Fintech revenues are projected to soar from $245 billion to $1.5 trillion by 2030. The fintech revolution has indeed transformed the financial landscape, creating unprecedented opportunities for investing, saving, borrowing, and transacting. However, unlike the funding boom of 2021 and early 2022, the current climate is tougher. Despite fintech’s substantial growth, it faces challenges such as market saturation, intense competition, and significant cybersecurity risks in fintech. Ensuring cybersecurity is paramount for fintech firms, as it directly influences investor confidence and valuation. To maintain long-term sustainability and competitiveness in this dynamic industry, firms must proactively tackle cybersecurity risks in fintech. Understanding the risks and implementing robust mitigation strategies are critical steps towards achieving this goal.

So, let’s delve deeper into how fintech startups can identify, mitigate, and overcome these cybersecurity risks in fintech sector while focusing on talent acquisition, market expansion, and regulatory innovation to bolster their positions in the market.

Emerging Cyber Risks in Fintech: Navigating the Digital Frontier

According to Statista,the financial services sector ranks second among the most frequently attacked industries. Fintech, while driving financial innovation, faces a mounting cyber threat landscape. Sophisticated phishing and ransomware attacks exploit vulnerabilities, risking sensitive financial data and operational integrity. Reliance on third-party services and APIs introduces supply chain vulnerabilities, with breaches posing systemic risks. To address these challenges, robust cybersecurity measures, continuous monitoring, and heightened awareness are imperative.

With the surge in mobile and digital banking, the risk of mobile malware and app vulnerabilities grows, endangering consumer data and transactions. Fintechs handle extensive, sensitive information, necessitating robust data protection and compliance with regulations. To tackle these challenges, fintech firms need to invest in advanced cybersecurity, conduct ongoing monitoring, and promote cyber awareness among employees and customers.

Key Cyber Exposures in Fintech: A Closer Look

Here are some of the top exposures in the fintech sector, elaborated in detail:

- Sophisticated Phishing Attacks: Phishing remains a major threat in fintech, employing tactics such as spear-phishing and BEC to deceive employees and customers, aiming to steal sensitive data.

- Ransomware Attacks: The surge in ransomware incidents poses a significant risk to fintech firms. Ransomware attacks encrypt data and demand hefty ransoms, leading to financial losses. Fintech startups must prioritize backup strategies, endpoint protection, and security training to mitigate these cybersecurity risks in fintech.

- Mobile Malware and Application Threats: Mobile banking’s rise brings higher risk from malware and app vulnerabilities, leading to data theft and unauthorized access. Fintechs must secure apps with testing, updates, and coding practices.

- Data Breaches and Insider Threats: Fintech firms holding sensitive data face high risks of breaches. Insider threats add to this. To mitigate, enforce strict access controls, continuous monitoring, and staff training.

- Regulatory Compliance and Data Protection: Compliance with data protection laws such as GDPR, CCPA, and others is crucial for fintech firms. Non-compliance can lead to hefty fines and legal issues. Implementing robust data protection measures and staying updated with regulations are key.

- Cloud Security Risks: Fintech firms embracing cloud services must tackle security risks, such as misconfiguration and data breaches. To safeguard their infrastructure, they should enforce strict access controls,and use encryption.

- AI and Machine Learning Vulnerabilities: AI and ML in fintech for fraud detection, credit scoring, and customer service pose new cyber risks such as adversarial attacks and data poisoning. Securing these systems requires rigorous testing, and monitoring.

- Social Engineering Attacks: Social engineering exploits human psychology, not technical flaws, to extract confidential data. Educating employees on its tactics and promoting a security-conscious culture mitigates these risks.

Mitigating Fintech Cyber Risks: Strategies for Enhanced Security

Fintech startups operate in a digital landscape where cyber threats are prevalent and evolving. Mitigating these risks requires a proactive approach, incorporating robust strategies to safeguard sensitive data, transactions, and systems. Below are detailed insights into key measures for mitigating cybersecurity risks in fintech:

Implement a Multi-Layered Security Framework: Fintech firms should adopt a multi-layered security framework that encompasses various security measures at different levels. This includes network security, endpoint protection, access controls, encryption, and intrusion detection systems. By implementing multiple layers of defense, fintech startups can create a formidable barrier against cyber threats.

Conduct Regular Security Audits and Assessments: Regular security audits and assessments are essential for identifying vulnerabilities and weaknesses in fintech systems and processes. These audits should encompass both internal and external assessments, including penetration testing, vulnerability scanning, and code reviews. By conducting thorough assessments, fintech firms can proactively identify and address security gaps before they are exploited by cyber attackers.

