The software industry has increasingly made up for a larger percentage of total revenue of many tech-first companies. From SaaS platforms to enterprise tools, the value of a business often depends on the quality, performance, and reliability of its software. Therefore, financial analysis alone is not enough to make safe investment decisions.

Software due diligence which is also called technology software due diligence or SW DD, focuses on evaluating a company’s software products, systems, and platforms and helps investors, VCs, as well as M&A teams identify potential risks, understand growth potential, and make informed decisions before an acquisition, funding, or IPO.

Dextralabs helps investors manage technology-related risks with thorough software due diligence. By analyzing software performance, architecture, team capabilities, and scalability, Dextralabs provides clear insights so investors can confidently back companies with strong, reliable software assets.

Also Read: The Recurring Tech DD blueprint 2026

What is Software Due Diligence?

Software due diligence is an act of evaluating the software that a company is selling instead of the tools that it uses on a day-to-day basis. How well the software functions, how good it is, and what risks are associated with it should be known before making a major investment.

This evaluation is important for several situations:

- M&A transactions: Check the company’s software before buying or merging.

- Significant investments: Ensure the software is reliable and scalable before funding.

- IPO readiness: Verify that the software can support growth and meet investor expectations.

It’s helpful to understand how software due diligence differs from other types of checks:

- Technical due diligence vs software due diligence: Technical due diligence examines the overall technology stack, both internal and external. Software due diligence pays special attention to the revenue-generating products.

- Financial due diligence vs software due diligence: Financial due diligence reviews numbers and accounts. Software due diligence reviews the actual product to see if it delivers value, is scalable, and can support future growth.

In short, software due diligence M&A and investments give investors confidence that the software being bought or funded is strong, secure, and built to last. It’s a key part of understanding a company’s true value and risk.

Also Read: You Can’t Scale AI in Finance Without Rethinking Risk Management

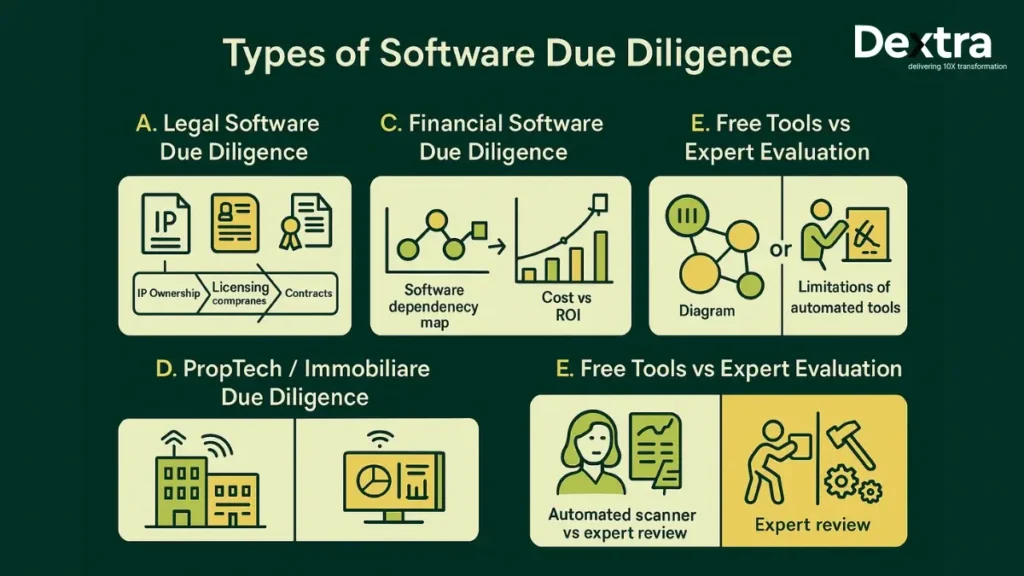

Types of Software Due Diligence (Evaluation-Based, Not Tool-Based)

Software due diligence is about evaluating a company’s software products, platforms, and systems, not just running automated tools. At Dextralabs, we help investors, VCs, and M&A teams in Singapore, USA, UAE, and India make informed decisions by reviewing software in a structured, expert-led way before M&A, funding, or IPO.

