The integration of emerging technologies transforms the way financial institutions operate and also reshapes how data privacy is managed and enforced. As financial institutions adopt AI, blockchain, big data, and advanced security measures, they improve their service offerings and fortify their data privacy frameworks.

Trends that are influencing and shaping data privacy protocols.

Let’s take a look at the ten emerging trends that are influencing and shaping data privacy protocols.

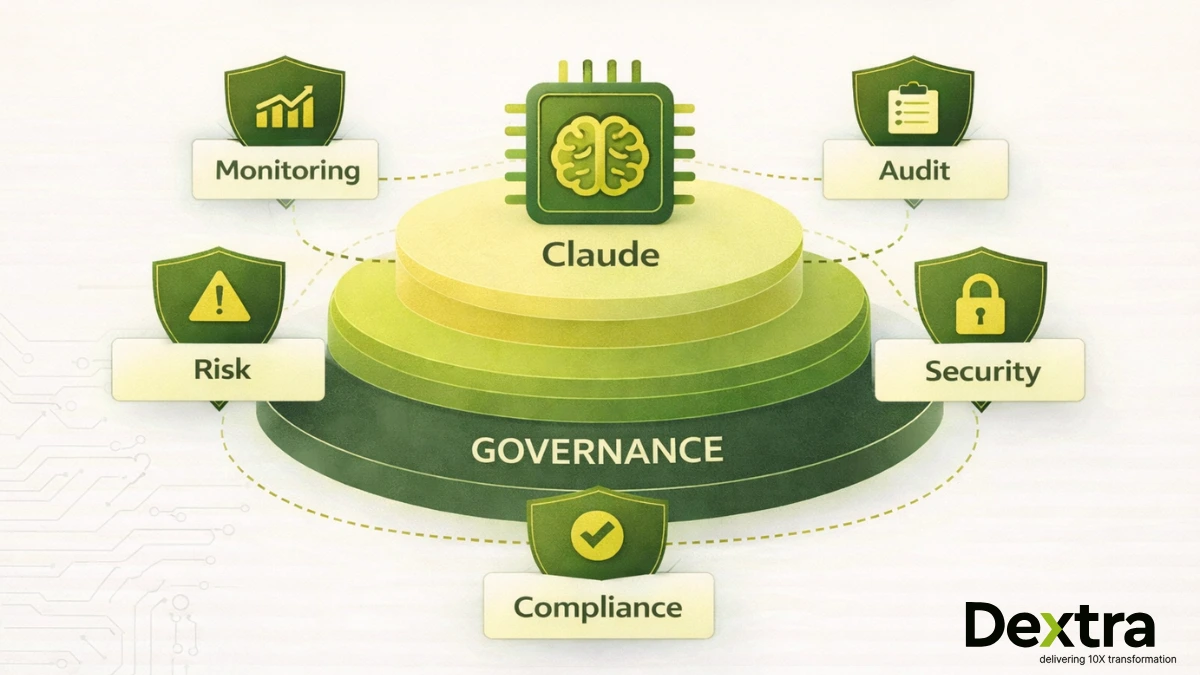

Artificial Intelligence

AI is key in advancing data privacy within fintech. Artificial intelligence technologies leverage algorithms to analyze data, identify patterns and potential security threats that might go unnoticed by traditional methods. AI systems can detect unusual behaviors and flag anomalies in real time, which is crucial for preventing fraud and unauthorized access.

For instance, if an AI algorithm detects a deviation from a user’s typical transaction patterns, it can trigger alerts or automatically block suspicious activities. This capability not only enhances fraud prevention but also supports compliance with stringent privacy regulations by ensuring that user data is protected from misuse.

Blockchain Technology

Unlike traditional databases, blockchain uses a distributed ledger that records transactions across a network of nodes. Each transaction is secured cryptographically and linked to the previous one, forming a chain that is resistant to tampering.

This immutability is essential for maintaining data integrity and ensuring compliance with privacy regulations. For example, in financial transactions, blockchain provides a transparent record that helps verify the authenticity and integrity of data.

Mobile-First

Mobile-first design prioritizes the optimization of applications for mobile devices. This is critical in addressing these challenges. As more users access financial services via smartphones and tablets, ensuring that mobile applications are secure against potential threats becomes paramount.

Robust encryption and security measures are essential components of mobile-first design. For instance, end-to-end encryption ensures that data transmitted between users and servers is protected from interception. Secure authentication methods, such as biometric logins, add a layer of protection.

Personalized Services

The use of AI and ML to offer personalized financial services has become a new and upcoming trend in fintech. By analyzing user data, fintech companies can tailor their offerings to meet individual needs, enhancing the user experience. Personalized recommendations, customized financial advice, and targeted promotions are different ways fintech companies leverage data analytics to improve their services.

The collection and analysis of user data must be managed tactfully to prevent privacy breaches. Fintech companies must implement data protection measures such as anonymization and aggregation.

Protected Data Analytics

Fintech companies must ensure that data analytics practices adhere to privacy standards. Implementing techniques such as data anonymization, where personal identifiers are removed from datasets, and data aggregation, where information is combined to prevent the identification of individuals. By adopting these methods, fintech companies can utilize data analytics to enhance their services while safeguarding user privacy.

