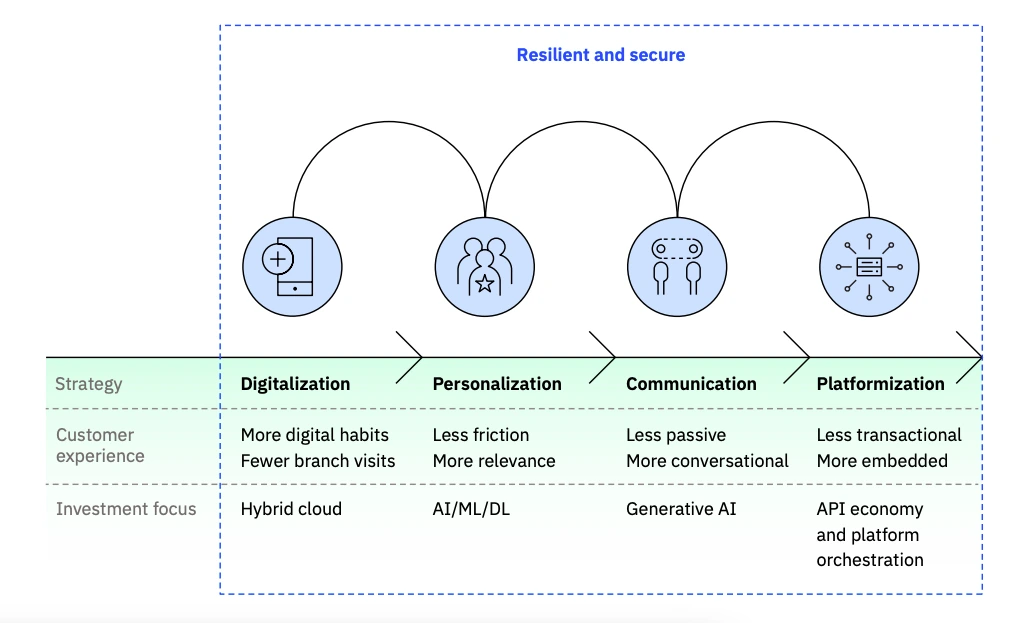

Banking and finance are undergoing a seismic transformation. Fueled by exponential technologies like generative AI and agentic systems, traditional financial institutions are reimagining operations, compliance, and client interaction. But as IBM’s 2025 report “Banking in the AI Era” sharply puts it, you can’t scale AI in finance without radically rethinking risk management.

