In the fast-growing fintech sector, making informed investment decisions is critical. As the industry grows, so does the complexity of its technology. The global Fintech market is projected to reach a staggering $1.5 trillion by 2030. With a current 2% share of the $12.5 trillion global financial services revenue, the fintech sector is predicted to expand to 7% by 2030, with banking fintechs accounting for about 25% of all banking values globally. This explosive growth is fueled by a surge in demand for innovative financial solutions, with Venture Capital (VC) firms actively seeking promising Fintech startups. However, for VCs and Private Equity (PE) partners, evaluating a Fintech startup goes beyond traditional financial metrics. A crucial yet often overlooked aspect is ensuring technology due diligence of the underlying technology stack and architecture.

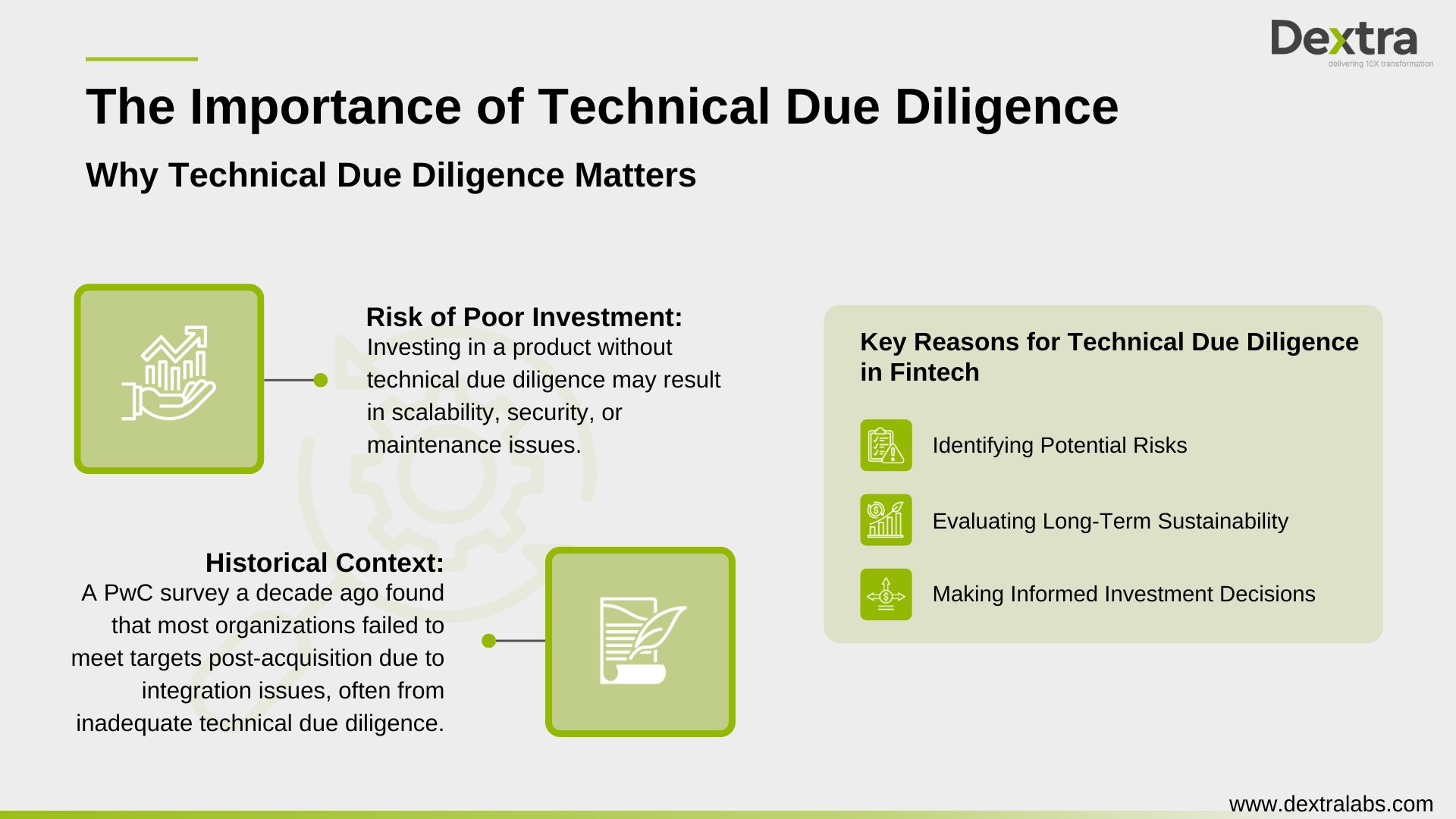

Why Technical Due Diligence Matters in Fintech

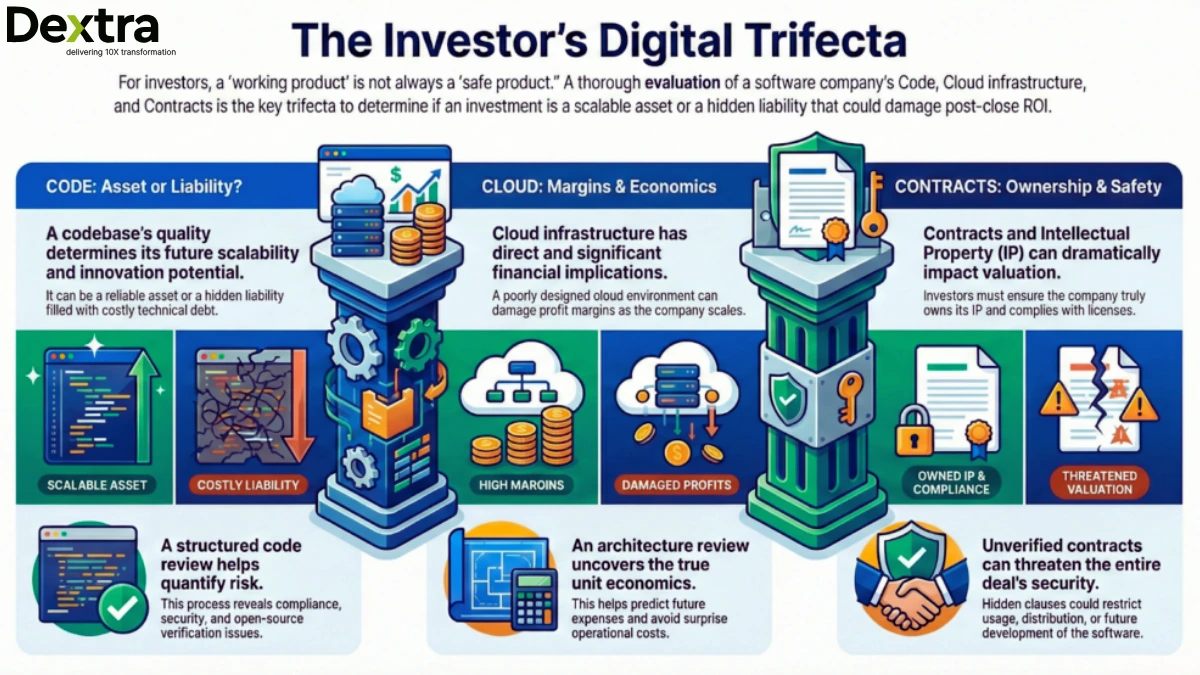

Technology due diligence is a thorough examination of a startup’s technology stack and architecture. This process helps investors and founders understand the technical strengths and weaknesses of a fintech startup. Without it, you risk investing in or building a product that may not be scalable, secure, or maintainable.

A survey by PwC a decade ago indicated that 49% of companies failed to achieve their targets post-acquisition due to integration issues, which often stem from inadequate technology due diligence. Therefore, it’s crucial to dive deep into the technology backbone of any fintech firm.