Legal Software Due Diligence Review

- IP ownership: Make sure that the company is in full ownership of the software and the intellectual property.

- Licensing integrity: Make sure all software licenses are valid and compliant.

- Open-source legal exposure: Check for risks of using open-source components.

- Contractual obligations: Look out for any agreements that may restrict the use of the software.

Vendor Software Due Diligence Analysis

- Reliability: Evaluate the stability of third-party software integrated into the product.

- Long-term support viability: Check whether vendors provide ongoing updates and support.

- Integration risks: Assess if external software can cause technical problems.

- Dependency impact: Understand how third-party tools affect the core product’s performance and value.

Financial Software Due Diligence Validation

- Cost efficiency of infrastructure: Review whether the software setup is optimized for costs.

- Scalability affecting revenue growth: Assess if the software can grow with the business.

- Refactoring expenses impacting ROI: Identify potential costs to fix or upgrade software that could affect investment returns.

Software Due Diligence Immobiliare (Property Technology Investments)

For PropTech and real estate platforms, Dextralabs evaluates:

- SaaS solutions for real estate operations

- Smart infrastructure and IoT systems

- Property data engines and analytics platforms

Free Due Diligence Software vs Expert Evaluation

- Automated tools can only give limited insights.

- Generic software misses subtle risks in code, architecture, or IP.

- Expert-led analysis, like Dextralabs’ approach, provides actionable, investment-grade insights.

SW DD for Early-Stage vs Growth-Stage Startups

- Early-stage/MVP software: Focus on core functionality, quick wins, and immediate risks.

- Growth-stage/enterprise software: Evaluate scalability, architecture evolution, and long-term maintenance.

- Risk tolerance differs, so analysis is tailored to the company’s stage.

By covering these types of software due diligence, Dextralabs ensures investors and corporate strategy teams have a clear, reliable view of the software’s value and risks, helping them make confident decisions in M&A, funding, or IPO processes.

Also Read:- Specialization and Value Creation: How Tech DD Drives Differentiation for Modern PE Firms

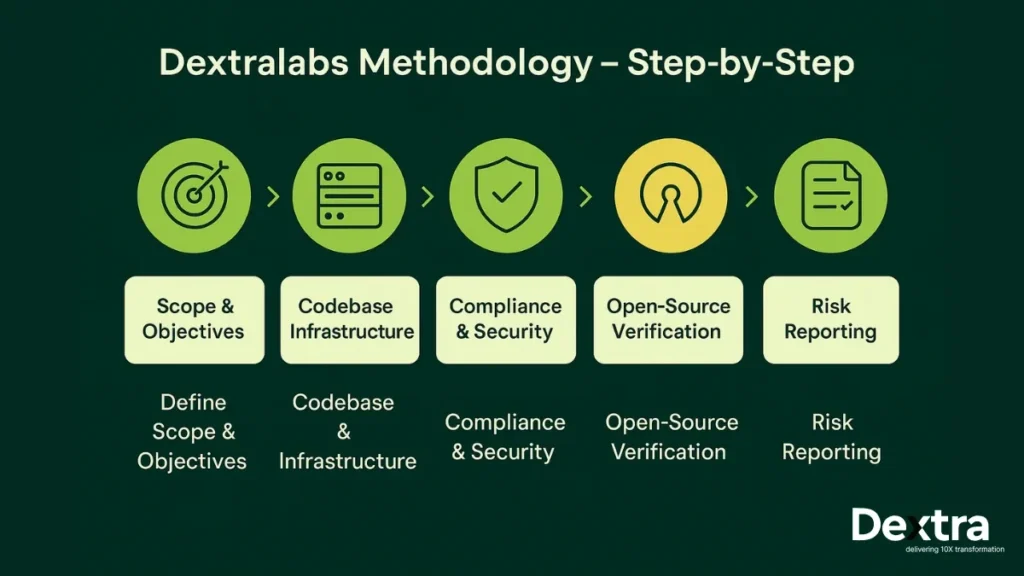

How to Run Software Due Diligence: Dextralabs Methodology

At Dextralabs, we follow a structured, expert-led approach to software due diligence. Our methodology helps Investors like VCs, and M&A leaders, evaluate software products, platforms, and systems with precision, ensuring informed, investment-grade decisions.