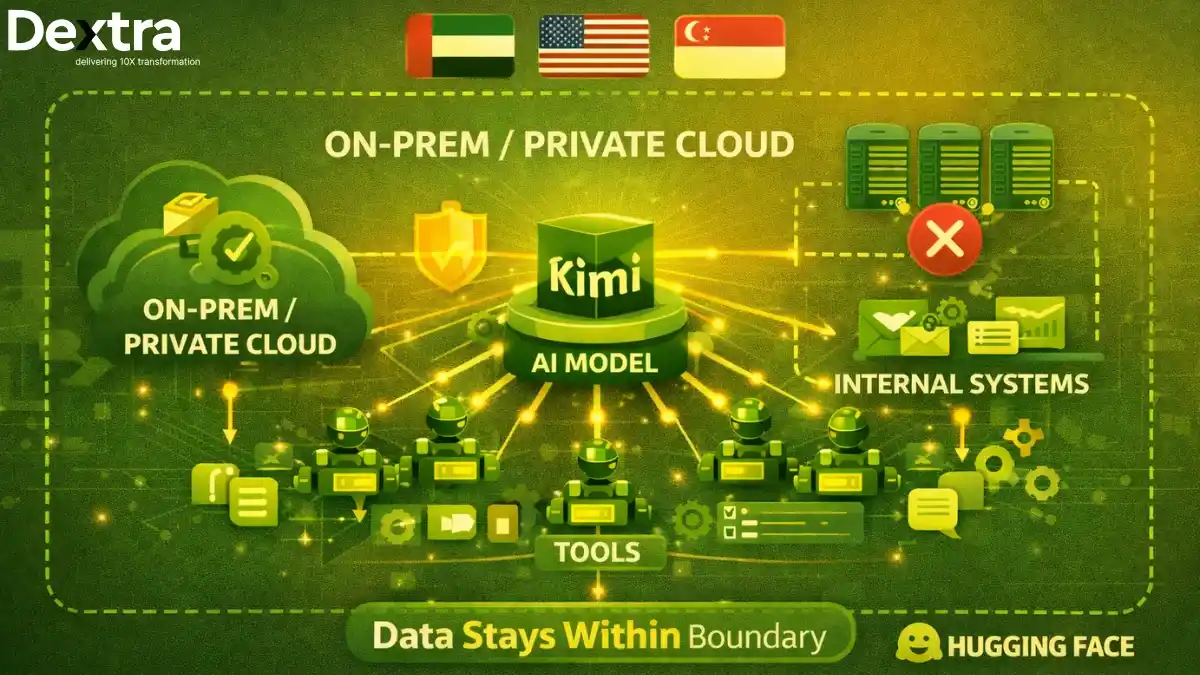

At Dextralabs, we help financial institutions navigate this exact crossroad with tailor-made solutions—ranging from Enterprise LLM deployment to Agentic AI interactions and custom AI agent development. This article delves into IBM’s latest findings, industry challenges, and how players like Dextralabs are helping rewire risk, compliance, and AI strategy in banking.

The Context: Why Does This Matters Now?

Banks today aren’t just rolling out AI tools because it’s trendy. They’re doing it because they have to. Rising fraud, increasingly sophisticated cyber threats, and mountains of regulatory obligations are pushing them toward more efficient, scalable solutions.

But with that comes a challenge: traditional risk management methods weren’t built for the speed and unpredictability of AI. As banks push ahead, they need to reshape their approach to risk or risk being left exposed.

What IBM Discovered? Dextralabs’ Key Findings:

The IBM survey, which included 100 banking executives across the US, UK, Australia, India, Singapore, and Germany, paints a vivid picture. From fraud detection to KYC automation, AI is already delivering high-value impact. But the roadblocks are equally significant, validation gaps, talent shortages, lack of real-time monitoring, and resistance to rethinking governance.

Let’s unpack the six core insights from IBM’s research and understand how they affect AI scalability in finance:

