In recent years, the Fintech industry has grown rapidly, transforming the way financial services are delivered and consumed. According to Mordor Intelligence, the size of the global Fintech market was projected to be USD 312.92 billion in 2024 and USD 608.35 billion by 2029, with a compound annual growth rate (CAGR) of more than 14% from 2024 to 2029. This growth is driven by the increasing adoption of digital payments, the rise of neobanks, and the expanding use of blockchain technology. Digital payments have transformed the Fintech industry by making money transfers faster, safer, and more efficient.

However, with this growth comes significant challenges, particularly in data management and privacy. This blog will explore what data management and privacy mean in the Fintech space, why they are crucial, and the challenges that arise.

Data Management and Privacy: The Tightrope Walk of Fintech Success

Fintech, the dynamic marriage of finance and technology, has revolutionized how we manage money. From peer-to-peer payments to robo-advisors, Fintech apps have become an essential part of our financial lives. But this convenience comes with a responsibility—safeguarding the vast amount of sensitive financial data collected by these platforms.

Data management in Fintech refers to the processes and systems used to handle data throughout its lifecycle. This includes collecting, storing, processing, and securing data. In Fintech, data comes from various sources such as customer transactions, financial records, and user behaviors. Proper data management ensures that this data is accurate, accessible, and secure.

The Data Trove: A Double-edged Sword for Fintech

Fintech thrives on data. Every transaction, every investment decision, and every click within a Fintech app generates valuable information. This data allows for:

- Personalized financial products and services: Imagine a loan offer tailored to your spending habits or an investment portfolio aligned with your risk tolerance. Data empowers Fintechs to cater to individual needs.

- Fraud detection and risk management: Anomalies in spending patterns can be red flags for potential fraud. Data analysis helps Fintechs identify and prevent suspicious activity, protecting both consumers and the startup.

- Market research and innovation: By understanding user behavior, Fintechs can develop new features and products that cater to evolving financial needs. However, this data trove presents a challenge – privacy.

The Importance of Privacy in Fintech

The average cost of a data breach worldwide is $4.45 million, 15% higher than in 2020, according to the IBM Cost of a Data Breach Report 2023. These costs can be especially devastating for smaller businesses. Privacy in Fintech is about safeguarding customers’ personal and financial information. This is crucial because Fintech companies handle a vast amount of sensitive data, including bank account details, credit card information, and personal identifiers.

Privacy is crucial in Fintech for several reasons. First and foremost, customers must trust that their personal and financial information is secure. A Fintech company that fails to protect data risks losing clients and reputation. GDPR and PCI DSS require strict privacy protections, thus compliance is required. Noncompliance might result in severe fines and judicial action. Finally, data security prevents identity theft and financial crime, making security essential to privacy.

The Fintech industry has many privacy issues. Since financial startups are major targets for hackers, data breaches are serious. Breaches can reveal sensitive data, causing financial and reputational harm. Company compliance with local and international privacy rules is difficult due to the ever-changing regulatory landscape. Fintech firms often share data with payment processors and credit agencies, adding complexity. Partners must follow strong privacy rules.

Finally, integrating emerging technologies such as AI and blockchain might complicate privacy initiatives because they must preserve user data.

