk areas we assess during our technical due diligence services, all tied back to your business goals:

1. Scalability Risks

If your infrastructure and systems can’t scale fast enough, it will hinder your growth. You might miss out on key market opportunities, or worse you can lose customers permanently. Instead of building new features, your team could waste time patching tech that can’t keep up. During tech due diligence, we examine how well the current tech setup can support 10x or 100x growth, and whether processes are automated or too reliant on manual work.

2. Knowledge Gaps & Skill Shortages

Many growing companies rely too heavily on a few senior engineers. If those people leave, the company risks losing vital knowledge. This creates “knowledge silos” that slow down development and make scaling difficult. As part of our IT due diligence checklist, we assess how well knowledge is documented and distributed across teams, and how resilient the company is to unexpected talent turnover.

3. Hiring Challenges

If the company’s technology stack is outdated or unattractive, it becomes harder (and also more expensive) to hire skilled engineers. Poor technical decisions also lead to growing technical debt, which demoralizes developers and leads to high churn. Our technology due diligence consulting takes an indepth look at whether the stack is helping or hurting the team’s ability to scale and hire.

4. Security Weaknesses

Security issues can cause serious damage like data loss, system outages, legal action, or reputation loss. Our technical due diligence includes a deep look into how security is managed across infrastructure, applications, and teams. We assess policies, encryption, access control, and whether the team actively monitors threats.

5. GDPR & Compliance Risks

For companies operating in or with the EU, GDPR compliance is a legal must. Failing to meet these standards can result in fines and legal restrictions. As part of our information technology due diligence, we evaluate how personal data is handled and whether the company has structured privacy practices in place.

6. Valuation-Driven Tech Stack

Some companies adopt new technologies simply to impress investors or increase their valuation. However, incorporating technologies like AI or blockchain without a real purpose only adds expense and limits long-term value. Our M&A technical due diligence evaluates whether the tech is actually solving problems or is just a diversion.

7. Process Inefficiencies

Teams that lack clear, efficient processes struggle with productivity. During our tech DD, we focus on understanding how work is planned, prioritized and delivered. Is there a defined delivery pipeline? Do meetings have great outcomes? Are teams aligned and working on the same initiatives? Poor process leads to wasted time, capital loss, and team frustration.

8. Data Mismanagement

Having a weak data strategy is a wasted opportunity. Without proper systems in place, companies fail to understand their users or make data-backed decisions. We look at data pipelines, reporting tools, and analytics capabilities as part of our technical DD to help you better understand what you may be missing out on to allow for better decision-making.

9. Tech Stack Misalignment

A tech stack should empower teams and not hold them back. If the current setup is slowing down product delivery or causing vendor lock-in, that’s a clear red flag. Our technology due diligence checklist covers stack selection, ecosystem maturity, long-term supportability, and risks tied to third-party tools or platforms.

Why Does It Matters?

Identifying these risks during a tech DD helps investors, VCs, and private equity firms avoid costly surprises. With Dextralabs as your technical due diligence consultant, you get actionable insights and practical recommendations no matter whether you’re preparing for a deal, planning a scale-up, or assessing a potential acquisition.

Our IT due diligence reports go beyond surface-level analysis. We tailor every review to your deal type, company size, and goals whether you’re doing a technical DD on a startup, a mid-sized SaaS business, or an enterprise tech provider.

What Does a Technology Due Diligence Report Include?

If you are going to invest in tech/Saas startups, AI companies or are getting ready for a funding round one of the important things that you will receive (or create) is a Technology Due Diligence report. This is not merely paperwork. A Technology Due Diligence report is the key to understanding the tech risks, opportunities, and future-readiness of a business.

At Dextralabs, we specialize in delivering sharp, focused, and actionable tech DD reports that help investors and decision-makers act with confidence.

What You Can Expect in a Tech Due Diligence Summary Report?

Every tech DD report we deliver includes a clear, concise executive summary. This gives you a quick overview of the most critical findings about what’s working, what’s not, and where your biggest risks (and opportunities) lie.