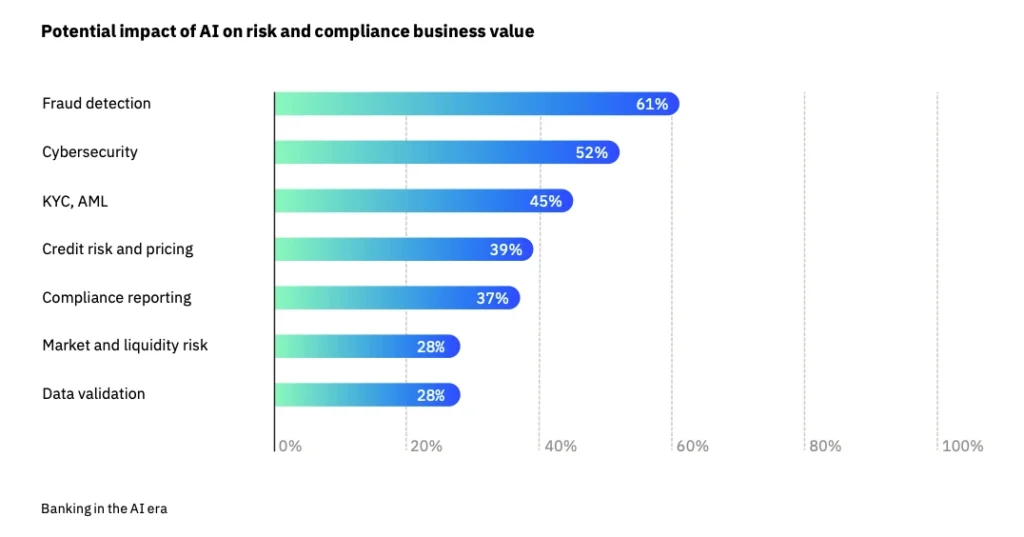

1. Fraud Detection Is Leading the Way

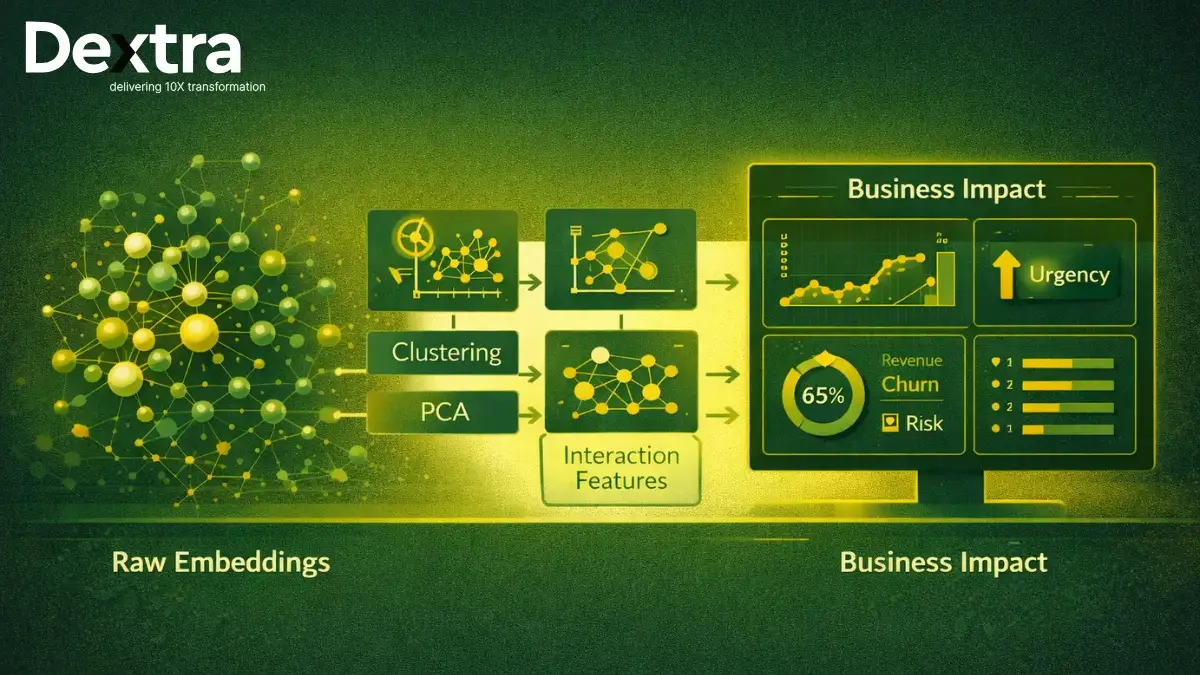

According to the survey, 61% of risk executives believe AI delivers the most value in fraud detection. Cybersecurity (52%) and KYC/AML (45%) follow closely.

It makes sense. Fraud tactics are getting more advanced, and AI can respond quickly to patterns that humans or static systems might miss. But just because AI helps doesn’t mean it’s risk-free. Models can drift, produce false positives, or miss new scams entirely if not constantly monitored and tested.

What to Do? Banks need AI systems that not only detect fraud but also evolve with it. That means regular updates, continuous monitoring, and backup plans when things go wrong.

Dextralabs in Action: We build adaptive fraud detection agents that use multi-modal data streams and reinforcement learning to catch fraud attempts before they escalate, reducing false positives and protecting digital trust.

2. KYC and AML: Still a Hard Nut to Crack

Despite their importance, KYC (Know Your Customer) and AML (Anti-Money Laundering) are the toughest areas to automate. 43% of executives said these are the most difficult to apply AI to.

Why? These tasks often depend on judgment and context. Reviewing documents, interpreting behaviors, and applying regulations from multiple countries isn’t easy to codify.

