With the rapid expansion of cloud computing, AI, and digital services, data center investments are reaching record highs, most notably in the USA and Singapore. In 2025, the global data center market is valued at about USD 386.71 billion and is forecast to surpass USD 1 trillion by 2034, with a consistent CAGR growth rate of 11.24%. Due to the complexity and size of these facilities, a data center technical due diligence approach typically requires a more rigorous technical due diligence approach. For investors, tech DD for data center investments is no longer an option; it has become a key strategic move that ensures both the technical and business viability of high-value infrastructure deals.

Given this landscape, data center technical due diligence is now a crucial step for investors. Tech DD for data center investments involves a comprehensive assessment of engineering infrastructure, physical and environmental security, power and cooling systems, and regulatory compliance. A robust data center investment due diligence process goes beyond reviewing basic infrastructure—it includes evaluating operational procedures, historical incident logs, IT systems architecture, and cloud infrastructure due diligence to identify risks, inefficiencies, and future upgrade needs.

What sets Dextralabs apart is our strategy-first approach. We make sure that our technology assessments are in sync with your business goals, helping to future-proof your investment and give your stakeholders peace of mind. Whether you’re entering the Singapore market or expanding in the USA, our technical due diligence services will ensure your data center investment is strong, scalable, and ready for the future. With our experience in spotting potential issues early and offering clear recommendations, you can make confident decisions, save costs in the long run, and maximize your ROI.

The Rising Importance of Data Center Investments

Data center investments are becoming more crucial than ever. The main drivers behind this surge are cloud computing, artificial intelligence (AI), IoT (Internet of Things), and the ongoing digital transformation. As more businesses shift to the cloud, implement AI, and use IoT to connect and control devices, the need for robust computing power and reliable infrastructure keeps growing. Simply put, without these advancements, companies wouldn’t be able to keep up with the pace of change.

This growing demand makes data center technical due diligence and tech DD for data center investments essential steps before making any major decisions.