We prioritize the findings based on their impact on the investment case. This means the report doesn’t just list issues; it explains which ones matter most, and why. You’ll see:

- Where the company is outperforming and may have a competitive edge

- Areas that need urgent improvement to support growth

- Evidence and rationale for each finding

- The potential impact of each issue on your business goals

Even if everything looks fine today, a 10x increase in users or headcount could break fragile systems. That’s why we don’t stop at what’s working now but we think about what happens next.

We Provide Tailored Analysis & Not Just Checklists

Not all findings are equally relevant for every company. Our assessments use a flexible framework inspired by our proprietary technology due diligence checklist, benchmarked against industry peers and adjusted for each company’s:

- Stage of growth

- Industry and regulatory environment

- Product and tech stack

- Strategic goals

Our team brings years of real-world experience, from M&A technical due diligence to advising CTOs and product teams. We give you not only the data, but also the context behind each insight.

You’ll Get Clear, Actionable Recommendations

One thing we constantly hear from investors and founders is this: “Don’t just tell me what’s wrong, tell me what to do.”

So that’s what we do.

Each finding comes with specific, actionable advice. We answer the question: If I were the CTO, what would I do next? In what order? Depending on the scope of your technical DD, our recommendations may include:

- Quick wins like adding tools to the CI/CD pipeline

- Improving code quality or team workflows

- Reorganizing team structures

- Addressing security gaps

- Reducing technical debt

- Preparing for future scale with smarter infrastructure choices

You’ll receive advice that your CTO can start using immediately without having to translate jargon or guess what we meant.

After delivering the report, we don’t just leave you to figure it out. We walk you through the results during a live session or “read-out,” where we explain key findings, answer questions, and dive deeper into anything you want to explore.

Post-DD Support (With Boundaries)

Some technology due diligence providers offer post-deal consulting or try to sell tech transformation services based on the findings. At Dextralabs, we intentionally avoid this.

We prefer to focus 100% on delivering the fastest, sharpest, most unbiased technology due diligence services in the market.

That said, we don’t disappear. We’re always available to answer questions, offer second opinions, or provide CTO sparring sessions. We love seeing tech companies thrive and we’re more than happy to support that mission however we can.

So, whether you’re:

- An investor planning your next deal

- A startup founder preparing for a funding round

- A business leader wanting a technology health check

Dextralabs is here to help you make smart, tech-informed decisions. Our reports give you what you really need: clarity, direction, and confidence.

Technology Due Diligence Checklist: What You Need to Prepare?

Going through a Technology Due Diligence (Tech DD) can feel overwhelming especially if it’s your first time. These reviews usually happen under tight deadlines and while your team is still trying to manage day-to-day business. But with the right preparation, the process can be smooth and even valuable.

At Dextralabs, we’ve already helped many companies like you that went through technology due diligence from Series A startups to Series C level to growth-stage tech firms. Whether you’re getting ready for an investment round, a sale, or a technical audit check, using a solid Technology Due Diligence checklist can save you time and reduce stress.

Why You Should Prepare Ahead?

Depending on the scope, a Tech DD can take a few hours or several days of work. It all depends on how much documentation you already have and how clean your tech setup is (especially if there’s a lot of technical debt).

A simple but helpful tip: Always ask for the expected scope and timeline before your Tech DD begins. This will help you plan and avoid last-minute scrambling.

What to Prepare for a Technology Due Diligence?

No matter who your Tech DD provider is, or when it’s scheduled, you can start preparing today. Here are four things we always recommend getting ready:

1. Product Demo & Demo Account

Have a live product demo ready to walk through your core features. Create a demo account, and make sure your team has all of the details of the product so that they feel comfortable explaining it thoroughly. Bonus tip: Include a quick product vision overview and a feature comparison list to help reviewers understand your value!

2. Key Metrics & KPIs

Organize important performance metrics like:

- Uptime

- Test coverage

- Development velocity

- Deployment frequency

Charts showing improvements over time can go a long way in demonstrating progress. Update them with the latest data so everything is current.