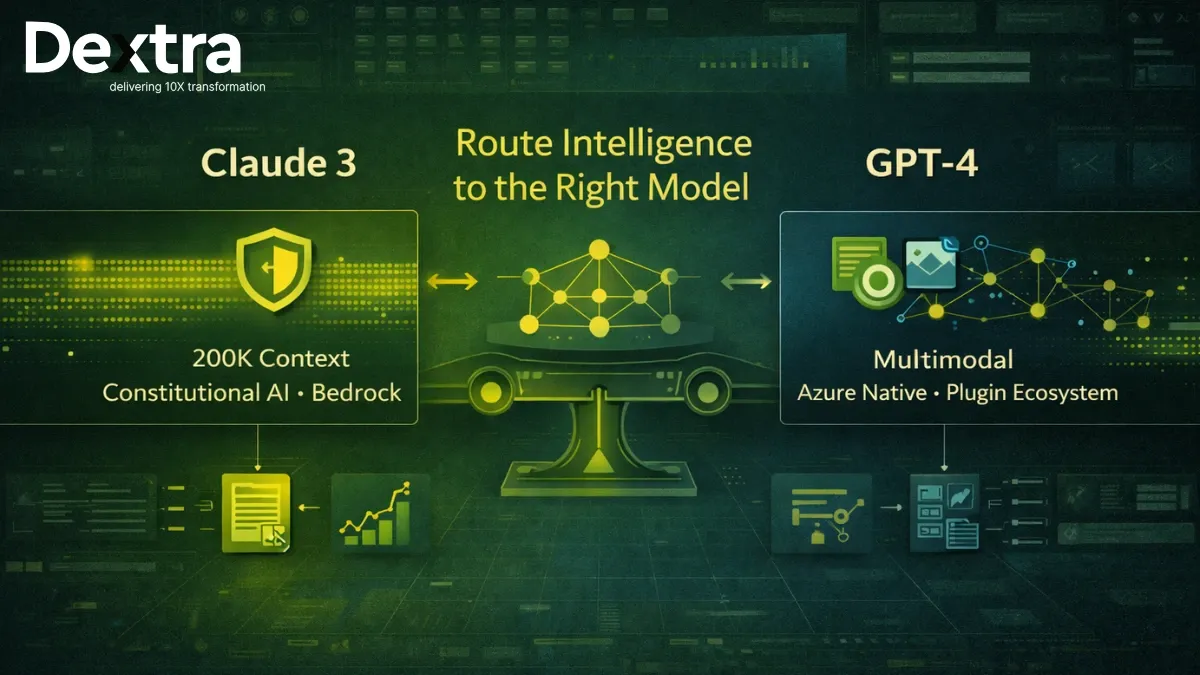

What Can Help? Agentic AI, a newer form of AI that uses multiple systems working together, is showing promise here. Instead of just flagging data, these agents can cross-check documents, validate IDs, and even make early assessments on risk.

At Dextralabs, We specialize in Agentic AI systems that orchestrate multiple specialized agents, OCR for document reading, NLP for sentiment/context parsing, and rule-based filters for jurisdictional requirements, to automate Customer Due Diligence (CDD) workflows with near-human accuracy.

3. Compliance Is Ripe for Smarter Automation

Compliance isn’t just about ticking boxes anymore. Regulators expect real accountability, and customers expect transparency.

Banks are starting to use AI agents that handle multiple tasks at once, collecting data, verifying details, and assessing risks, all in real time. This isn’t futuristic talk; it’s already underway.

Why Does It Work? AI can process thousands of data points in seconds and spot inconsistencies that might take a human hours to find. When designed well, it adds a layer of proactive control that’s hard to match.

Dextralabs supports this with custom-built AI agents tailored to each client’s compliance needs, including document parsing, behavior analysis, and continuous learning.

