What if we told you there was a secret formula you could use to convert every dollar you invested into profit? Okay, we might not have a magical solution to offer, but it’s quite close! What we’re talking about is Return on Investment (ROI).

The calculation isn’t all there is to know about the Return on Investment Formula. In fact, it is the one financial tool you can use to both analyze your past mistakes and predict the future with accuracy. It can tell you whether your financial efforts are fulfilling your goals or taking you further away from them.

In the following sections, we will take you on a journey through both logical explanations and calculations of ROI, helping you understand why it should be a part of your strategy. Don’t forget to open up a Word doc or sticky notes on the side to note down important pieces of information you want to use once you’re done reading!

What is Return on Investment (ROI)?

Before we move on to anything else, let’s quickly understand how most of the financial world defines ROI. Return on Investment Formula is usually defined as a performance measure utilized in situations where a company wants to gauge the potential efficiency or profitability of their investment in a particular project.

As the phrase suggests, ROI quite literally measures the specific “return” on investment you get from investing in an idea. Since this gives you a measurable figure against projects, it is often used to pit multiple projects against one another to choose the most efficient one.

The Return on Investment formula depends mainly on three factors;

- Initial Investment Amount

- Maintenance Costs

- The Cash Flow Resulting from Investment

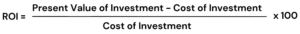

The ROI formula is one of the many ratios businesses use to analyze their current profitability or the potential rewards that can be reaped from an investment. To calculate it, you must divide the return of an investment by the cost of it.

Studying the Ratio: How the ROI Formula Works

Wondering how to calculate return on investment? The Return on Investment formula is derived through the following calculation;

Part 1: The Numerator

The numerator part of the ROI formula, also known as the net profit from the investment, can be broken up into two different parts. The first is the present value of the investment, and the second is the cost of the investment.

The present value of the investment would be the total revenue or gains you have made from the entire investment. It does not take into account any of the costs at this level. It is simply the proceeds that have been or could be obtained from selling the investment in question.

The cost of the investment, on the other hand, is something that needs to be deducted from the value of the investment to find out the actual net profit that can be derived from said investment. This cost usually includes any initial money spent, such as the purchase price. It should also take into account maintenance costs, upgrades, or any other expenses needed to maintain the investment.

Part 2: The Denominator

This is quite simply the same figure we discussed above, i.e. the total cost of the investment. Why does it exist in the denominator?

Well, in easier terms, the ROI hopes to find the ratio between the profit extracted from an investment as opposed to the cost that went into it. That requires for the cost to be placed on the opposing, comparative end.

Once we have divided our net profit by our cost of investment, we have a figure we can use to obtain our percentage or ratio.

Part 3: The Ratio

ROI is almost always described as a ratio or percentage of something. The return is expressed as a percentage to provide the owner or investor with a standardized way of comparing multiple investments of different sizes.

In case one receives a positive ROI, it indicates a net gain. A negative ROI, on the other hand, indicates a net loss. The higher the ROI, the more proof of the fact that the investment gains compare positively with the cost.

Return on Investment Formula: Scenario-Based Calculation

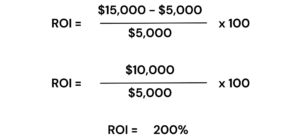

Let’s tail the growth of a company that runs a marketing campaign for a new product over the course of three months. The costs associated with the campaign include;

- Online Ads: $3,000

- Social Media Promotions: $1,500

- Email Marketing: $500

The campaign’s total cost amounts to $5,000. As for the revenue the company yields from the investment, that stands at a whopping $15,000. This revenue is directly linked to the marketing campaign and is over and above what they were initially earning.

Here, the ROI formula would start off by subtracting the cost from the gains. Then it would go on to divide that figure by the cost and multiply by 100 for the percentage.

For this company, we can safely assume the marketing ROI would be at around 200%. This means that for each dollar the company invested in the campaign, they didn’t just earn back their own dollar but also an additional two dollars in profit. This shows the campaign to be a success.

If you’re looking for something to save time, consider accessing a Return on Investment calculator!

Critiquing the ROI Calculation Formula: The Limitations

There are a couple of essential factors that the ROI does not take into account. You must note that for your business, the Return on Investment ratio will not estimate compounding returns over time.

For example, if one of your investments has an ROI of 18% over six years, and another has an ROI of 14% over four years, the ROI calculation formula will not be enough to determine whether the former investment is better or the latter.

For example, if one of your investments has an ROI of 18% over six years, and another has an ROI of 14% over four years, the ROI calculation formula will not be enough to determine whether the former investment is better or the latter.

Moreover, you must also consider the fact that the value of money changes over time. The basic ROI formula doesn’t take that into account and fails to account for inflation. So, you might get projections based on whether your investment might be fruitful. However, the accuracy could be compromised as inflation isn’t accounted for.

One must also keep in mind that no two investments are ever alike in terms of their risk. Although Investment A might look more fruitful to you in the long run, the risk associated with said investment could far surpass that of Investment B, thus making the second option more beneficial.