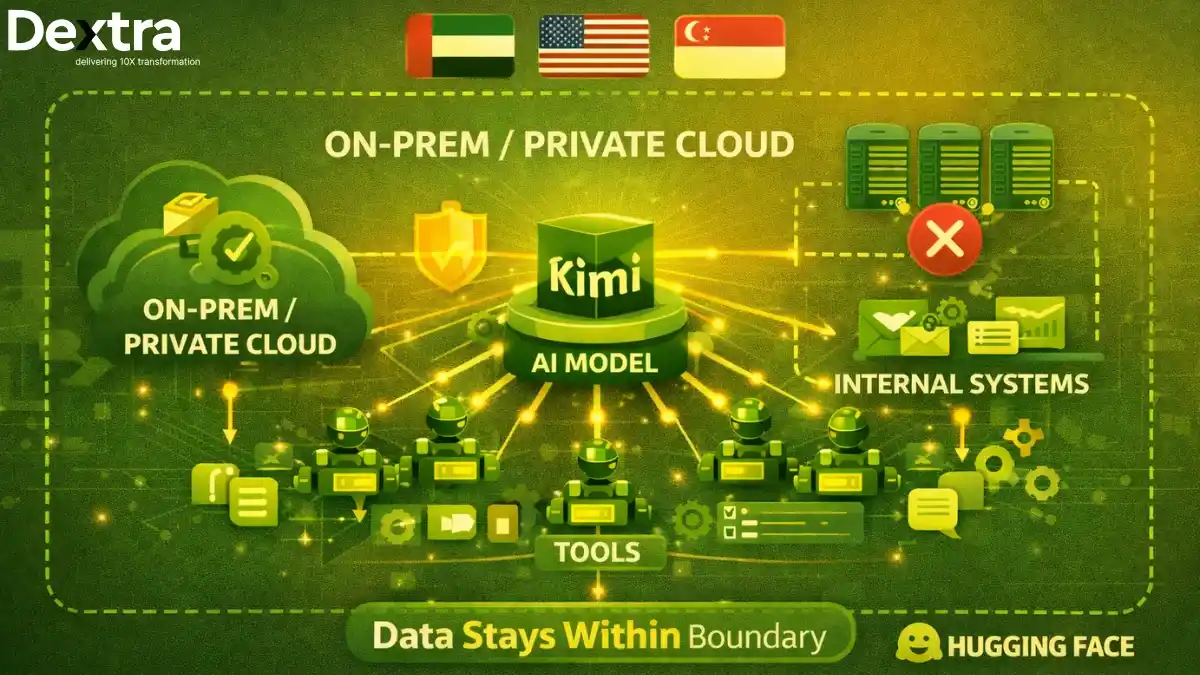

Singapore and the United States are two of the most strategic hubs for data center infrastructure. Singapore is known for its strong digital policies, reliable power supply, and excellent connectivity, making it a top location for data center due diligence in Singapore. In the U.S., large-scale projects and cloud expansion are attracting heavy investment, especially in areas focused on cloud infrastructure due diligence and future growth.

Recent trends and forecasts indicate strong momentum in the data center industry. According to Grand View Research, market size in the data center sector is expected to reach USD 652.01 billion by 2030, with a CAGR of 11.2% expected between 2025 and 2030. As this market grows, so do the risks, making proper data center investment due diligence more important than ever. Investors are now using detailed data center due diligence checklists to assess everything from data center investment risks to data center scalability assessments, compliance reviews, and data center security audits.

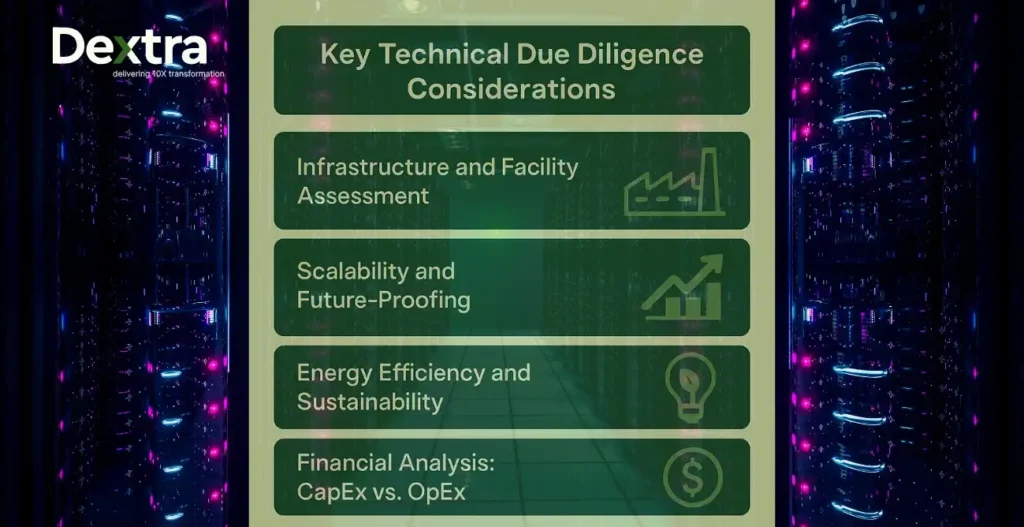

Key Technical Due Diligence Considerations

Thorough tech DD for data center investments is essential to avoid surprises and reduce risks. Below are the most important areas to focus on when evaluating a facility or deal.

1. Infrastructure and Facility Assessment

A solid data center technical due diligence starts by checking the mechanical and electrical systems. This includes reviewing the power supply, cooling systems, and redundancy to make sure everything runs smoothly without any hiccups. It’s also super important to assess the building management systems and carry out a full data center security audit to ensure physical access is secure and well-monitored at all times.

