Traditional due diligence is slow, manual and often overwhelming. Venture capital (VC) and private equity (PE) professionals spend hours reviewing documents, checking every detail and trying to spot hidden risks, only to face delays and human errors.

This outdated process doesn’t match the speed of modern markets like the U.S. and Singapore.

That’s where AI is making a real difference.

AI tools in due diligence are helping investors cut due diligence time by up to 40%, according to recent industry reports. These tools quickly scan contracts, highlight red flags and uncover patterns that may go unnoticed by human teams. From natural language processing to machine learning, AI is changing how deals are reviewed and closed.

For VCs and PE firms, using AI in tech dd is no longer optional, it’s becoming essential to stay competitive and make faster, safer investment decisions.

Tech DD, Reinvented

AI-powered insights, Fast turnarounds, Unmatched accuracy. Discover why leading investors choose Dextralabs as top Tech DD agency.

Book a Free ConsultationCore AI Technologies Powering Modern Tech Due Diligence

Let’s examine the AI tools that are really pulling the weight in modern tech due diligence! These AI technologies enable VC and PE firms to work faster, identify risks sooner and ultimately invest smarter.

1. Natural Language Processing (NLP)

Reading through long legal contracts, patents and technical documents takes hours and even then, it’s easy to miss things. That’s where Natural Language Processing (NLP) comes in. NLP helps computers “read” and understand all that complex text. It can quickly pick out key clauses, deadlines, or risky terms without needing a human to go through every word.

According to Dextralabs’s recent study, NLP tools save a lot of time and help avoid mistakes by automatically analyzing large volumes of documents, something that would take a human team days or even weeks.

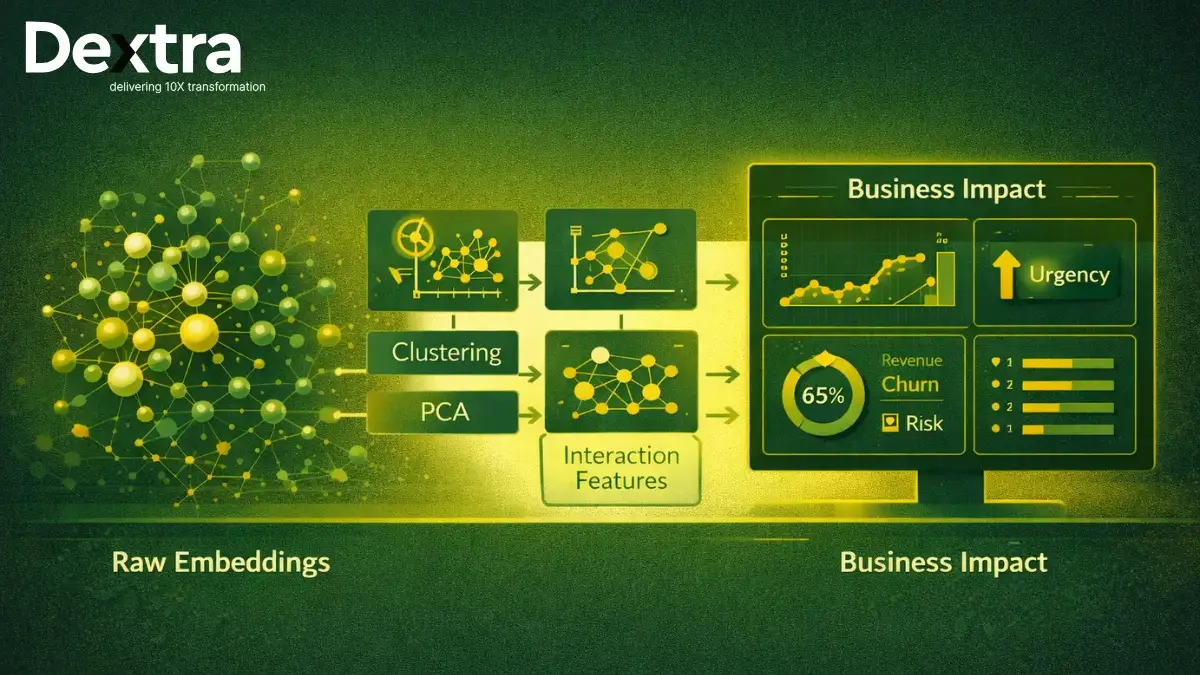

2. Machine Learning (ML)

Machine Learning (ML) is particularly useful for how VC firms use AI to evaluate startups. Machine learning tools can analyze historical data and forecast a startup’s ability to scale, as well as expose potential risks such as technical debt and market challenges. With this data, investors can make smart decisions on which startups to invest in.

As explained by RedBlink, ML makes it easier to understand whether a company can grow smoothly or if there might be trouble down the road.

3. Intelligent Document Processing (IDP)

At times, the information is not conveniently entered into a spreadsheet – it is often hidden in scanned documents, invoices, or reports. This is where Intelligent Document Processing (IDP) comes in. IDP extracts informative data like financial numbers, important terms and red flags from an unstructured document.

Appian says that IDP can turn unorganized data into clean, easy-to-use insights, which means you spend less time sorting through files and more time making decisions.

4. Generative AI

Generative AI is one of the most exciting developments in tech due diligence. Not only can it draft summaries and simulate post-acquisition scenarios, but it’s also becoming a key player in deal sourcing. Generative AI for deal sourcing can help investors identify potential acquisition targets by scanning through enormous amounts of market data, company profiles and whatever sources to produce a set of deals that have good potential for acquisition.

Generative AI tools give deal teams a better view of possible outcomes, which helps reduce risk and improve planning.

