In fintech, where innovation intertwines with financial services, the importance of meticulous technology due diligence cannot be overstated. As fintech continues to reshape traditional financial landscapes, investors and stakeholders are increasingly aware of the critical role that data management and privacy play in the success and sustainability of these ventures. The FinTech market size is projected to rise from $340.10 billion in 2024 to $1152.06 billion by 2032, at a CAGR of 16.5%.

The stakes have never been higher for ensuring the robustness and integrity of technological infrastructure within the sector. In this blog post, we embark on a comprehensive journey through the intricacies of conducting technology due diligence in fintech, with a keen focus on data management and privacy.

Understanding the Terrain: What is Fintech Data Management?

First things first, let’s demystify the term. Fintech data management encompasses the collection, storage, processing, and utilization of financial data within a technology-driven financial services ecosystem. Fintech data management is the backbone of modern financial services, integrating cutting-edge technology with traditional financial operations. At its core, fintech data management involves the systematic collection, storage, processing, and utilization of financial data within a technology-driven ecosystem.

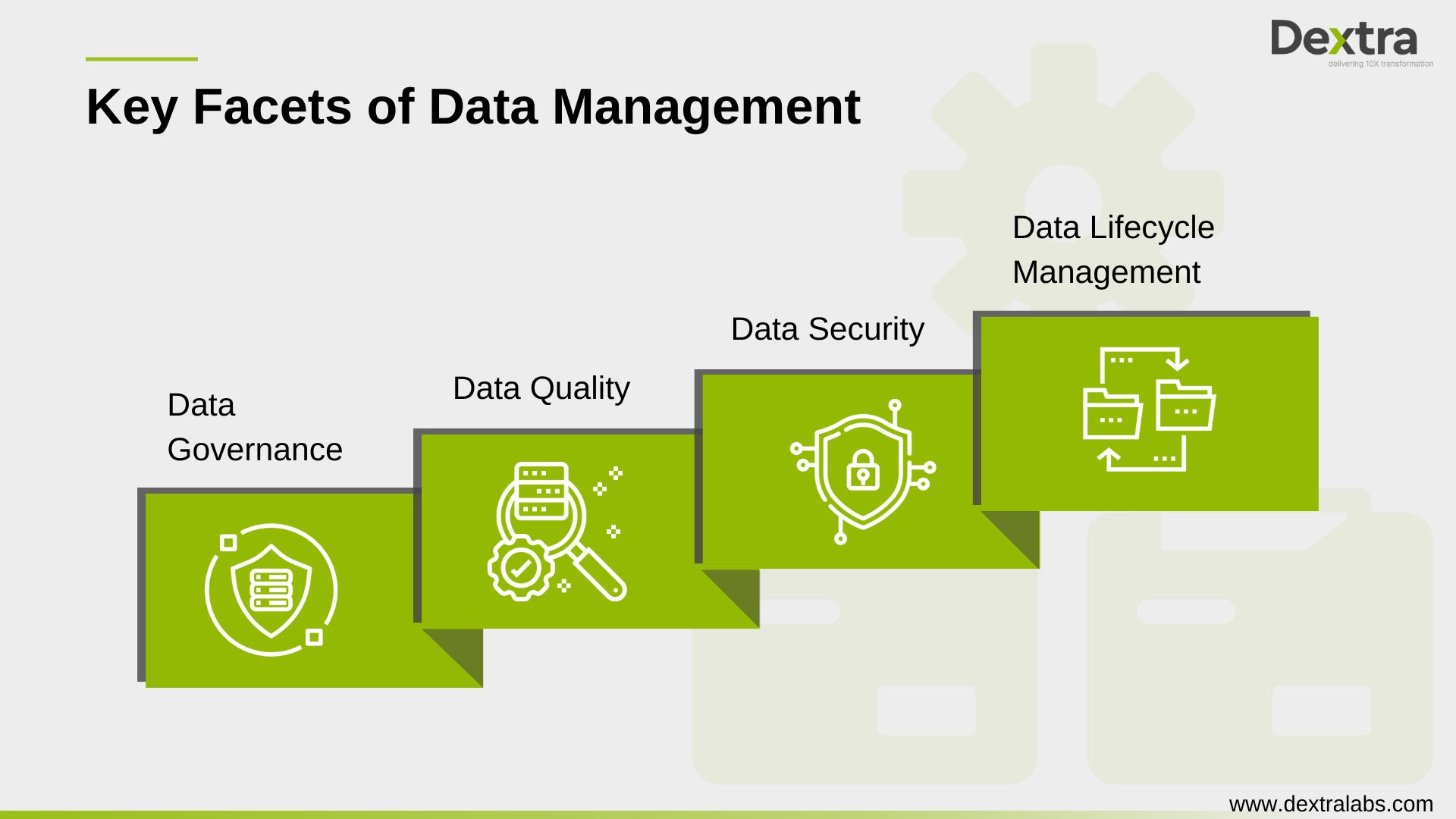

To delve deeper, consider the various facets of fintech data management:

- Data Collection: Fintech companies gather vast amounts of financial data from diverse sources, including transactions, customer profiles, market trends, and regulatory information. This data collection process is often automated and can encompass structured data (e.g., transaction records) as well as unstructured data (e.g., social media sentiment analysis).