4. Testing Under Pressure Is Now Essential

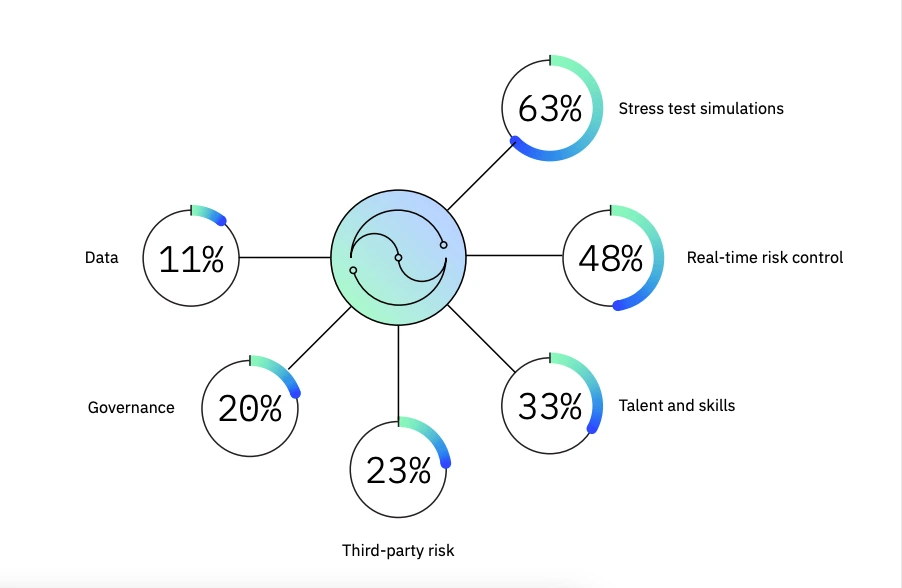

More than 60% of banks say stress testing is the top priority when managing AI risk. Before models go live, they need to be pushed to their limits.

It’s no longer acceptable to test AI systems only under normal conditions. Banks need to simulate the bad days too, fraud spikes, market crashes, or technical failures.

What Works? Create controlled environments where models can be tested and monitored under extreme conditions. This helps identify weak points and gives teams a chance to fix them before real damage happens.

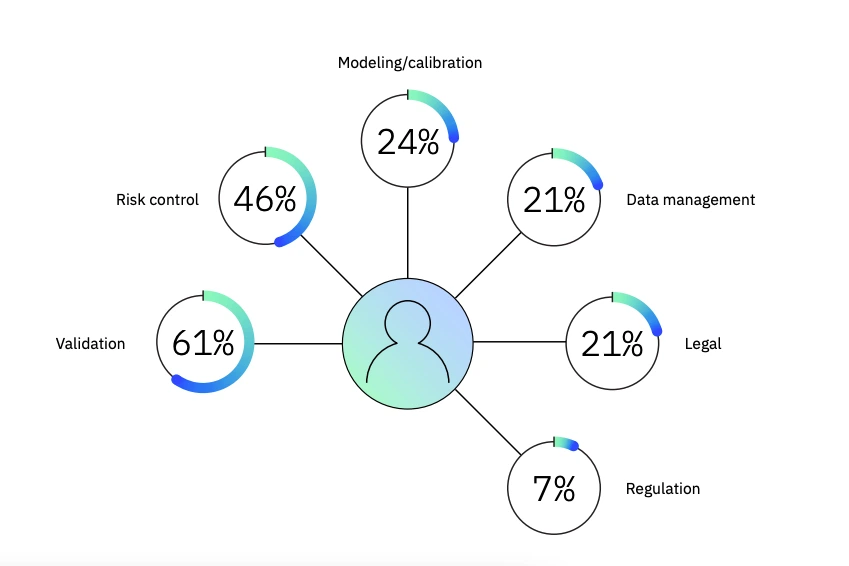

5. Talent Is a Real Bottleneck

Even with the right tools, banks are struggling with a talent shortage. IBM found that 61% of risk executives see a gap in AI model validation skills, and 46% point to a lack of expertise in real-time risk control.

This isn’t just a hiring issue, it’s about building teams that understand both finance and machine learning.

A Practical Fix: Start with internal upskilling. Build interdisciplinary teams where data scientists and risk officers collaborate closely. Dextralabs also offers Ai Consulting services and workshops to help bridge these gaps quickly and effectively.

6. Real-Time Monitoring Is Rare (and That’s Worrying)

Only 25% of banks use real-time monitoring for their high-risk AI systems. That’s a startling number, considering how fast AI can go off track.

A model that works today might fail tomorrow, especially if the data feeding it changes. Without real-time alerts and corrections, banks are flying blind.

What Needs to Change? Implement centralized dashboards that show how models are performing minute by minute. Build systems that alert your team when performance drops or strange patterns emerge.