Step 1: Define Scope & Objectives

Before any technology due diligence, we clarify the purpose of the evaluation.

- Investment intent clarity: Understand whether the focus is M&A, funding, or IPO readiness.

- Targeted risk identification: Identify potential software risks that could impact valuation or operations.

- Custom evaluation priorities: Align the assessment with the investor’s specific goals and strategic requirements.

Step 2: Codebase & Infrastructure Review

We examine the software’s core structure and infrastructure to assess long-term stability.

- Software architecture mapping: Analyze design patterns, modularity, and scalability.

- Cloud infrastructure evaluation: Check deployment setups, redundancy, and cost efficiency.

- DevOps pipeline analysis: Review development workflows, CI/CD processes, and release reliability.

Step 3: Compliance & Security Assessment

Software compliance and security are critical for investment confidence.

- Security framework compliance: Evaluate adherence to standards like ISO, NIST, GDPR, and HIPAA.

- Regulatory exposure analysis: Identify potential legal or compliance risks in the software.

- Risk profiling: Determine the severity and likelihood of security and regulatory issues.

Step 4: Open-Source Usage Verification

Third-party and open-source components can introduce hidden risks.

- License validation: Ensure all open-source usage meets legal requirements.

- Security risk verification: Check for vulnerabilities in third-party libraries.

- Maintenance lifecycle check: Confirm that dependencies are actively maintained and supported.

Step 5: Risk Synthesis & Reporting

Finally, we consolidate findings into actionable insights for investors.

- Technical risk scoring: Assign objective ratings to software risks.

- Investment readiness evaluation: Determine if the software meets quality, scalability, and compliance expectations.

- Strategic recommendations: Provide guidance on mitigating risks, improving performance, and maximizing value.

Through this approach, Dextralabs assures investors and corporate groups of a direct, clear, expert view of software health, potential pitfalls, and opportunities, so that they can move ahead with M&A, funding, or IPO plans with confidence.

Software Due Diligence Checklist for Investors

A well-defined software due diligence checklist enables investors, VCs, and M&A teams to assess software quickly and effectively. At Dextralabs, we adopt a structured methodology to address all the important areas of a company’s software products and systems.

Key elements of a software due diligence checklist help us understand the real health and risks of the software before investing. Here’s what we focus on:

- Code maintainability: We check how easy it is to update, fix, or add new features to the software without causing problems.

- Architecture scalability: We see if the software design can handle growth and more users as the business expands.

- Dependency risks: We identify any risks from third-party libraries, frameworks, or vendor tools that the software relies on.

- Open-source compliance: We make sure all open-source components follow proper licenses and are safe to use.

- Security posture: We review data protection, cybersecurity measures, and compliance with standards like ISO, NIST, and GDPR.

- Technical debt: We look for temporary fixes, old code, or legacy issues that could slow down future updates or increase costs.

- Infrastructure sustainability: We check cloud setups, DevOps pipelines, and overall operations to ensure the software can scale safely and efficiently.

This software due diligence checklist provides investors with a concise, practical perspective of strengths, weaknesses, and risks of the software, which they can use to make confident decisions before M&A, funding, or IPO.

Software Due Diligence in M&A Transactions

Software due diligence in M&A is a must whenever we’re looking at buying a tech or software-driven company. It helps us really understand the value of the software, spot hidden risks, and make smarter investment decisions.

- Impact on valuation negotiations: By showing the software’s strengths, weaknesses, and any technical debt, we can set a fair price and also have better leverage when negotiating the deal.

- Role in deal structuring: The insights we get from software evaluations guide deal terms, payment plans, and even contingency strategies tied to how the software performs.

- Risk mitigation for acquirers: It’s crucial to catch vulnerabilities, licensing issues, or architecture limits early on, so we can reduce surprises after the acquisition and feel more confident about the investment.

- Influence on post-merger integration success: It would be easier to think ahead and plan integration, align the team, and maintain business continuity when you know the software’s architecture, dependencies, and scalability upfront.