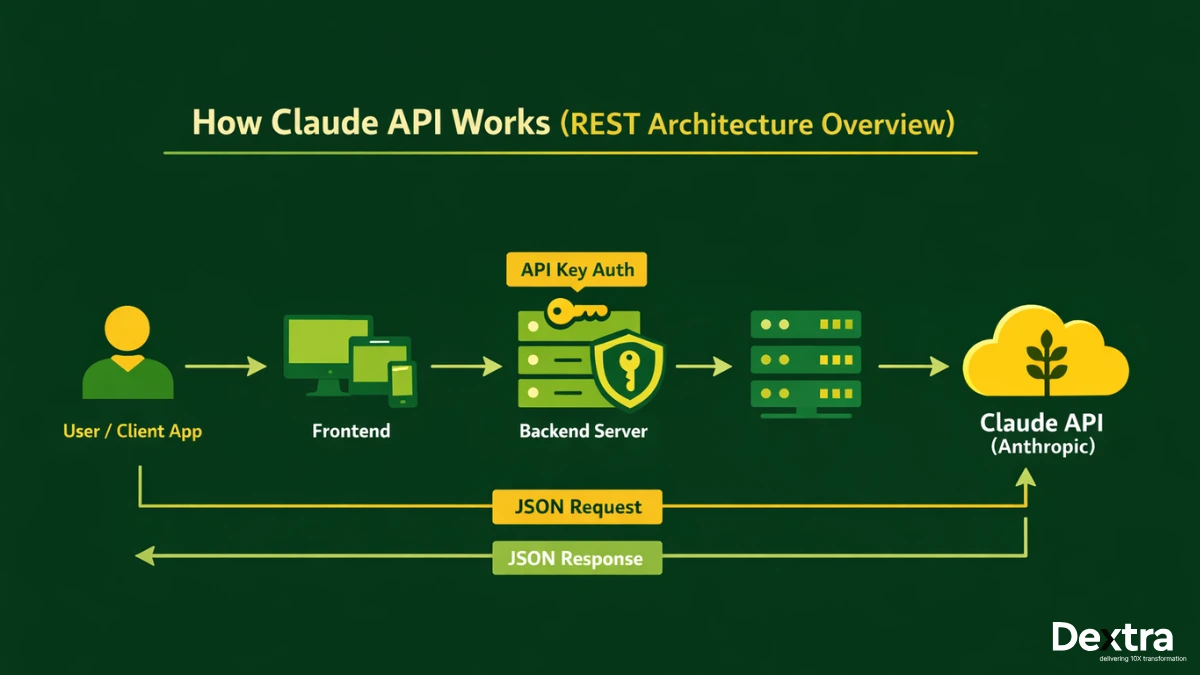

Strengthen Third-Party Risk Management: Fintech startups often rely on third-party service providers and APIs for critical functions such as payment processing and identity verification. However, this reliance introduces supply chain vulnerabilities, as a breach in a partner’s system can have cascading effects. To mitigate these cybersecurity risks in fintech, firms should implement robust third-party risk management practices, including thorough due diligence, contractual agreements, and ongoing monitoring of vendor security practices.

Maintain Compliance with Regulatory Requirements: Compliance with regulatory requirements is paramount for fintech startups, given the sensitivity of the data they handle. Firms must stay abreast of evolving regulations and ensure full compliance with standards such as GDPR, PCI DSS, and others applicable to their operations.