Dextralabs provides AI monitoring tools that make this kind of visibility possible from day one.

So, What Does This All Mean?

IBM’s research isn’t just a warning. It’s a roadmap. It tells us that AI in banking can bring huge gains, but only if managed carefully.

The banks that succeed will be the ones who:

- Build resilient AI systems with built-in checks

- Train teams to validate and control these systems

- Monitor in real time, not just in monthly reviews

- Use newer technologies like agentic AI to tackle tricky problems

At Dextralabs, we help financial institutions put these ideas into practice with services that include:

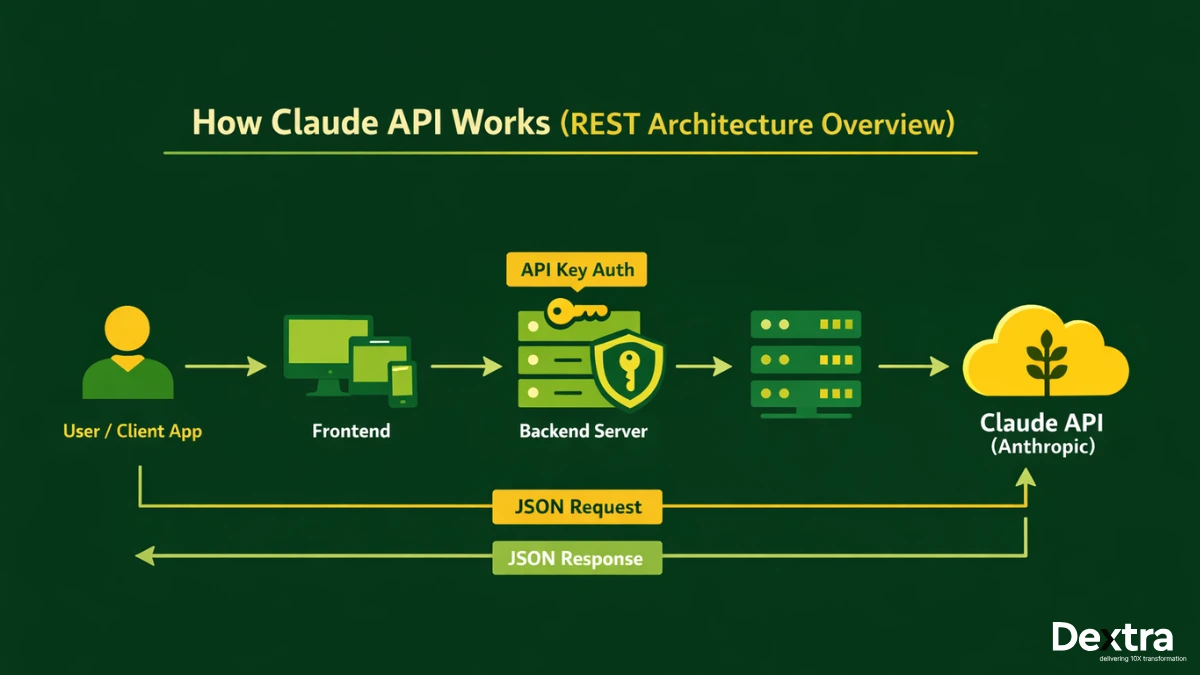

- Enterprise LLM Deployment

- Agentic AI Integration

- Custom AI Agent Development

- AI Consulting for Risk and Compliance

Final Thoughts: Banking on AI Requires a Risk Renaissance

IBM’s study confirms a hard truth: you can’t scale AI in banking if you don’t rebuild your risk foundation from scratch.

This isn’t just a technical transformation, it’s cultural, operational, and strategic. Financial institutions must embrace new roles, rethink validation, and empower AI agents that learn, act, and self-correct.

At Dextralabs, we don’t just develop AI, we help banks transform into intelligent, risk-resilient enterprises. Whether it’s Agentic AI architecture, LLM customization, or enterprise deployment, we bring deep expertise and tailored solutions to every engagement.

The future of AI in finance is here. The real question is, are you ready to manage the risk and unlock its power?