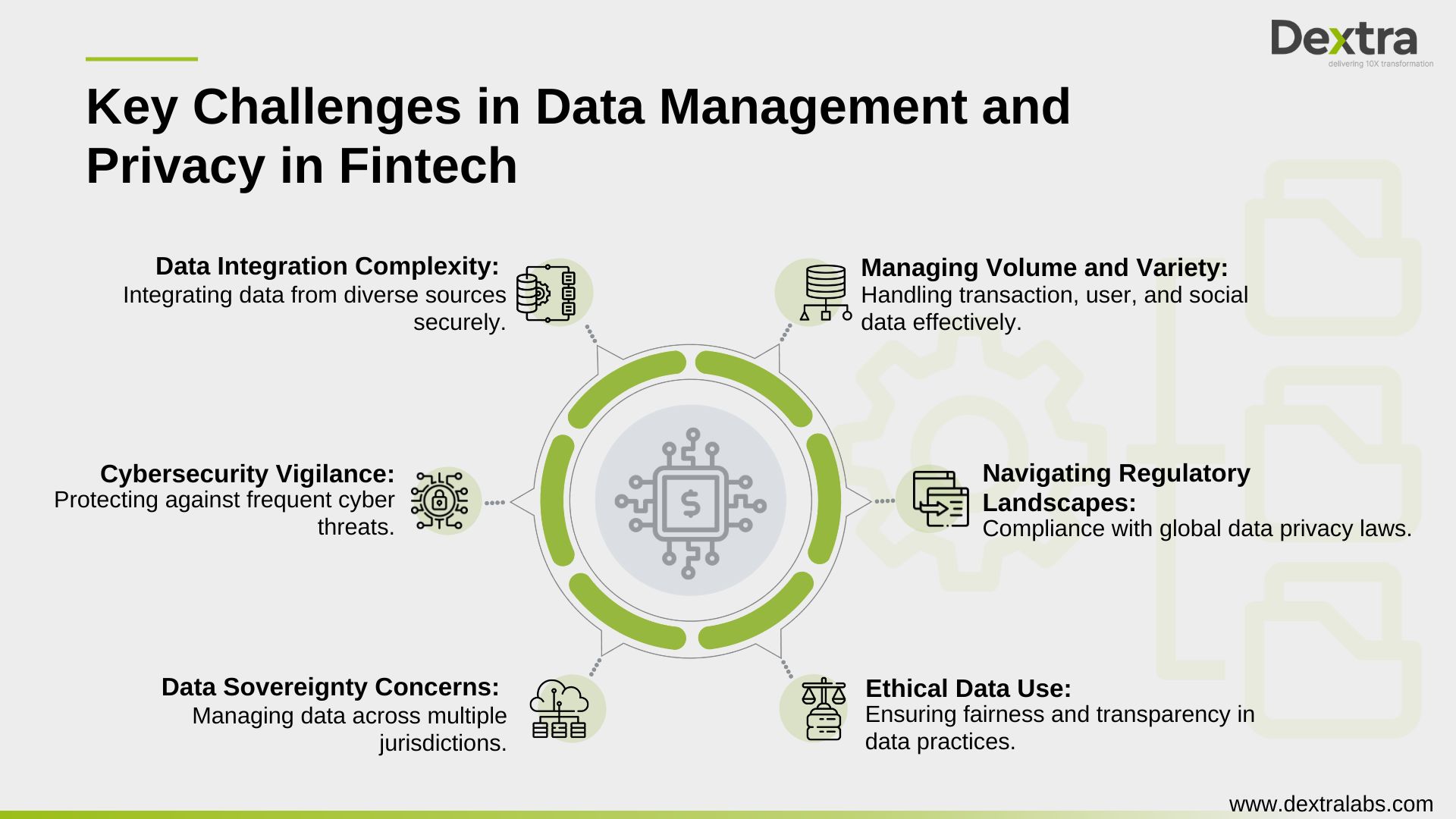

Challenges in Data Management and Privacy in Fintech

The Fintech sector faces numerous challenges in managing data and ensuring privacy. These challenges range from the complexity of integrating diverse data sources to the constant threat of cyberattacks. Additionally, regulatory compliance, data sovereignty, and ethical considerations add layers of complexity to data management in Fintech.

- Complexity of Data Integration: Fintech companies often need to integrate data from multiple sources, including legacy financial systems, modern digital platforms, and third-party providers. This integration can be complex, requiring sophisticated technology and expertise to ensure that data is merged accurately and securely.