To investors and corporate strategy teams, Software due diligence M&A is not a choice that is optional but rather a necessity that protects investment, improves results and facilitates the post-acquisition operations.

Key Questions for Software Due Diligence

Software Product & Code:

- Is the back-end well-designed and reliable?

- Is the code clean, optimized, and efficient?

- Are there any major defects or vulnerabilities in the code?

- Does the architecture support growth and future needs?

- Does the software use modern technologies and coding practices?

- How much technical debt exists, and how might it affect future work?

- Is any part of the software built on outdated or legacy systems?

- Are standard security protocols properly implemented?

- How is data stored, managed, and protected?

User Experience & Front-End:

- Is the front-end well-built and responsive?

- Is the UX/UI intuitive and user-friendly?

- Where are the main friction points for users?

- What are the daily or monthly active users, and is usage growing?

- What feedback do customers provide about the software?

- Who are the main users of the product?

Development Team & Processes:

- Is the software development team well-structured and skilled?

- Does leadership have a clear vision for the product roadmap?

- Does the team fully understand the current software state?

- Are team roles and skills aligned with the roadmap requirements?

- Are resources used efficiently?

- How fast does the team deliver updates or features?

- Is knowledge about the software architecture shared across the team?

- What is developer retention and turnover like?

- Are security practices followed consistently?

- Are software processes mature and repeatable?

Delivery & Quality:

- How reliable is the product roadmap and delivery schedule?

- Does the team use automation to improve efficiency?

- How is testing and quality assurance handled?

- How often are bug fixes required after release?

- Do projects stay within budget?

- How are release scopes and priorities decided?

- Is communication clear between technical and business teams?

- Are there plans to maintain team productivity while scaling?

- Are there feedback channels for users and internal teams?

- Does the company practice continuous development?

- Are data governance and security training in place?

Market & Strategic Position:

- Is the company well-positioned in the market?

- Does it have unique intellectual property or differentiators?

- How does it compare to competitors?

- Does it meet performance targets like the Rule of 40?

- Is the company adopting modern technologies effectively?

- What stage of growth is the company in?

- Is it ready for potential acquisition?

Leadership & Team Confidence:

- Can leadership answer questions confidently and clearly?

- Does the team understand current software problems and have plans to fix them?

- Can they clearly explain the product’s value proposition?

- Are roadmap expectations realistic given available resources?

- Is the team collaborative, transparent, and easy to work with?

Software Due Diligence Report Template Structure

Having a properly designed and/or well-structured software due diligence report template allows investors, VCs, and M&A teams to quickly understand the strengths, risks, and investment potential. Dextralabs offers reports with clear and actionable insights to make informed decisions.

Key sections include:

- Executive Summary: A clear overview of the software, highlighting the main findings and recommendations for investors.

- Risk Categorization Matrix: A visual guide showing which risks are critical, moderate, or low, helping focus attention where it matters most.

- Architecture Review Findings: Detailed insights into the software’s design, scalability, and how future-proof it is.

- Security & Compliance Summary: Assessment of cybersecurity, regulatory compliance, and potential vulnerabilities.

- IP & Licensing Status: Verification of intellectual property ownership, open-source compliance, and any third-party dependencies.

- Technical Debt Overview: Analysis of legacy code, temporary fixes, or maintenance challenges that could impact long-term value.

- Strategic Investment Advice: Expert recommendations on risk mitigation, software improvements, and readiness for M&A, funding, or IPO.

Using this software due diligence report template, investors gain a complete, structured view of the software’s health and potential, enabling confident and strategic investment decisions.

Common Mistakes Investors Make Without Software DD

Skipping proper software due diligence can lead to costly errors. Some common mistakes include:

- Trusting surface-level technical indicators: Just because software seems to work doesn’t mean it’s built to last or scale.

- Assuming a working product equals sustainable software: A functioning product may still have hidden issues that affect long-term value.

- Ignoring hidden compliance risks: Failing to check licensing, data protection, or regulatory requirements can create legal problems later.

- Underestimating technical debt impact: Old code, quick fixes, or legacy systems can increase maintenance costs and slow down growth.