Fintech solutions handle sensitive financial data and require robust security measures. A poorly architected tech stack can lead to vulnerabilities, compliance issues, and ultimately, a loss of customer trust. Here’s why technology due diligence in fintech is essential:

- Identifying Potential Risks: A thorough evaluation helps uncover hidden technical problems such as outdated infrastructure that requires huge maintenance costs and further need optimization. Another problem is insecure coding practices or scalability limitations. These issues can hinder future growth and impact the long-term viability of the business.

- Evaluating Long-Term Sustainability: A strong tech stack built with future-proof technologies ensures the Fintech solution can adapt and evolve with changing market demands. Technology due diligence helps assess the maintainability and scalability of the underlying architecture.

- Making Informed Investment Decisions: Technology due diligence provides valuable insights into the true cost of ownership and potential development challenges. This information empowers VCs and PE partners to make informed investment decisions based on a realistic understanding of the technology behind the business.

Understanding the Technology Stack

A fintech’s technology stack is a combination of software tools, programming languages, frameworks, and databases used to build and run applications. Each component of the stack must be evaluated to ensure it meets the startup’s current and future needs.

Key Areas to Evaluate

- Programming Languages and Frameworks: Are they modern and widely supported? For instance, Python, Java, and JavaScript are popular in fintech for their robust libraries and frameworks.