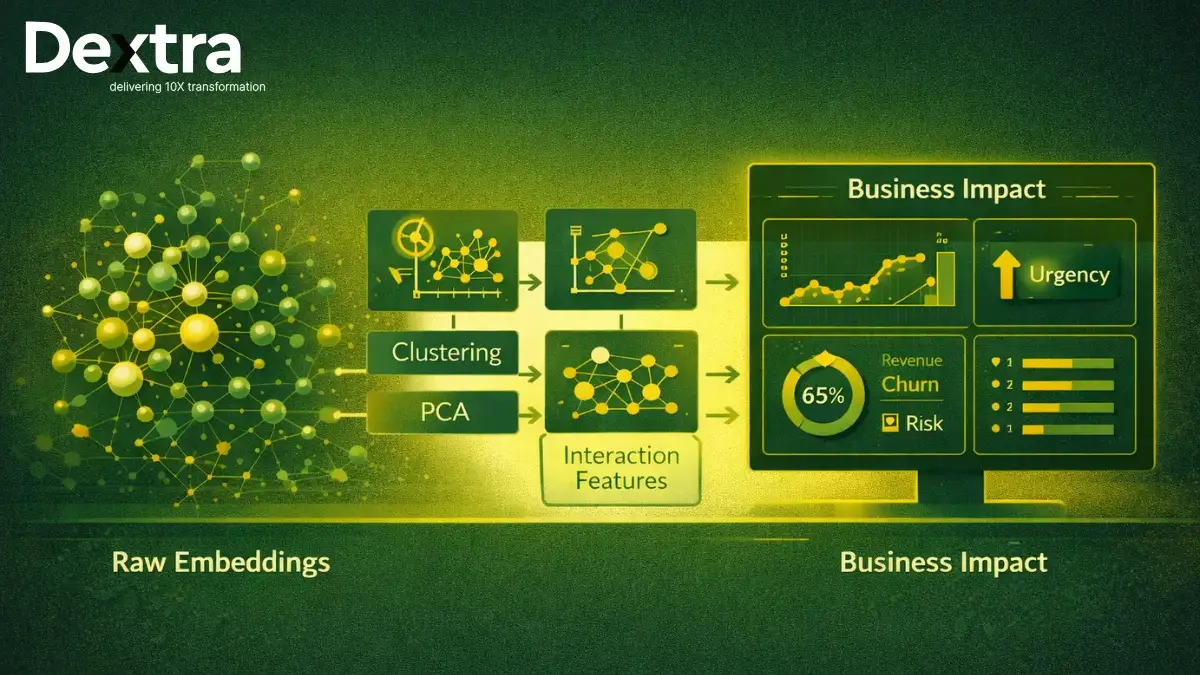

- Volume and Variety of Data: The sheer volume and variety of data in Fintech can be overwhelming. Companies must manage data from transactions, user interactions, social media, and more. Handling such diverse data sets requires advanced data management systems and skilled professionals.

- Cybersecurity Threats: Fintech firms are attractive targets for cybercriminals. According to a report by IBM, financial services firms experience 300 times more cyberattacks than other industries. Protecting against these threats requires constant vigilance and investment in advanced security technologies.

- Regulatory Compliance: Fintech companies must navigate a complex web of regulations that vary by country and region. Ensuring compliance with laws such as GDPR, PCI DSS, and the California Consumer Privacy Act (CCPA) can be challenging, especially for startups with limited resources.

- Data Sovereignty: Data sovereignty refers to the idea that data is subject to the laws and governance structures of the country in which it is collected. This can create challenges for Fintech companies operating in multiple jurisdictions, as they must comply with varying regulations.

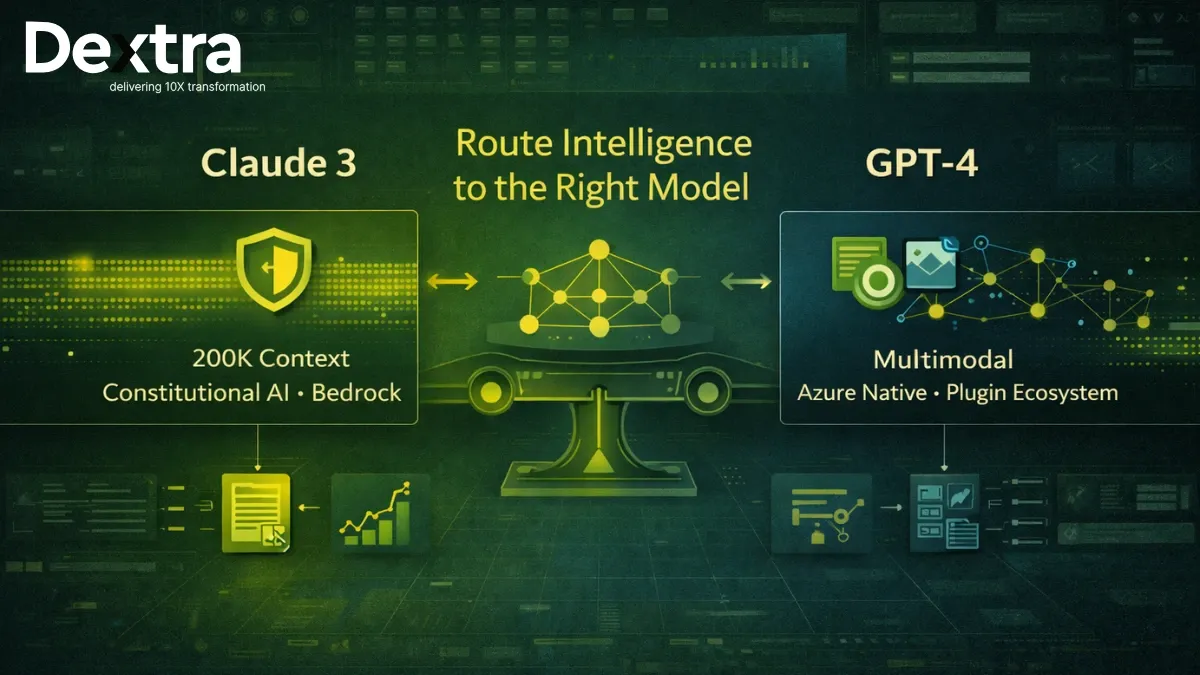

- Ethical Considerations: With the rise of AI and machine learning in Fintech, ethical considerations around data use are becoming more prominent. Companies must ensure that their use of data is fair, and transparent, and does not discriminate against certain groups.

Best Practices for Data Management and Privacy

Fintech organizations must follow security and compliance best practices to manage and protect data. Here are some key data protection and client trust tactics for Fintech organizations. Strong governance policies, sophisticated security, and privacy promotion are the practices to be followed.