Careful software due diligence helps investors avoid these pitfalls, ensuring smarter decisions for M&A, funding, or IPO.

Dextralabs’ Software Due Diligence Framework:

At Dextralabs, our software due diligence framework is designed as though every evaluation must deliver investment-grade confidence. We dig deep into software products, platforms, and systems to uncover hidden risks and provide clear insights for M&A, funding, or IPO decisions.

Our methodology combines global expertise across SaaS, AI, and enterprise systems with a structured, actionable approach. We assess code quality, architecture, technical debt, IP, licensing, security, and compliance, showing how each factor impacts business value and investment outcomes.

Investors, VCs, PE firms, and deal aggregators trust Dextralabs because we deliver actionable risk intelligence, not just a list of technical findings. Our evaluations highlight what matters most for decision-making, helping teams prioritize risk mitigation and roadmap improvements.

We provide expert evaluations across Singapore, USA, UAE, and India. By approaching tech due diligence as though every detail counts, Dextralabs gives investors a full, expert view of software health, scalability, and growth potential.

Benefits of Software Due Diligence by Dextralabs

- Reduced investment risk: Dextralabs identifies hidden technical problems, compliance gaps, and IP issues, helping investors avoid surprises and make safer decisions.

- Accurate company valuation: Our evaluations give a clear view of software value, allowing fair pricing and preventing overvaluation.

- Better deal negotiation leverage: Insights into software strengths and weaknesses give investors stronger ground during deal discussions.

- Data-driven decision making: Structured, expert analysis replaces assumptions with clear, actionable insights for smarter investment choices.

- Long-term scalability assurance: We assess how the software can grow, integrate new features, and support future business needs, ensuring lasting value.

Use Cases of Software Due Diligence

Software due diligence plays a critical role in many investment and strategic scenarios, helping investors and corporate teams make informed decisions.

- Startup acquisition by PE: Private equity firms rely on software due diligence to verify the technology, identify hidden risks, and assess scalability before acquiring startups.

- SaaS investment decisions: Evaluating SaaS platforms thoroughly ensures that investors understand the product’s architecture, technical debt, and long-term growth potential.

- IPO readiness evaluation: For companies preparing to go public, software due diligence confirms that technology systems are stable, secure, and capable of handling increased demand.

- M&A consolidation strategies: During mergers, due diligence helps assess integration risks, software compatibility, and opportunities to streamline operations.

- Enterprise tech assessment: Large organizations use software due diligence to evaluate in-house or third-party systems, ensuring that investments in technology support strategic goals and scalability.

By applying software due diligence in these scenarios, investors and corporate leaders can make confident, data-driven decisions while reducing risks and maximizing value at the same time.

Secure Your Investment with Dextralabs

Before investing, make sure your decision is backed by expert-led software due diligence. Dextralabs evaluates the real technical health of software products, uncovering hidden risks that standard checks often miss.

With our insights, investors, VCs, and PE firms can make confident, risk-aware decisions for M&A, funding, or IPOs. Protect your investment and understand the true value of the software before committing capital.

[Check Our White Papers on Tech DD] [Speak to Our Due Diligence Experts]

FAQs on software due diligence:

Q. What is software due diligence?

Software due diligence is the process of evaluating a company’s software, platforms, or systems to check quality, risks, and investment potential. It helps investors make informed decisions before M&A, funding, or IPO.

Q. How does software due diligence differ from technical due diligence?

While technical due diligence focuses on engineering and code quality, software due diligence looks at business impact, scalability, IP, compliance, and investment risks.

Q. When should investors perform SW DD?

Investors should perform software due diligence before acquisitions, funding rounds, IPOs, or any major software-related investment to minimize risks.

Q. Who conducts software due diligence?

Expert teams like Dextralabs or specialized consultants carry out software due diligence, combining technical analysis with strategic investment insights.

Q. What does a software due diligence report include?

A software due diligence report usually includes architecture review, code quality, IP and licensing status, security and compliance checks, technical debt assessment, and strategic recommendations.

![How to Build LLM Applications with LangChain: A Complete Python Tutorial [2025]](https://dextralabs.com/wp-content/uploads/2025/08/langchain-for-llm-application-development.webp)