- Databases: Are they scalable and secure? Choices such as PostgreSQL or MongoDB are common for their reliability and performance.

- DevOps Tools: Automation tools such as Jenkins or Docker streamline development and deployment, enhancing efficiency.

- Backend Infrastructure: The backbone of any fintech application. This includes servers, databases, and frameworks that handle data processing and storage. Key considerations include scalability, performance, and security.

- Frontend Technologies: These are the tools and frameworks used to create the user interface. For fintech apps, user experience is critical. The interface must be intuitive, responsive, and secure.

- APIs and Integrations: Fintech applications often need to integrate with third-party services such as payment gateways, financial institutions, and regulatory bodies. The robustness and security of these integrations are vital.

- Security Measures: Given the sensitive nature of financial data, stringent security protocols are a must. This covers secure coding techniques, encryption, and frequent security assessments.

Evaluating the Architecture

The architecture of a fintech application dictates how its components interact. A well-designed architecture ensures the system is scalable, secure, and resilient. Common architectures in fintech include microservices and serverless architectures.

Key Considerations

- Scalability: Can the system handle increased loads without performance degradation? Scalable infrastructure is provided by cloud-based services such as AWS and Azure.

- Security: Is the data protected against breaches and unauthorized access? Implementing robust encryption and access controls is essential.

- Resilience: Can the system recover quickly from failures? Redundancy and fail-over mechanisms are critical for maintaining uptime.

Security and Compliance

Security is a top concern in fintech due to the sensitive nature of financial data. According to IBM’s 2023 Cost of a Data Breach Report, the average cost of a data breach globally was $4.45 million, a rise of 15% over three years. Ensuring compliance with regulations such as GDPR, PSD2, and CCPA is non-negotiable.

Security Checks

- Data Encryption: Encrypting data while it is in transit and at rest.

- Access Controls: Role-based access to limit who can view or modify data.

- Regular Audits: Periodic security audits to identify and address vulnerabilities.

- Incident Response Plan: A well-defined plan to handle breaches.

Performance and Scalability Testing

Performance and scalability are critical for fintech applications that must handle large volumes of transactions. Conducting thorough testing ensures the system can meet user demands without compromising performance.

Testing Methods

- Load Testing: Simulating high traffic to test system performance.

- Stress Testing: Pushing the system beyond normal operational capacity to identify breaking points.

- Endurance Testing: Running the system under normal conditions for an extended period to detect memory leaks or performance degradation.

Code Quality and Maintainability

High-quality, maintainable code is the foundation of a robust fintech application. Poor code quality can lead to bugs, security vulnerabilities, and increased maintenance costs.

Code Review Practices

- Automated Testing: To find problems early, use unit tests, integration tests, and end-to-end testing.

- Code Reviews: Regular peer reviews to ensure adherence to coding standards.

- Continuous Integration/Continuous Deployment (CI/CD): Automating the integration and deployment process to catch and fix issues early.

Documentation and Knowledge Transfer

Comprehensive documentation and effective knowledge transfer are crucial, especially during transitions such as mergers or acquisitions. Clear documentation helps new developers understand the system quickly and reduces the risk of knowledge loss.

Documentation Essentials

- System Architecture: Diagrams and descriptions of how different components interact.

- API Documentation: Clear instructions on how to use APIs.

- Code Documentation: Comments and guidelines within the codebase.

- Operational Procedures: Runbooks and guides for routine operations and troubleshooting.

Vendor and Third-Party Risk Management

Many fintech companies rely on third-party services for various functions, from cloud hosting to payment processing. It’s important to assess the reliability and security of these vendors.

Vendor Evaluation Criteria

- Service Level Agreements (SLAs): Clearly defined performance and availability standards.

- Security Practices: Ensuring vendors comply with security standards and regulations.

- Business Continuity: Vendors should have robust disaster recovery plans.

Conclusion: Building Trust Through Technical Confidence

Technology due diligence may seem like an additional hurdle, but for VCs and PE partners, it’s a necessary step towards building trust and confidence in potential Fintech investments. By uncovering potential technical problems early on, investors can make informed decisions, mitigate risks, and support the long-term success of promising Fintech ventures.

In a sector as dynamic as fintech, a strong technical foundation fosters innovation, scalability, and ultimately, customer trust. By embracing technology due diligence, Fintech startups can demonstrate transparency, build confidence with potential investors, and pave the way for sustainable growth in the ever-evolving financial landscape.

For further insights and tailored advice on technology due diligence in fintech, partner with experts like Dextra, who specialize in guiding startups and investors through the intricacies of technology assessments.