2. Scalability and Future-Proofing

Every investor should look at the data center’s current capacity and ability to expand. A data center scalability assessment checks whether the facility can grow with demand and support new technologies. Modular setups and support for AI or edge computing show that the site is ready for future needs. These factors matter a lot in cloud infrastructure M&A deals.

3. Energy Efficiency and Sustainability

Energy use affects both costs and compliance. Metrics like PUE (Power Usage Effectiveness) help track energy efficiency. Many modern centers now use green tech or renewable energy sources. A good technical due diligence agency Singapore or elsewhere will also check for alignment with local sustainability goals and regulations.

4. Regulatory Compliance and Risk Management

Focus on compliance when you’re undergoing a full data center compliance review of cybersecurity, data privacy, and risk assessments involving natural disasters, outages, and other imperatives. Be sure to check for compliance with both GDPR and HIPAA benefits and other local mandates. Ultimately, you should be able to minimize significant data center investment risks and ensure continuity of operations.

5. Financial Analysis: CapEx vs. OpEx

Knowing the balance of capital expenditures (CapEx) versus operating expenses (OpEx) is critical. A detailed cost-benefit analysis helps you plan better and predict ROI more accurately. In fast-moving sectors like cloud infrastructure M&A, smart financial planning is just as important as having solid infrastructure in place.

Dextralabs: Your Trusted Partner for Tech DD in Singapore

Dextralabs is a trusted technical due diligence agency in Singapore, specializing in helping investors navigate the complexities of data center investments. With expertise in data center technical due diligence and cloud infrastructure M&A., Dextralabs has a proven history of continuously assessing projects in Singapore and internationally. Helping investors from Singapore and the USA, and providing key insights for investors in data centre scalability, compliance reviews, and understanding data centre investment risks. Their assessments have helped clients avoid costly surprises, making informed decisions in rapidly growing markets.

What sets Dextralabs apart is its use of advanced methodologies and proprietary tools for comprehensive evaluations. By combining real-time infrastructure data, data center security audits, and in-depth financial modeling, Dextralabs offers customized insights that drive better investment outcomes.

Final Words: Navigating the Future of Data Center Investments

As the data center capital continues to grow, tech DD for data center deals has become an important part of efforts to ensure long-term success. Everything from assessing the infrastructure and scalability to evaluating energy efficiency and regulatory compliance, thorough data center due diligence is essential for identifying potential risks and maximizing returns. Complete, accurate, and well-conceived data center security audits for risk management and compliance reviews are only two among other factors that require expert attention to avoid costly mistakes.

Working with trusted experts such as Dextralabs can greatly reduce risks and offer the insights required to make informed decisions. Investors should prioritize comprehensive due diligence so they can outpace their competitors and nurture returns from their data center investments.

FAQs on Tech DD for data center investments:

Q. What is technical due diligence (Tech DD) in data center investments?

Tech DD in data center investments involves a comprehensive evaluation of the facility’s infrastructure, scalability, network resilience, and compliance to assess long-term viability and risks.

Q. Why is Tech DD critical before investing in data center infrastructure?

Tech DD helps investors identify potential operational or scalability issues, hidden costs, regulatory gaps, or outdated technologies that could impact ROI or deal value.

Q. What key components should be assessed during data center Tech DD?

Key components include power and cooling systems, uptime and redundancy, network architecture, energy efficiency (PUE), security protocols, and cloud/hybrid-readiness.

Q. How does data center scalability impact investment decisions?

Scalability affects a center’s ability to handle future growth. Limited expansion capacity or outdated design can restrict revenue potential and require costly upgrades.

Q. What role do ESG factors play in data center due diligence?

Environmental, Social, and Governance (ESG) metrics are increasingly vital. VCs and PE firms now assess energy usage, carbon footprint, and sustainability practices in their Tech DD process.

Q. How can VCs and PE firms mitigate risk during a data center acquisition?

They should engage specialized Tech DD advisors, conduct site audits, evaluate SLAs and vendor contracts, and assess the center’s compliance with industry and regulatory standards.