3. Core Documentation

You don’t need to start from scratch you can just gather what’s already available:

- Technical architecture diagrams

- Product & engineering roadmaps

- List of third-party tools and software licenses

- IT infrastructure and data flow documents

These help the technical due diligence consultant understand your system faster.

4. Access to Tools and Platforms

The Tech DD team may need access to:

- GitHub or GitLab (codebase)

- JIRA or Linear (issue tracking)

- Datadog or similar (monitoring tools)

- Notion, Confluence, or Google Docs (internal documentation)

Having accounts and permissions set up in advance can save time and help the technical DD team do their job efficiently.

Why a Technology Due Diligence Checklist Matters?

A proper checklist helps you stay one step ahead. It ensures you:

- Gather all relevant paperwork (e.g., software licenses, IP contracts and architecture diagrams)

- Evaluate your technology stack and development team to improve the vulnerable areas

- Get ready for technical interviews with investors or buyers

- Identify weak areas and start fixing them before they become deal-breakers.

- Highlight your strengths and show your tech in the best light possible

If your business relies heavily on software, data, or digital infrastructure, a technology due diligence checklist isn’t just helpful but it’s essential.

Whether you’re raising capital, planning for M&A, or simply checking in on your tech foundation, Dextralabs is here to support you with expert tech due diligence consulting. Our reports are clear, actionable, and built to help you move fast without missing what matters.

Why Choose Dextralabs as Your Technology Due Diligence (Tech DD) Partner?

Making smart decisions about tech investments is crucial and even one wrong move can cost millions. That’s why technology due diligence (Tech DD) is essential before investing, merging, or scaling your tech business. At Dextralabs, we offer expert tech due diligence consulting that helps investors and companies understand the real value and risks tied to their technology.

Our Unique RCOI Approach

What sets Dextralabs apart is our special RCOI approach that focuses on:

- Risks: Identifying potential tech problems that could cause liabilities.

- Costs: Understanding the financial impact linked to those risks.

- Opportunities: Spotting areas where improvements can boost growth.

- Impact: Showing the financial benefits from seizing these opportunities.

This means we don’t just find issues but we also explain how they affect your investment and what actions can improve the future.

When to Partner with Dextralabs for Tech DD?

- Pre-Investment: Spot hidden risks, know the real tech value, and get clear insights before you commit.

- Post-Investment: Fix tech problems fast, optimize your systems, and maximize returns.

- M&A Support: Help manage technology integration and uncover risks before deals close.

Comprehensive Technology Due Diligence Services

Our team brings broad experience across industries like SaaS, fintech, healthtech, and more. We cover:

- Technology stack and architecture reviews

- Code quality and security assessments

- Cloud cost and service evaluations

- Data privacy and GDPR compliance checks

- Intellectual property (IP) and open-source software analysis

- Team skill evaluation and process reviews

Why Clients Trust Dextralabs?

- Flexible for Any Business Size: We customize our Tech DD to your scale and complexity whether you’re a small company or a large enterprise.

- Actionable Recommendations: Our reports include clear next steps, often written from the perspective of experienced CTOs, making it easy to prioritize and act on findings.

- Focus on Accuracy and Speed: We specialize in Tech DD and provide accurate, unbiased, timely information.

- Proven Track Record: With dozens of successful Tech DD projects, we understand what matters most to investors and tech leaders.

- Deep Industry Knowledge: Our team stays on top of the latest trends and challenges in tech, allowing us to provide insights that are not only relevant but also forward-thinking that also ensures your business stays ahead of the curve.

- Collaborative Approach: We take the time to fully engage with your team, working hand-in-hand to understand your unique goals, technical challenges, and business needs, so that we can deliver tailored, practical solutions that align with your vision for the future.

What You Gain by Choosing Dextralabs?

- A thorough understanding of your technology’s strengths and weaknesses

- Clear insights into risks that could impact your business value

- Expert guidance on where to improve for better growth and scalability

- Confidence to make informed investment decisions

- A trusted partner who cares about your tech success

If you want to reduce risk, unlock hidden tech value, and make smarter investment choices, Dextralabs is the technology due diligence partner you need. Reach out today and let us help you navigate your next tech investment with confidence!