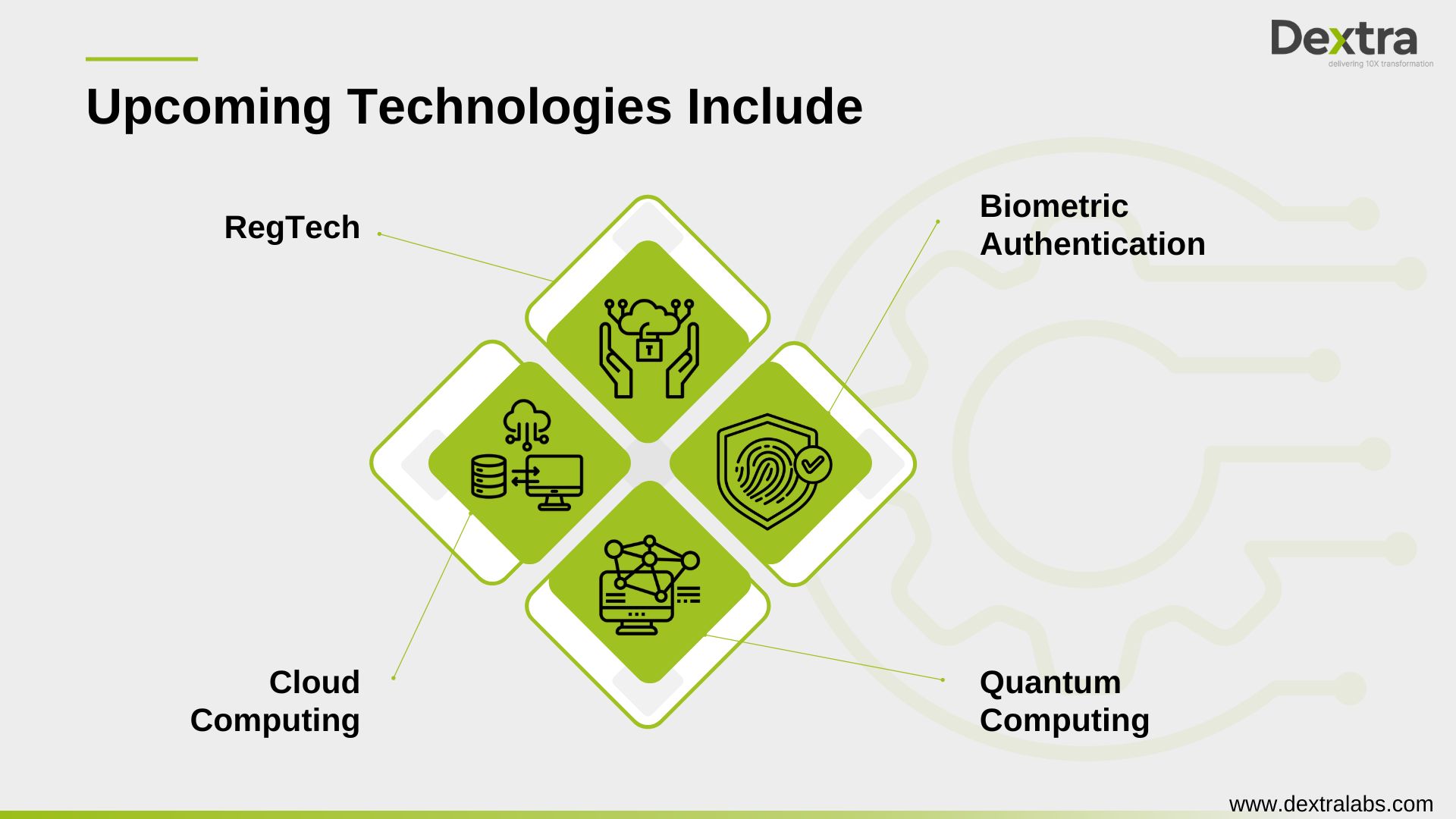

RegTech Solutions

Regulatory Technology is a new and emerging field that leverages advanced technologies to streamline compliance processes. RegTech solutions utilize AI, big data analytics, and other technologies to help financial institutions manage regulatory requirements more efficiently.

For instance, RegTech platforms can automate tasks such as monitoring transactions for suspicious activity and generating regulatory reports. This type of automation reduces human error and ensures compliance with regulatory standards. By adopting RegTech solutions, fintech companies can enhance their compliance efforts, improve operational efficiency, and reduce the burden of manual processes.

Biometric Authentication

Biometric technologies include facial recognition and fingerprint scanning, which are being increasingly used in fintech applications to enhance security. These technologies provide a higher level of protection compared to traditional methods.

Biometric authentication enhances data privacy by ensuring that access to financial accounts is granted only to authorized users. For instance, facial recognition systems can quickly and accurately verify a user’s identity, reducing the risk of unauthorized access.

Cloud Technology

Cloud computing enhances data privacy in several ways. It uses advanced encryption techniques to secure data at rest and in transit. Stringent access controls allow organizations to define who can access specific data and under what conditions, further bolstering privacy. Advanced threat detection and response mechanisms are integral to cloud services, helping in the identification of security breaches.

Quantum Computing

Quantum computing can enhance data privacy through several methods. It uses quantum key distribution (QKD) to create unbreakable encryption. With QKD, any attempt to intercept the key changes the data, highlighting that a breach has occurred.

Quantum computers can decipher complex mathematical problems quickly, allowing for the development of stronger encryption algorithms that are harder for traditional computers to crack. Quantum random number generators can create truly random keys, making encryption even more secure.

Quantum-resistant algorithms are being developed to protect data against future quantum attacks. These algorithms ensure that data remains secure even when quantum computers become more powerful.

Conclusion

The fintech sector is undergoing a transformation driven by new technologies and trends that are reshaping data privacy. From AI and blockchain to mobile-first design and biometric authentication, these innovations are enhancing data security and user protection. As fintech companies navigate this evolving landscape, staying up to date about technological advancements and regulatory requirements is crucial.