- Implement Strong Data Governance Policies: Establishing clear data governance policies is essential. This includes defining roles and responsibilities for data management, setting standards for data quality, and implementing processes for data access and use.

- Invest in Advanced Security Measures: Fintech businesses need to make investments in cutting-edge security tools including intrusion detection systems, multi-factor authentication, and encryption. Finding and fixing vulnerabilities can be aided by routine penetration tests and security audits.

- Ensure Regulatory Compliance: Keeping up with regulatory changes is crucial. Companies should have dedicated compliance teams and use technology to automate compliance processes where possible. Engaging with legal experts can also help navigate complex regulatory landscapes.

- Foster a Culture of Privacy: Creating a culture that prioritizes privacy is essential. This involves training employees on the importance of data privacy, implementing privacy-by-design principles in product development, and regularly reviewing and updating privacy policies.

- Partner with Trusted Third Parties: When partnering with third parties, Fintech companies should conduct thorough due diligence to ensure these partners adhere to strict data management and privacy standards. This includes reviewing their security measures and privacy policies.

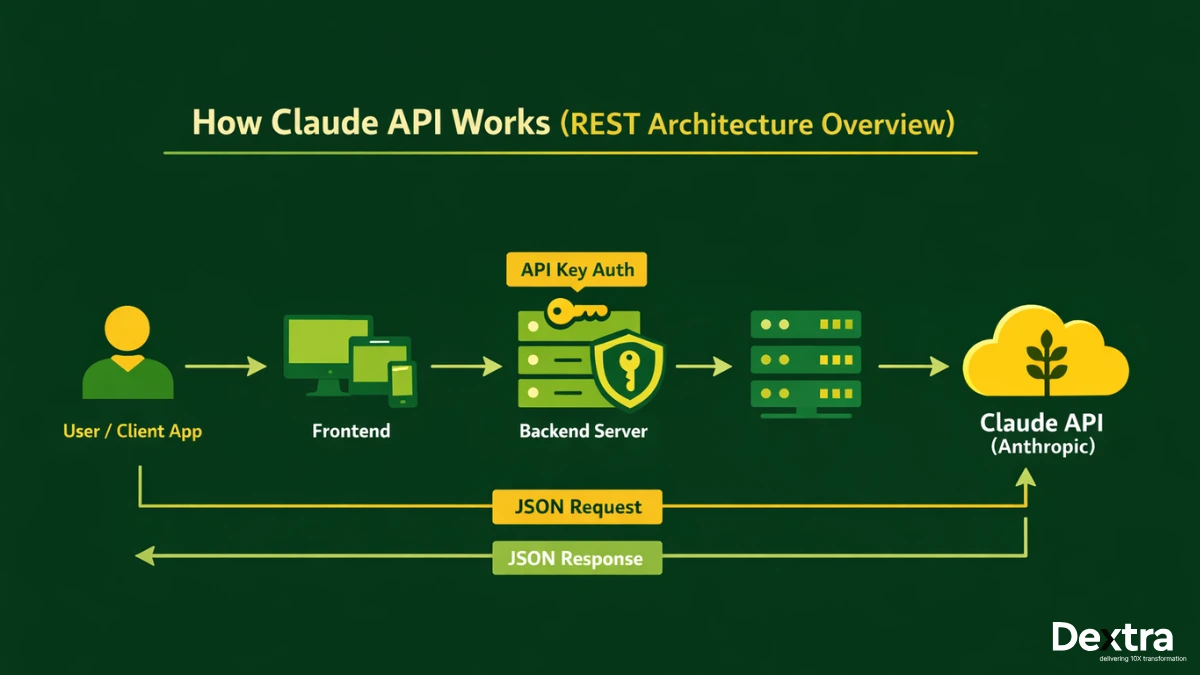

- Use Technology Wisely: Leveraging technologies, such as AI and blockchain can enhance data management and privacy efforts. However, these technologies should be implemented thoughtfully, with a focus on security and ethical considerations.

The Bottom Line: Data Management and Privacy – A Competitive Advantage

Data management and privacy are critical in the Fintech space, they are not just compliance hurdles; they are strategic differentiators. By prioritizing data security, embracing data governance, and fostering transparency with users, Fintechs can not only build trust but also gain a competitive advantage. After all, in the world of finance, trust is currency, and data privacy is the key to safeguarding its value. By implementing strong data governance policies, investing in advanced security measures, and fostering a culture of privacy, Fintech firms can navigate the challenges of data management and privacy effectively.

As a technology strategy partner, Dextra is committed to helping startup founders and investors understand and address these crucial issues, ensuring the success and integrity of their ventures in the dynamic world of Fintech. Have any thoughts on your mind? Share with us to take it further!