The great news is that variations of the ROI formula exist to guide you through all these variations. Using these can get you all the answers you need about potential investments that are subject to financial hurdles.

Variations of the Rate of Return Formula

The ROI formula doesn’t just exist in one shape and form. It has multiple variations according to different industries and contexts. Here are some common examples;

- Annualized ROI

This return on investment formula is associated with the length of time an investment is held. Thus, it adjusts the ROI to an annual rate to account for the number of years.

Here, ‘n’ accounts for the number of years the investment is held. This ROI formula is often used in situations where a company is dealing with multiple investments in different holding periods.

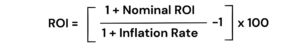

2. Real ROI

As the name suggests, a Real ROI calculation formula would have to do with the REAL value of money. This means the investment return value would need to account for the effect of inflation. In such a case, this would provide a “real” return in terms of the purchasing power of the investor.

Although this isn’t always a go-to formula for investors, it is useful in countries where economies are hit with significant inflation. In that case, the final value of the investment, even when projected, would showcase returns adjusted for inflation.

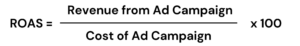

3. Return on Advertising Spend (ROAS)

This may be a unique rate of return formula, but it is getting increasingly popular, especially amongst e-commerce businesses. Most e-commerce businesses have to advertise their products online, and these ads cost money.

The ROAS measures revenue that is generated for each dollar spent on advertising. The formula is as follows;

4. Customer ROI

As for the customer ROI calculation formula, it focuses entirely on the profitability of acquiring or retaining customers over time. It is often used in businesses that focus mostly on customer acquisition or retention, such as SaaS companies or subscription services like Netflix. The ROI is calculated through the following requirements.

For example, if the customer’s lifetime value is $2,000 (that’s how much they spend on the business) and the cost to acquire the customer was $500 (for example, the cost it takes for Netflix to run the streaming service for that one customer) then the customer ROI would be;

{ ($2,000 – $500) / 500 } * 100

= { $1,500 / 500 } * 100

= 300%

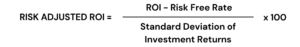

5. Risk-Adjusted ROI

As the name suggests, this Return on Investment has been adjusted for risk. Although different industries follow different models, we have provided to you the Sharpe Ratio below;

The Sharpe Ratio is often used in finance to evaluate whether the higher return on investment for a project justifies the higher risk involved in investing in the project as opposed to a different project with slightly lesser risk.

Although the variations don’t stop here, we do! That’s because the variations are countless and span across multiple industries as well as use cases. However, the examples listed above stand out no matter the industry! They’re ones you will often find as you move through multiple projects and present your reports to investors.

Benefits of Calculating Investment Return Ratios

Now that we have dissected how to calculate investment return and all the variations, here are some reasons you SHOULD lean on this handy ratio to evaluate your investments;

1 . ROI is Easy to Calculate

This ratio is pretty easy to calculate. Fewer figures are required to complete the calculation for the investment return ratio, and you can find all of them in your financial statements or balance sheets.

2. ROI is Great for Comparative Analysis

Want to compare two investments and pit them against one another to figure out which to push your hard-earned profits into? No worries! ROI has widespread applications and since it’s easy to calculate, anyone can use the tool. Multiple comparisons are possible, especially when you use one of the many variations associated with it for different scenarios.

3. Litmus Test for Profitability

ROI ratios can be a great litmus test for the potential profitability of an investment or project. You can visualize whether an investment would be profitable before you step into it full throttle.

How To Increase Your ROI?

Before you invest in an idea or project, here are a few steps you can take to ensure a higher ROI;

- Data Analytics: The world is moving towards technological advancement; why shouldn’t you take the first leap into it too? Make data analytics your best friend and invest in tools that have great analytical capabilities. When considering an investment, acquire a tool that can show you potential profits and implications that can be reaped from it.

- Research Your Target Audience: Conduct market research before you invest in a new idea. Knowing your target audience allows your idea to have a greater chance of future success. Investments that are based on sound research never fail!

- Think Outside the Box: Don’t be afraid to try out something new! Don’t rely solely on investment return ratios; look at other tests too! Mark up the risk of one project against another. At the end of the day, if your gut is calling out to it, go ahead! You never know, it might just turn into a success.

Final Thoughts: What is a Good ROI?

A good ROI is in the eyes of the beholder! No, really! It all depends on what you are looking for. So, if you are risk-averse, an investment with lower risk may look more appealing. On the other hand, if you want a higher ROI regardless and are willing to put up with the risk, you may pick a different option.

Moreover, for some people, shorter investments are much more preferred as opposed to longer, more drawn-out ones. Plus, ROI expectations also vary across industries depending on higher barriers to entry.

We advise you not to just go with the numbers. Analyze your ROI and figure out the trends others in your industry are following. Better yet, consult a financial expert who can take you through it!