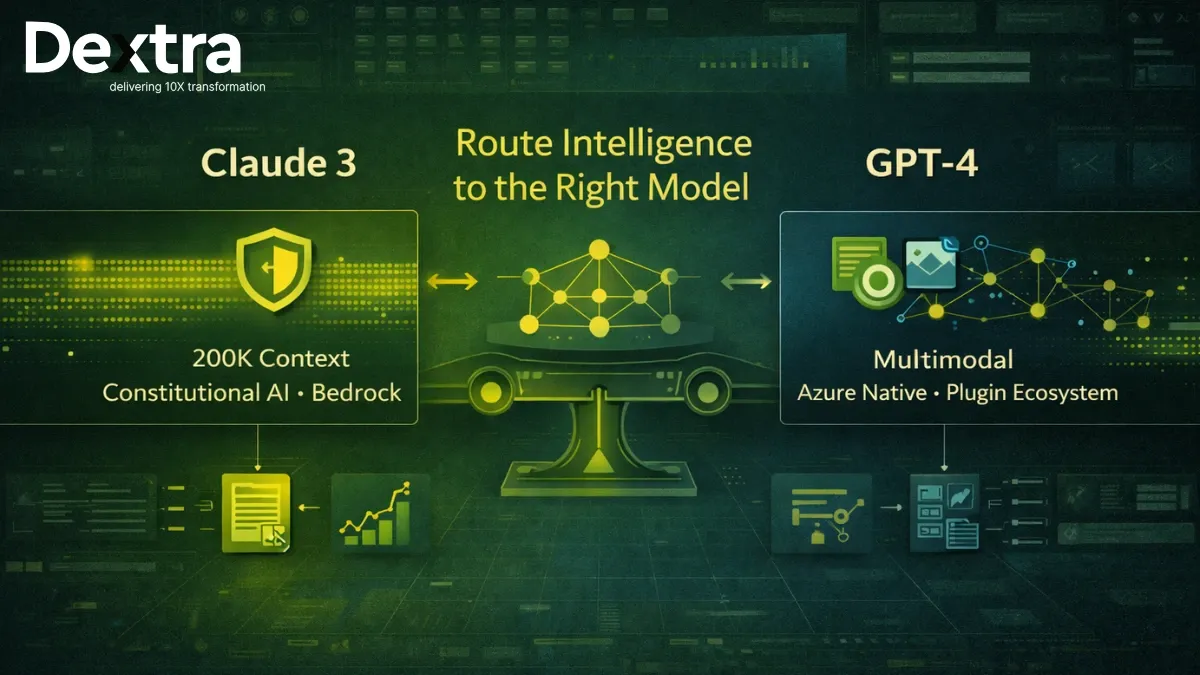

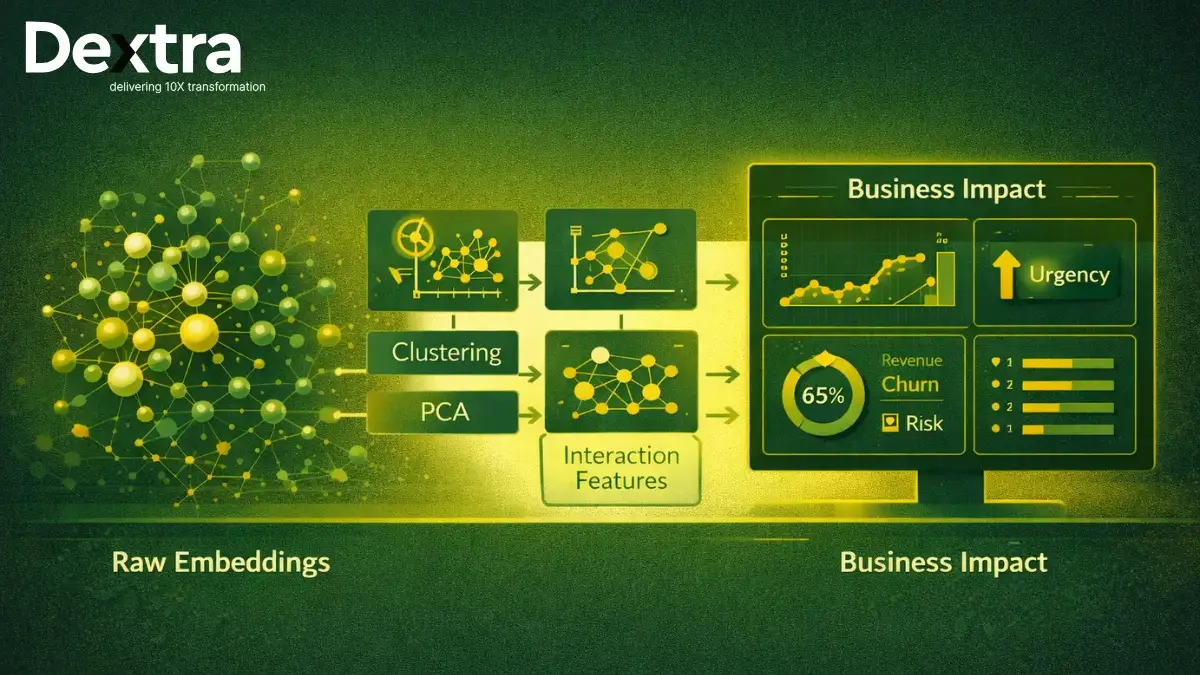

Embrace Advanced Technologies: Fintech firms should leverage advanced technologies such as artificial intelligence (AI), machine learning (ML), and behavioral analytics to enhance their cybersecurity capabilities. These technologies can help in detecting and responding to cyber threats in real time, as well as predicting and preventing future attacks. By harnessing the power of AI and ML, fintech startups can stay one step ahead of cybercriminals and better protect their systems and data.

In Summary

As fintech continues to redefine the landscape of financial services, cybersecurity remains a paramount concern. To address these challenges effectively, fintech startups must prioritize cybersecurity initiatives and invest in robust defense mechanisms. By implementing multi-layered security frameworks, conducting regular audits, strengthening third-party risk management, educating employees and customers, embracing advanced technologies, and maintaining compliance with regulatory requirements, fintech firms can mitigate cybersecurity risks in fintech and build a resilient foundation for future growth and innovation. In doing so, they can uphold the trust of their founders and secure the future of financial innovation.

Unlock the Potential of Your Fintech Venture with Dextra’s Expert Technical Due Diligence Services! Ensure Robustness and Scalability in Your Technology Stack and Architecture. Book a Consultation Today and Secure Your Fintech Future!