- Data Storage: Once collected, financial data must be securely stored to ensure accessibility, reliability, and compliance with regulatory requirements. Fintech companies leverage sophisticated storage solutions, including cloud-based platforms and distributed databases, to accommodate the growing volume and complexity of financial data.

- Data Processing: Financial data undergoes extensive processing to extract actionable insights, facilitate decision-making, and enhance operational efficiency. This involves data cleansing, normalization, aggregation, and analysis using advanced analytics techniques such as machine learning, artificial intelligence, and predictive modeling.

- Data Utilization: The ultimate goal of fintech data management is to harness financial data to deliver innovative products and services that meet the evolving needs of consumers and businesses. This can range from personalized financial advice and automated investment platforms to real-time payment solutions and fraud detection systems.

Why Data Management Matters?

Data lies at the heart of fintech operations, serving as the lifeblood that fuels innovation, informs decision-making, and enhances customer experiences. Effective data management practices are indispensable for fintech companies to unlock the full value of their data assets while safeguarding against risks such as data breaches, unauthorized access, and regulatory non-compliance.

During the technology due diligence process, evaluators scrutinize various facets of data management, including:

- Data Governance: Assessing the framework of policies, procedures, and controls governing the collection, storage, usage, and sharing of data. Strong data governance ensures accountability, transparency, and alignment with regulatory requirements such as GDPR, CCPA, and industry-specific standards such as PCI DSS.

- Data Quality: Evaluating the accuracy, completeness, consistency, and timeliness of data across different systems and databases. High data quality is imperative for informed decision-making, analytics, and maintaining trust with stakeholders.

- Data Security: Examining the measures implemented to protect data against unauthorized access, cyber threats, and breaches. This encompasses encryption, access controls, network security, threat detection, incident response, and adherence to security frameworks Such as ISO 27001.

- Data Lifecycle Management: Reviewing the processes governing the creation, usage, retention, archival, and disposal of data throughout its lifecycle. A well-defined data lifecycle management strategy optimizes storage resources, minimizes compliance risks, and enhances data privacy.

The Privacy Predicament

Now, let’s talk about privacy. In an era where data breaches make headlines with alarming frequency, safeguarding user information isn’t just a nice-to-have—it’s non-negotiable. Fintech companies deal with a treasure trove of sensitive data, including financial records, personal identifiers, and transaction histories. Any slip-up in privacy protection could spell disaster for both customers and the company alike.

Charting Excellence: A Systematic Guide to Due Diligence in Fintech

In the quest to distinguish exceptional fintech entities from less promising counterparts, the initial stride entails meticulous due diligence. A comprehensive inquiry into the company’s strategies concerning data management and privacy. Presented here is a systematic guide delineating each step to adeptly manoeuvre through the intricate terrain.

- Documentation Deep Dive: Begin by poring over the company’s policies, procedures, and compliance documentation. Look for red flags, such as vague privacy policies or outdated security protocols.

- Tech Stack Scrutiny: Next, assess the company’s technological infrastructure. Is their data storage secure? Do they employ encryption and other security measures to protect sensitive information? Are they compliant with industry standards like GDPR or CCPA?

- Compliance Check: Speaking of regulations, make sure the company is playing by the rules. Are they registered with the relevant regulatory bodies? Have they faced any past fines or legal entanglements related to data management?

- Team Talent: A company is only as strong as its weakest link, and that includes its human capital. Evaluate the team’s expertise in data security and privacy. Do they have dedicated personnel overseeing these areas, or is it more of an afterthought?

- Past Performance: Lastly, dig into the company’s track record. Have they experienced any data breaches or security incidents in the past? How did they respond, and what measures did they take to prevent future occurrences?

Final Thoughts

Within the fintech sector, data takes on a dual significance as a useful resource and a possible source of risk. While it can spur creativity and reveal new opportunities when used properly, it can also have detrimental effects when handled poorly. By carefully examining data management and privacy policies, investors can reduce risks, strengthen user trust, and create a financial environment that is more secure and resilient. Therefore, it is crucial to follow the proverb ‘trust but verify’ when starting a fintech journey. This kind of caution increases financial viability and fosters user gratitude.

For further insights and tailored advice on technology due diligence in fintech, partner with experts like Dextralabs, who specialize in guiding startups and investors through the intricacies of technology assessments.