Key Benefits for VCs and PE Firms:

AI and automation aren’t just helpful, but they’re changing the game for venture capital and private equity firms. Whether you’re evaluating a startup or planning a cross-border acquisition, these tools bring major advantages to the table.

Speed

One of the biggest wins is speed. Traditional due diligence can take months, but with AI, firms can cut that timeline down to just a few weeks. For example, Centerline demonstrated a gain in productivity of 35% by utilizing V7 Go – clear evidence of how reducing due diligence timelines with automation makes the process not only quicker but more efficient.

By automating these repetitive tasks, AI frees firms to focus on high-value decisions. This leads to faster deal-making and a more agile investment process.

Accuracy

Manual review can miss things, especially when there’s a mountain of data to go through. AI tools are trained to catch what humans might overlook. They’re now flagging risks like cybersecurity gaps, IP conflicts and compliance issues with 90 %+ precision, giving investors peace of mind before they sign on the dotted line.

Depth

Today’s deals often span multiple countries and languages, which makes due diligence even more complex. AI can help here, too. It’s capable of analyzing cross-border regulatory frameworks and multilingual contracts for global deals, providing a deeper understanding of risks and legal requirements.

Real-World Applications

AI in tech due diligence isn’t just theory but it’s already helping firms in real deals. Here are a few real-world examples:

Case Study: How a Singaporean PE Firm Used AI to Uncover Hidden Liabilities

A Singaporean private equity firm leveraged AI to conduct a deep dive into the codebase of a SaaS startup. By using advanced AI tools to analyze the startup’s software, the firm uncovered hidden liabilities that would have been missed during a traditional manual review. These liabilities included significant technical debt and potential security vulnerabilities, both of which could have led to future financial and operational challenges. This AI-powered investigation allowed the firm to make a more informed decision, preventing a potentially risky investment.

AI tools enabled a quicker, more comprehensive evaluation of the code, highlighting issues that traditional due diligence would have overlooked.

M&A Automation

AI tools like V7 Go aren’t just about automating document review. They also play a big role in M&A automation by helping firms streamline the analysis of important documents like Confidential Information Memorandums (CIMs) and 10-Q financial reports. These AI tools significantly reduce the time needed for document analysis, allowing deal teams to focus more on strategic decision-making.

Portfolio Monitoring

When the deal is done, that does not mean that AI stops working. It is now being used in continuous risk assessment of existing investments. With AI-driven analytics, firms have the opportunity to continuously track their investment’s risk and opportunity, enabling an earlier identification of risks and a smoother transition to change, before it grows into a bigger problem.

Future Trends in AI-Driven Tech DD:

AI is becoming increasingly smart and its future role in tech due diligence is even more exciting. Below are a few trends to watch for:

Generative AI Advancements

AI will soon be able to simulate various outcomes after mergers and acquisitions, including the AI-driven M&A risk assessment. AI will work through many simulations to predict how post-merger integration will proceed, as well as point out competitive threats and context, giving a more thorough understanding of each of the possible risks.

AI-Powered Valuation Models

Another trend is the use of AI-powered valuation models. These tools will use past deal data to predict startup growth trajectories more accurately. By analyzing historical data, AI can forecast how a company might perform, helping investors make better decisions about which startups to back.

Checklist: Implementing AI in Your Tech DD Process

Ready to bring AI into your due diligence process? Here’s a simple checklist to get started:

- Audit existing workflows for automation potential

Look at your current processes like document review or risk scoring and figure out which ones can be automated with AI. This will save time and reduce errors. - Prioritize tools with OCR, NLP and customizable risk thresholds

Choose AI tools like V7 Go or Appian IDP that include optical character recognition (OCR), natural language processing (NLP) and customizable risk thresholds to tailor the tool to your needs. - Train teams to interpret AI outputs and maintain ethical AI practices

AI may provide insights, but your team will have to interpret these findings. Provide training to make sure your employees know how to correctly use AI outputs, as well as implement ethical AI use.

Final Thoughts

It is clear that AI and automation are evolving the field of tech due diligence. These innovations are helping both VC and PE firms complete due diligence faster with increased accuracy and deeper insights, allowing them all to make better, faster and more informed investment decisions. As these technologies continue to develop, the future of due diligence is even more promising.

The next step? Book a FREE tech due diligence consultation with one of the experts at Dextra Labs to ensure your business is ready for the future!

Invest with Confidence

Leverage automation and expert tech diligence tailored for venture capital and private equity.

Book a Free ConsultationFAQs on AI in Tech DD:

Q. How does AI speed up the due diligence process for investors and PE firms?

AI can analyze massive amounts of data; contracts, financials, codebases, in a fraction of the time it takes a human team. It automates repetitive tasks like document review and risk checks, helping dealmakers move faster without compromising on quality.

Q. Can AI identify risks that human analysts might miss?

Yes. AI tools are trained to detect patterns, anomalies, and inconsistencies that may not be immediately obvious to human reviewers. This includes spotting unusual financial trends, hidden clauses in legal documents, or compliance gaps in tech infrastructure.

Q. What types of AI technologies are used in tech due diligence?

Common tools include natural language processing (NLP) for contract analysis, machine learning for financial modeling and fraud detection, and automation platforms that track and summarize compliance data and operational risks.

Q. Will using AI require my team to have technical expertise?

Not necessarily. Most modern AI due diligence platforms are designed with user-friendly dashboards and guided workflows. While having tech-savvy staff helps, many tools are built for legal, financial, and investment professionals without deep coding knowledge.

Q. How can using AI in due diligence impact deal outcomes?

By speeding up reviews and uncovering hidden risks early, AI helps firms make quicker, more informed decisions. This can improve deal confidence, reduce post-acquisition surprises, and give investors a competitive edge in closing opportunities.